Form ST 104HM, Tax Exemption on Lodging Accommodations and Instructions 2019-2026

Understanding the ST 104HM Tax Exemption on Lodging Accommodations

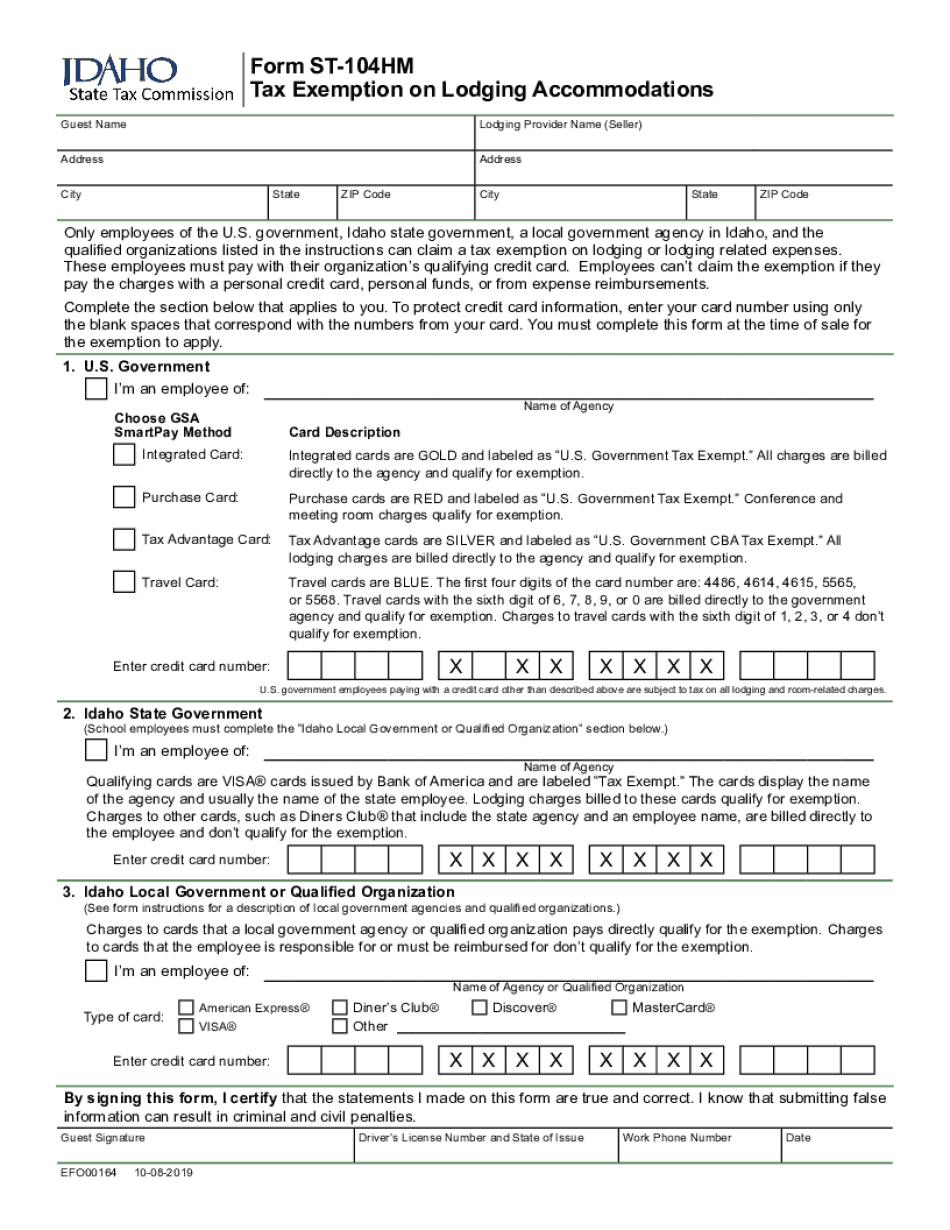

The ST 104HM form is crucial for individuals and businesses seeking tax exemptions on lodging accommodations in Idaho. This form allows eligible taxpayers to claim a sales tax exemption for lodging expenses incurred during business activities. Understanding the purpose of this form can help ensure compliance with state tax regulations while maximizing potential savings. The ST 104HM is specifically designed for use in Idaho and is an essential document for those involved in tax lodging and accommodations.

Steps to Complete the ST 104HM Form

Completing the ST 104HM form requires careful attention to detail to ensure accuracy. Here are the key steps to follow:

- Begin by downloading the ST 104HM form from the Idaho State Tax Commission website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the lodging accommodations for which you are seeking an exemption, including the name and address of the lodging provider.

- Clearly state the purpose of your lodging stay, ensuring it aligns with the criteria for tax exemption.

- Sign and date the form to certify that the information provided is accurate and complete.

Legal Use of the ST 104HM Form

The legal use of the ST 104HM form is governed by Idaho state tax laws. To qualify for a tax exemption, the lodging must be used for business purposes, such as attending conferences or meetings. It is important to retain all supporting documentation, including invoices and receipts, as these may be required for verification. Misuse of the form or providing false information can result in penalties, including fines or disqualification from future exemptions.

Eligibility Criteria for the ST 104HM Form

To be eligible for the ST 104HM tax exemption, certain criteria must be met. Generally, the exemption applies to individuals or businesses that incur lodging expenses for qualifying business activities. Eligible taxpayers may include:

- Businesses attending trade shows or industry conventions.

- Employees traveling for work-related purposes.

- Non-profit organizations conducting business-related activities.

It is essential to review the specific eligibility requirements outlined by the Idaho State Tax Commission to ensure compliance.

Obtaining the ST 104HM Form

The ST 104HM form can be obtained through several methods. Taxpayers can access the form online from the Idaho State Tax Commission's official website. Additionally, physical copies may be available at local tax offices or government buildings. It is advisable to ensure you have the most current version of the form to avoid any issues during submission.

Examples of Using the ST 104HM Form

Practical examples of using the ST 104HM form can help clarify its application. For instance, a business attending a national conference in Idaho may use the ST 104HM to exempt sales tax on lodging expenses incurred during the event. Similarly, a non-profit organization hosting a workshop may claim exemptions for accommodations provided to guest speakers. These examples illustrate the form's utility in various business contexts, emphasizing its importance for tax compliance and financial planning.

Quick guide on how to complete form st 104hm tax exemption on lodging accommodations and instructions

Complete Form ST 104HM, Tax Exemption On Lodging Accommodations And Instructions seamlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form ST 104HM, Tax Exemption On Lodging Accommodations And Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form ST 104HM, Tax Exemption On Lodging Accommodations And Instructions effortlessly

- Find Form ST 104HM, Tax Exemption On Lodging Accommodations And Instructions and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form ST 104HM, Tax Exemption On Lodging Accommodations And Instructions and ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 104hm tax exemption on lodging accommodations and instructions

Create this form in 5 minutes!

How to create an eSignature for the form st 104hm tax exemption on lodging accommodations and instructions

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the ST 104 document in airSlate SignNow?

The ST 104 is a specific document type within airSlate SignNow designed for various business needs. It enables users to streamline their signing processes while ensuring compliance. Utilizing the ST 104 can improve efficiency, as it offers a straightforward approach to document management.

-

How does airSlate SignNow simplify the ST 104 eSignature process?

airSlate SignNow simplifies the signing process for the ST 104 by providing a user-friendly interface that allows for quick and easy electronic signatures. With automated workflows, users can manage their ST 104 documents from initiation to completion seamlessly. This minimizes delays and enhances productivity.

-

What are the pricing options for using airSlate SignNow with ST 104 documents?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs for handling ST 104 documents. You can choose from monthly or annual subscriptions based on your usage. Each plan includes robust features tailored to optimize document signing processes, including ST 104.

-

Can I integrate airSlate SignNow with other apps for managing ST 104 documents?

Yes, airSlate SignNow supports various integrations that enable effective management of ST 104 and other documents. You can seamlessly connect it with CRM systems, cloud storage, and productivity tools to streamline your workflow. These integrations elevate efficiency and enhance your overall user experience.

-

What are the benefits of using airSlate SignNow for ST 104 management?

Using airSlate SignNow for ST 104 management offers several benefits, including reduced turnaround times and enhanced document security. You can track the status of your ST 104 forms in real-time, leading to improved organizational transparency. Additionally, its compliance features ensure that your documents meet all necessary regulations.

-

Is airSlate SignNow compliant with regulations when handling ST 104 documents?

Absolutely! airSlate SignNow is fully compliant with all major eSignature regulations, ensuring that your ST 104 documents are legally binding. This adherence to standards provides peace of mind for users, knowing that their document management processes are secure and recognized legally.

-

How secure is my data when using airSlate SignNow for ST 104?

Data security is a top priority for airSlate SignNow. When handling ST 104 and other documents, your information is protected with advanced encryption methods and secure data storage protocols. Regular security audits further ensure that your documents stay confidential and safe from unauthorized access.

Get more for Form ST 104HM, Tax Exemption On Lodging Accommodations And Instructions

Find out other Form ST 104HM, Tax Exemption On Lodging Accommodations And Instructions

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF