Formulario W 7 Sp 2016

What is the Formulario W-7 Sp

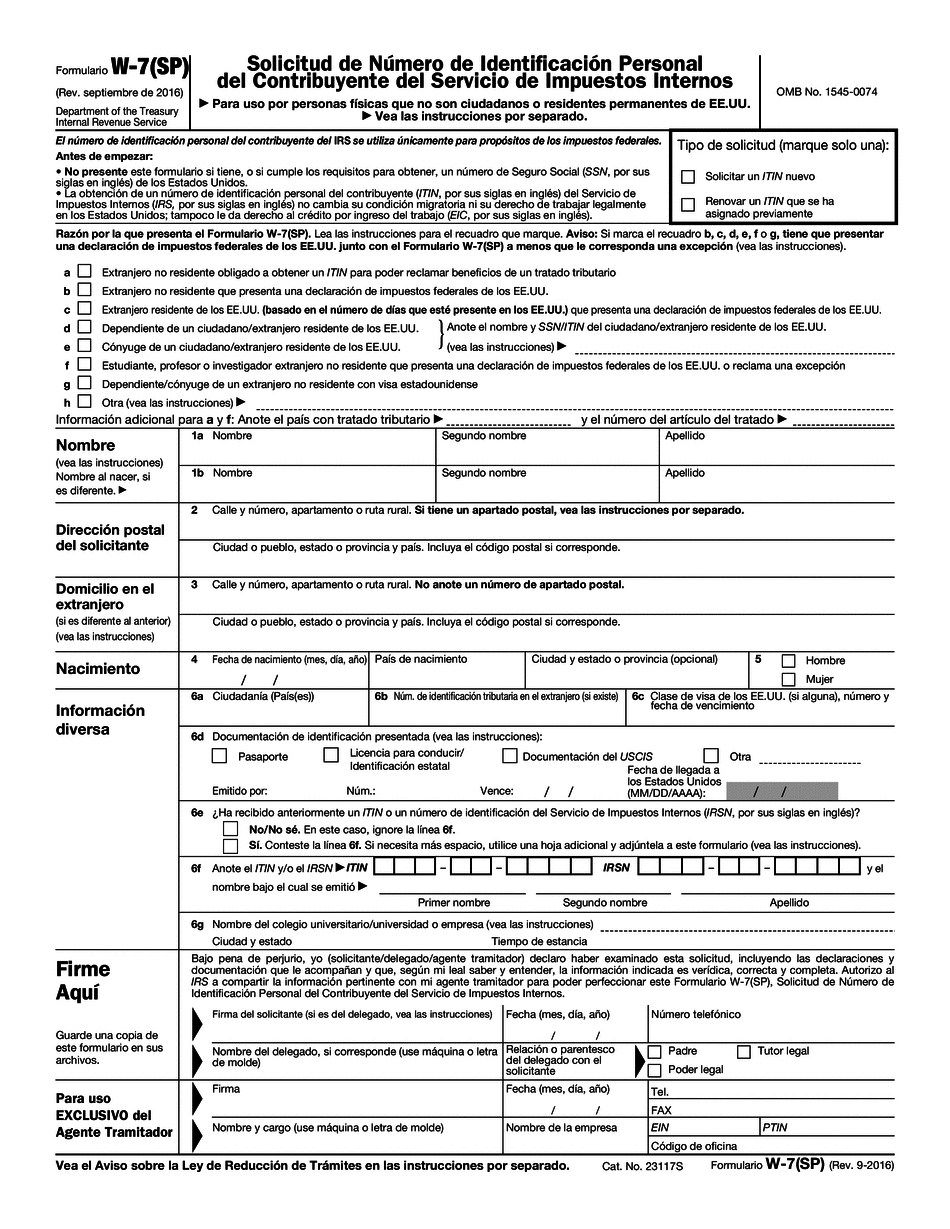

The Formulario W-7 Sp is a tax form used by individuals who are not eligible for a Social Security number but need to file a U.S. tax return. This form is specifically designed for non-resident aliens and their dependents who are applying for an Individual Taxpayer Identification Number (ITIN). The W-7 Sp is the Spanish version of the W-7 form, ensuring accessibility for Spanish-speaking applicants. It is essential for those who need to comply with U.S. tax laws while lacking a Social Security number.

Steps to complete the Formulario W-7 Sp

Completing the Formulario W-7 Sp involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of identity and foreign status. The form requires personal information such as your name, address, and date of birth. Fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form along with the required documentation to the IRS, either by mail or through an authorized acceptance agent.

Required Documents

When submitting the Formulario W-7 Sp, specific documents must accompany the application to establish identity and foreign status. Acceptable documents include a passport, national identification card, or other government-issued identification that includes your photo. Additionally, you may need to provide documents that support your claim for an ITIN, such as a tax return or a statement explaining the need for an ITIN. It is crucial to ensure that all documents are current and valid to avoid delays in processing.

Legal use of the Formulario W-7 Sp

The Formulario W-7 Sp is legally recognized for obtaining an ITIN, which is essential for fulfilling U.S. tax obligations. It allows individuals to report income and claim tax benefits, even if they do not qualify for a Social Security number. Proper use of the form ensures compliance with IRS regulations, thus avoiding potential penalties or legal issues. Understanding the legal implications of the W-7 Sp is vital for non-resident aliens and their dependents who engage in U.S. financial activities.

Form Submission Methods

The Formulario W-7 Sp can be submitted through various methods to accommodate different preferences. You can mail the completed form directly to the IRS, ensuring that it is sent to the correct address based on your location. Alternatively, individuals may choose to work with an authorized acceptance agent who can assist in submitting the form on their behalf. In some cases, applicants may also submit the form in person at designated IRS offices. Each method has its own processing times, so it is important to choose one that aligns with your needs.

Eligibility Criteria

To qualify for an ITIN using the Formulario W-7 Sp, applicants must meet specific eligibility criteria. Primarily, the individual must be a non-resident alien, a dependent of a U.S. citizen or resident alien, or a spouse of a U.S. citizen or resident alien. Additionally, the applicant must have a valid reason for needing an ITIN, such as filing a tax return or claiming a tax benefit. Understanding these criteria is crucial for ensuring a successful application process.

Quick guide on how to complete form w 7 sp 422467339

Complete Formulario W 7 Sp effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage Formulario W 7 Sp on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign Formulario W 7 Sp effortlessly

- Obtain Formulario W 7 Sp and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that require new document prints. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Adjust and eSign Formulario W 7 Sp and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 7 sp 422467339

Create this form in 5 minutes!

How to create an eSignature for the form w 7 sp 422467339

How to create an eSignature for your Form W 7 Sp 422467339 in the online mode

How to make an electronic signature for the Form W 7 Sp 422467339 in Chrome

How to make an eSignature for putting it on the Form W 7 Sp 422467339 in Gmail

How to create an electronic signature for the Form W 7 Sp 422467339 from your mobile device

How to make an electronic signature for the Form W 7 Sp 422467339 on iOS

How to make an electronic signature for the Form W 7 Sp 422467339 on Android

People also ask

-

What is a formulario w7 and why do I need it?

The formulario w7 is an application form used by individuals to obtain an Individual Taxpayer Identification Number (ITIN) from the IRS. This is essential for those who are required to file U.S. taxes but do not qualify for a Social Security Number. Understanding the formulario w7 process is important for ensuring compliance with tax regulations.

-

How does airSlate SignNow help with formulario w7 documentation?

airSlate SignNow streamlines the process of completing your formulario w7 by allowing you to eSign and send documents securely. Our platform makes it easy to gather signatures and manage documents from any device, ensuring that your application is submitted accurately and on time. This innovative solution simplifies the complexities associated with tax documentation.

-

Is airSlate SignNow cost-effective for managing formulario w7 applications?

Yes, airSlate SignNow is a cost-effective solution for managing your formulario w7 applications. We offer various pricing plans tailored to different business needs, ensuring you get the best value for your investment. By choosing our services, you can save on time and resources while effectively managing important documents.

-

What features does airSlate SignNow offer for handling formulario w7?

airSlate SignNow offers numerous features for handling the formulario w7, including eSignature capabilities, document templates, and secure storage. Our intuitive interface simplifies the document preparation process, while built-in compliance ensures that all submitted forms meet regulatory requirements. This makes airSlate SignNow a comprehensive tool for form management.

-

Can I integrate airSlate SignNow with other applications for formulario w7 processing?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including CRM and document management systems, enhancing your formulario w7 processing workflow. This allows you to synchronize your data and streamline your operations, making it easier than ever to manage your tax-related documents.

-

What are the benefits of using airSlate SignNow for formulario w7 submissions?

Using airSlate SignNow for formulario w7 submissions provides several benefits, such as increased efficiency and enhanced security. Our platform eliminates the hassles of paper-based processes, allowing you to complete applications faster. Additionally, our encrypted eSignature ensures that your sensitive information remains protected throughout the process.

-

How do I get started with airSlate SignNow for my formulario w7 needs?

Getting started with airSlate SignNow for your formulario w7 needs is easy! Simply sign up for an account, choose the plan that suits you best, and upload your documents. Our user-friendly interface will guide you through the process of completing and sending your formulario w7 within minutes.

Get more for Formulario W 7 Sp

- Form to request personal day

- Explain quotyesquot answers below circle questions you dont know the answers to intermountainhealthcare form

- Medstar washington hospital center authorization form whcenter

- Hospital bills form

- Caring hearts programpdffillercom form

- Tb skin test form 21942863

- Full form of mmr in ehs

- Ccip participant dossier providence health amp services alaska alaska providence form

Find out other Formulario W 7 Sp

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation