Form W 7SP Rev February Application for IRS Individual Taxpayer Identification Number Spanish Version 2007

What is the Form W-7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

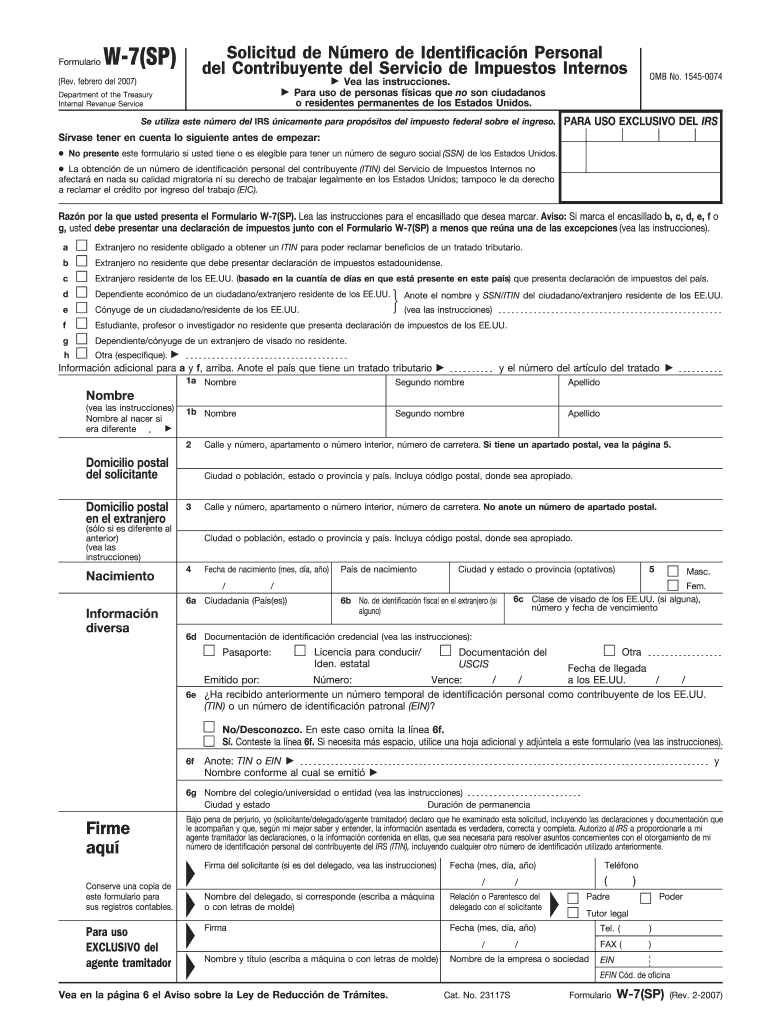

The Form W-7SP Rev February is an official document used by individuals who are not eligible for a Social Security Number (SSN) but need an Individual Taxpayer Identification Number (ITIN) for tax purposes. This Spanish version of the form is specifically designed to assist Spanish-speaking applicants in completing their tax obligations in the United States. The ITIN is essential for those who need to file a tax return or are required to provide a taxpayer identification number for various financial transactions.

How to use the Form W-7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

To use the Form W-7SP Rev February, applicants should first ensure they meet the eligibility criteria for obtaining an ITIN. The form must be filled out accurately, providing personal information such as name, address, and date of birth. It is crucial to include the reason for needing an ITIN, which can range from filing a tax return to claiming tax treaty benefits. Once completed, the form can be submitted along with the required supporting documents to the IRS.

Steps to complete the Form W-7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

Completing the Form W-7SP involves several key steps:

- Gather necessary documents, including proof of identity and foreign status.

- Fill out the form, ensuring all sections are completed in Spanish.

- Provide a valid reason for applying for an ITIN.

- Attach required documentation, such as a passport or national identification card.

- Submit the completed form and documents to the IRS, either by mail or through an acceptance agent.

Required Documents

When submitting the Form W-7SP, applicants must include specific documents to verify their identity and foreign status. Acceptable documents include:

- Passport (must be current and valid)

- National identification card

- Birth certificate (for children)

- Other government-issued documents that include a photo

All documents must be original or certified copies from the issuing agency.

Eligibility Criteria

To qualify for an ITIN using the Form W-7SP, applicants must meet certain eligibility criteria. These include:

- Not being eligible for a Social Security Number (SSN).

- Having a valid federal tax purpose for needing an ITIN.

- Providing proof of identity and foreign status through acceptable documents.

Individuals must ensure they meet these criteria before submitting their application to avoid delays.

Application Process & Approval Time

The application process for the Form W-7SP involves filling out the form and submitting it to the IRS along with required documents. Generally, the IRS takes about six to eight weeks to process the application. Applicants should ensure that all information is accurate and complete to avoid processing delays. If additional information is needed, the IRS may contact the applicant for clarification.

Quick guide on how to complete form w 7sp rev february 2007 application for irs individual taxpayer identification number spanish version

Effortlessly Prepare Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version on Any Device

Digital document management has become increasingly favored among organizations and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly and without holdups. Handle Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Modify and eSign Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version with Ease

- Locate Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and bears the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it onto your PC.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version and guarantee seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 7sp rev february 2007 application for irs individual taxpayer identification number spanish version

Create this form in 5 minutes!

How to create an eSignature for the form w 7sp rev february 2007 application for irs individual taxpayer identification number spanish version

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

The Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version is a key document for individuals who require an ITIN for tax purposes in the U.S. This form allows applicants to submit their details in Spanish, making the process more accessible. It plays a vital role in ensuring compliance with IRS regulations for non-resident aliens.

-

How can I complete the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version using airSlate SignNow?

airSlate SignNow offers a streamlined platform to complete the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version. Users can fill out the form electronically, sign it, and send it securely. This eliminates the need for physical paperwork and simplifies the submission process.

-

What are the pricing options for using airSlate SignNow to manage Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

airSlate SignNow provides flexible pricing plans tailored for individuals and businesses looking to handle documentation like the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version. The plans are competitively priced, ensuring that you get cost-effective solutions without compromising on quality or service.

-

What features does airSlate SignNow offer for the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

With airSlate SignNow, users benefit from features like electronic signatures, templates for the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version, and secure document sharing. These features enhance the overall efficiency of completing tax-related forms, ensuring that your submissions are accurate and secure.

-

Are there any benefits to using airSlate SignNow for the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

Using airSlate SignNow to manage the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version offers numerous benefits such as time savings, secure storage, and elimination of paper usage. Additionally, the platform is user-friendly, ensuring that everyone can navigate it easily, regardless of their tech-savviness.

-

Can I integrate airSlate SignNow with other applications for handling Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

Yes, airSlate SignNow supports integrations with various applications, which can enhance how you manage the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version. This integration allows for seamless workflow management, ensuring that all necessary documentation is handled efficiently and effectively.

-

Is airSlate SignNow secure for submitting Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

Absolutely! airSlate SignNow employs advanced security protocols to ensure that your data remains confidential and secure when submitting the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version. With end-to-end encryption, you can trust that your information is protected at all times.

Get more for Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

- Document locator and personal information package including burial information form florida

- Florida copy form

- Florida will form

- Injury workers compensation 497303537 form

- Georgia suspension form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497303539 form

- Ga odometer disclosure statement form

- Ga odometer form

Find out other Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment