Form W 7 Sp 2024-2026

What is the Form W-7 SP?

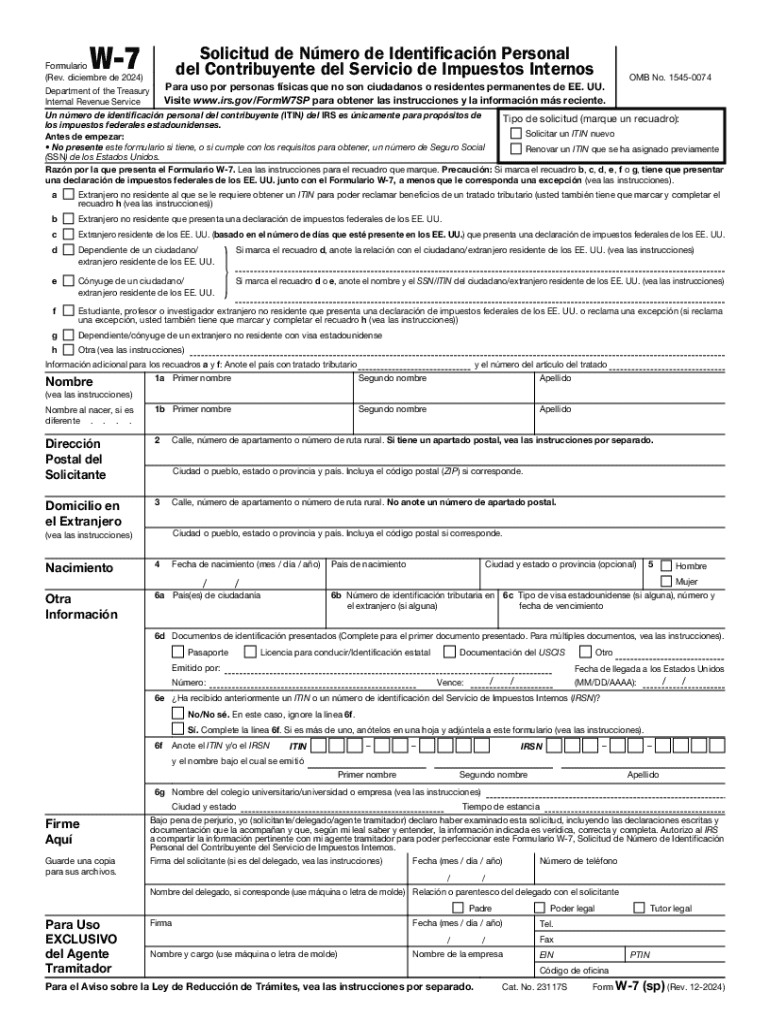

The Form W-7 SP is an IRS document specifically designed for individuals who are not U.S. citizens and need to apply for an Individual Taxpayer Identification Number (ITIN) for tax purposes. This form is primarily used by non-resident aliens, their spouses, and dependents who are not eligible for a Social Security number. The W-7 SP version is tailored for Spanish-speaking applicants, providing instructions and information in Spanish to facilitate the application process.

How to use the Form W-7 SP

Using the Form W-7 SP involves several steps. First, individuals must complete the form accurately, ensuring all required information is provided. This includes personal details such as name, address, and foreign status. After filling out the form, applicants must submit it along with the necessary documentation that proves their identity and foreign status. This can include a passport, national identification card, or other government-issued documents. The completed form can be submitted by mail or in person at designated IRS locations.

Steps to complete the Form W-7 SP

Completing the Form W-7 SP requires careful attention to detail. Follow these steps:

- Obtain the Form W-7 SP from the IRS website or through authorized providers.

- Fill out the personal information section, ensuring accuracy in names and addresses.

- Indicate the reason for applying for an ITIN in the relevant section.

- Gather supporting documents that verify your identity and foreign status.

- Review the form for completeness and accuracy before submission.

Required Documents

When submitting the Form W-7 SP, applicants must include specific documents to support their application. Required documents typically include:

- A valid passport or a combination of documents that includes a government-issued ID and a birth certificate.

- Any documents that establish foreign status, such as a visa or residency card.

- Proof of connection to the U.S. if applicable, such as a tax return or a letter from a financial institution.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-7 SP can vary depending on individual circumstances. Generally, it is advisable to submit the form as soon as the need for an ITIN arises, especially if it is required for tax filing purposes. The IRS recommends that applicants submit the form before the tax filing deadline to avoid delays in processing. Keeping track of important dates, such as the annual tax filing deadline, is crucial for timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Form W-7 SP can be submitted through various methods. Applicants have the option to:

- Mail the completed form along with supporting documents to the address specified in the form instructions.

- Submit the form in person at designated IRS Taxpayer Assistance Centers.

- Utilize authorized acceptance agents who can assist with the application process and submit the form on behalf of the applicant.

Create this form in 5 minutes or less

Find and fill out the correct form w 7 sp 770493940

Create this form in 5 minutes!

How to create an eSignature for the form w 7 sp 770493940

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for managing 2024 impuestos?

airSlate SignNow offers a range of features designed to streamline document management for 2024 impuestos. Users can easily create, send, and eSign documents, ensuring compliance and efficiency. The platform also includes templates specifically tailored for tax-related documents, making it easier to manage your 2024 impuestos.

-

How does airSlate SignNow help with the preparation of 2024 impuestos?

With airSlate SignNow, preparing your 2024 impuestos becomes a hassle-free process. The platform allows you to collect signatures and approvals quickly, ensuring that all necessary documents are in order. This efficiency can save you time and reduce stress during tax season.

-

What is the pricing structure for airSlate SignNow when dealing with 2024 impuestos?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it an affordable choice for managing 2024 impuestos. You can choose from monthly or annual subscriptions, with options that include additional features as needed. This ensures you only pay for what you use while effectively managing your tax documents.

-

Can airSlate SignNow integrate with other tools for 2024 impuestos?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, enhancing your workflow for 2024 impuestos. This integration allows you to sync data and documents effortlessly, reducing the risk of errors and improving overall efficiency. You can connect with popular platforms to streamline your tax preparation process.

-

What benefits does airSlate SignNow provide for small businesses handling 2024 impuestos?

For small businesses, airSlate SignNow offers a cost-effective solution to manage 2024 impuestos efficiently. The user-friendly interface simplifies the eSigning process, allowing you to focus on your business rather than paperwork. Additionally, the platform's security features ensure that your sensitive tax documents are protected.

-

Is airSlate SignNow compliant with regulations for 2024 impuestos?

Absolutely, airSlate SignNow is designed to comply with industry regulations, making it a reliable choice for managing 2024 impuestos. The platform adheres to eSignature laws and data protection standards, ensuring that your documents are legally binding and secure. This compliance gives you peace of mind during tax season.

-

How can I get started with airSlate SignNow for my 2024 impuestos?

Getting started with airSlate SignNow for your 2024 impuestos is simple. You can sign up for a free trial to explore the features and see how it fits your needs. Once you're ready, choose a pricing plan that suits your business, and start managing your tax documents with ease.

Get more for Form W 7 sp

- Dtf 719 form

- How to form an association pdf

- Qatar visa application form pdf

- Sample adoption contract image texalmal form

- Medical technologist skills checklist form

- Waiver of signature form

- Aquatic rescue sequence fill online printable fillable form

- New submission to add the cobas u 411 urine analyzer for use with the chemstrip 10 ua form

Find out other Form W 7 sp

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements