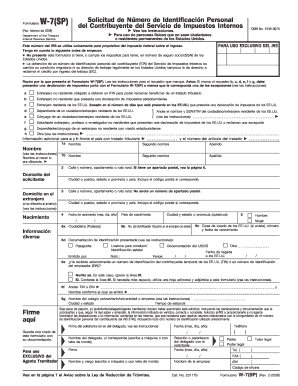

Form W 7SP Rev February Application for IRS Individual Taxpayer Identification Number Spanish Version 2008

What is the Form W-7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

The Form W-7SP Rev February is an application specifically designed for individuals who need to obtain an Individual Taxpayer Identification Number (ITIN) from the IRS, but prefer to complete the process in Spanish. This form is essential for non-resident aliens and others who are not eligible for a Social Security Number but need to fulfill their tax obligations in the United States. The W-7SP allows applicants to provide necessary information to the IRS in their preferred language, ensuring clarity and understanding throughout the application process.

Steps to complete the Form W-7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

Completing the Form W-7SP involves several important steps to ensure accuracy and compliance. First, gather all required documents, including proof of identity and foreign status. Next, fill out the form carefully, providing all requested information such as name, address, and reason for needing the ITIN. It is crucial to review the completed form for any errors before submission. Finally, submit the form along with the necessary supporting documents to the IRS, either by mail or through an authorized acceptance agent. Following these steps will help facilitate a smooth application process.

Required Documents for the Form W-7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

When applying for an ITIN using the Form W-7SP, applicants must provide specific documentation to support their identity and foreign status. Acceptable documents include a valid passport, national identification card, or other government-issued identification with a photo. Additionally, documents must show the applicant's name and address. For those who are dependents, the IRS may require additional documentation, such as birth certificates or school records. Ensuring that all required documents are included with the application is essential for a successful submission.

Legal use of the Form W-7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

The Form W-7SP is legally recognized by the IRS as a valid means for individuals to apply for an ITIN. This form must be used in accordance with IRS guidelines to ensure that the application is processed correctly. It is important to understand that the ITIN is used solely for tax purposes and does not authorize individuals to work in the United States or provide eligibility for Social Security benefits. Proper use of the form helps maintain compliance with U.S. tax laws and regulations.

How to obtain the Form W-7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

The Form W-7SP can be obtained directly from the IRS website or through authorized acceptance agents who assist applicants in completing tax forms. It is available for download in PDF format, allowing individuals to print and fill it out at their convenience. Additionally, some community organizations may provide the form and assistance in completing it, particularly for those who may face language barriers. Accessing the form is straightforward, ensuring that all eligible individuals can apply for their ITIN as needed.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form W-7SP can be done through various methods, depending on the applicant's preference and situation. The form can be mailed directly to the IRS along with required documents. Alternatively, applicants may choose to submit the form in person at designated IRS Taxpayer Assistance Centers. Some individuals may also opt to use authorized acceptance agents who can help facilitate the submission process. It is important to choose a submission method that aligns with the applicant's circumstances to ensure timely processing of the application.

Quick guide on how to complete form w 7sp rev february 2008 application for irs individual taxpayer identification number spanish version

Complete Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version seamlessly on any device

Web-based document administration has gained traction among businesses and individuals. It serves as an excellent sustainable substitute for traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the functionalities required to create, modify, and eSign your documents quickly without interruptions. Manage Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version on any device using the airSlate SignNow Android or iOS applications, and enhance any document-related process today.

The easiest method to modify and eSign Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version effortlessly

- Find Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version and click Get Form to begin.

- Employ the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a classic wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 7sp rev february 2008 application for irs individual taxpayer identification number spanish version

Create this form in 5 minutes!

How to create an eSignature for the form w 7sp rev february 2008 application for irs individual taxpayer identification number spanish version

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

The Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version is a document used to apply for an Individual Taxpayer Identification Number (ITIN) from the IRS. This version is specifically tailored for Spanish-speaking applicants, ensuring they can understand and complete the application process efficiently.

-

How can airSlate SignNow help with the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

airSlate SignNow allows users to easily send and eSign the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version. Our platform simplifies the process, ensuring documents are completed, signed, and sent securely, all within a user-friendly interface.

-

What features does airSlate SignNow offer for managing forms like the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

Our platform offers a range of features for managing forms, including document templates, customizable workflows, and real-time collaboration. With airSlate SignNow, you can track the status of the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version in real time, ensuring timely completion.

-

Is there a cost associated with using airSlate SignNow for the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

Yes, airSlate SignNow provides various pricing plans to accommodate different business needs. Our cost-effective solutions ensure you have access to the tools necessary for managing the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version without overspending.

-

Can I integrate airSlate SignNow with other software for processing the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

Absolutely! airSlate SignNow supports seamless integrations with a variety of third-party applications, making it easy to manage the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version alongside your existing software. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version?

Using airSlate SignNow for the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version offers increased efficiency and security. Our platform ensures a hassle-free eSigning experience, reduces paper usage, and provides a legally binding record of agreements.

-

How secure is the submission of the Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version through airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to ensure that your Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version is submitted securely and confidentially, protecting sensitive personal information.

Get more for Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

- How to fill up comelec registration form

- Comelec registration form

- Post office death claim form with nomination

- Cac registration form

- Deep borewell odisha online apply 2020 21 last date form

- Form 888

- Ui 2 7 form 2020 word document

- Job no 4696corporate relationship opening form april 21final4 11 20224

Find out other Form W 7SP Rev February Application For IRS Individual Taxpayer Identification Number Spanish Version

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now