Instructions Ss 4 Form 2019

What is the SS-4 Form?

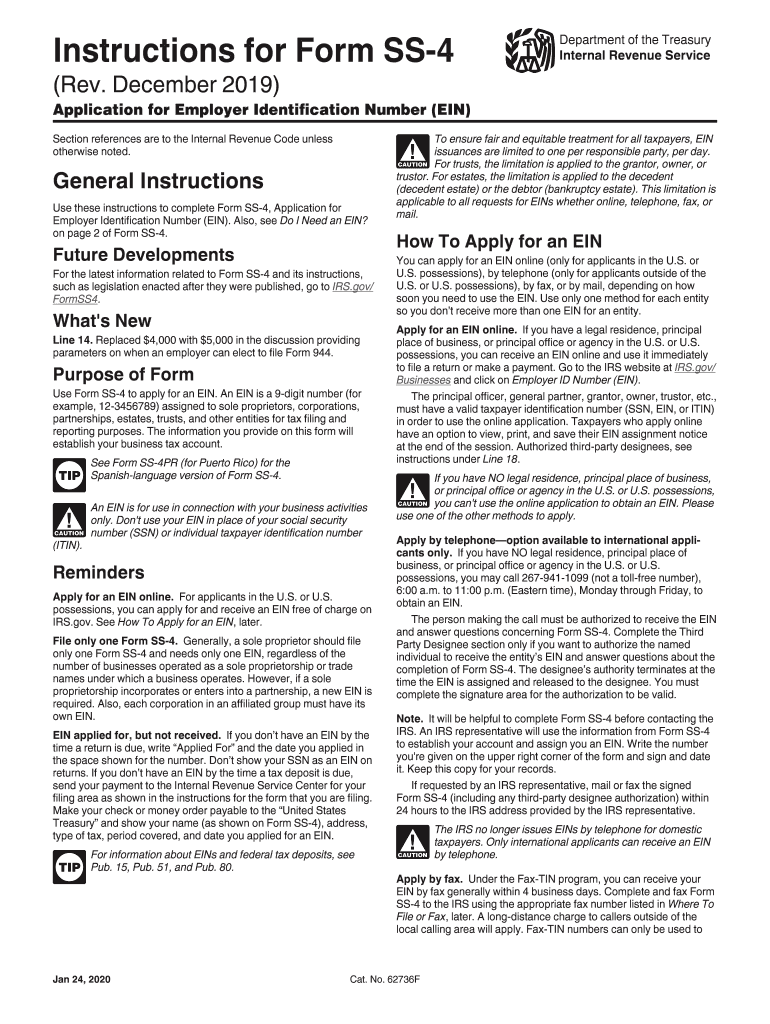

The SS-4 form, also known as the Application for Employer Identification Number (EIN), is a crucial document used by businesses and entities in the United States to obtain an Employer Identification Number from the Internal Revenue Service (IRS). This number is essential for various tax and business purposes, including opening a bank account, hiring employees, and filing tax returns. The SS-4 form is applicable to a wide range of entities, including sole proprietorships, partnerships, corporations, and nonprofit organizations.

Steps to Complete the SS-4 Form

Completing the SS-4 form involves several key steps to ensure accuracy and compliance with IRS requirements. Here is a simplified process:

- Gather Information: Collect necessary details about your business, such as the legal name, trade name, address, and the type of entity.

- Identify Responsible Party: Designate an individual responsible for the entity, typically a principal officer or owner.

- Fill Out the Form: Carefully complete each section of the SS-4 form, ensuring that all information is accurate and up-to-date.

- Review: Double-check the form for any errors or omissions before submission.

- Submit: Send the completed form to the IRS via mail or online through the IRS website.

Legal Use of the SS-4 Form

The SS-4 form serves a legal purpose as it is the official application for obtaining an EIN, which is required for compliance with federal tax laws. An EIN is necessary for businesses to report taxes, hire employees, and establish business credit. Using the SS-4 form correctly ensures that businesses operate within the legal framework set by the IRS, thereby avoiding potential penalties or legal issues.

IRS Guidelines for the SS-4 Form

The IRS provides specific guidelines for completing and submitting the SS-4 form. It is important to follow these guidelines closely to ensure that the application is processed without delays. Key points include:

- Ensure that the form is filled out completely and accurately.

- Submit the form in a timely manner, especially if you need the EIN for immediate business operations.

- Understand the implications of the EIN for tax reporting and compliance.

Required Documents for the SS-4 Form

When completing the SS-4 form, certain documents and information are typically required. This may include:

- Legal name and address of the business entity.

- Type of entity (e.g., corporation, partnership, sole proprietorship).

- Responsible party's name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Reason for applying for an EIN, such as starting a new business or hiring employees.

Form Submission Methods

The SS-4 form can be submitted to the IRS through various methods, including:

- Online: Businesses can apply for an EIN directly on the IRS website, which is the fastest method.

- Mail: Completed forms can be mailed to the appropriate IRS address based on the entity's location.

- Fax: In some cases, the form can be faxed to the IRS, although this option may not be available for all applicants.

Quick guide on how to complete instructions for form ss 4 rev december 2019 instructions for form ss 4 application for employer identification number ein

Effortlessly Prepare Instructions Ss 4 Form on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly and without hurdles. Manage Instructions Ss 4 Form on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

How to amend and eSign Instructions Ss 4 Form with ease

- Locate Instructions Ss 4 Form and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with the tools airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs with just a few clicks from a device of your choice. Alter and eSign Instructions Ss 4 Form to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ss 4 rev december 2019 instructions for form ss 4 application for employer identification number ein

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ss 4 rev december 2019 instructions for form ss 4 application for employer identification number ein

How to make an electronic signature for your Instructions For Form Ss 4 Rev December 2019 Instructions For Form Ss 4 Application For Employer Identification Number Ein online

How to make an electronic signature for your Instructions For Form Ss 4 Rev December 2019 Instructions For Form Ss 4 Application For Employer Identification Number Ein in Chrome

How to make an electronic signature for signing the Instructions For Form Ss 4 Rev December 2019 Instructions For Form Ss 4 Application For Employer Identification Number Ein in Gmail

How to make an electronic signature for the Instructions For Form Ss 4 Rev December 2019 Instructions For Form Ss 4 Application For Employer Identification Number Ein straight from your smart phone

How to create an eSignature for the Instructions For Form Ss 4 Rev December 2019 Instructions For Form Ss 4 Application For Employer Identification Number Ein on iOS devices

How to create an eSignature for the Instructions For Form Ss 4 Rev December 2019 Instructions For Form Ss 4 Application For Employer Identification Number Ein on Android

People also ask

-

What are ss4 instructions for signing documents?

The ss4 instructions guide you through filling out the SS-4 form to apply for an Employer Identification Number (EIN). With airSlate SignNow, you can easily eSign documents once you have your EIN, streamlining the process and ensuring compliance.

-

How does airSlate SignNow help with ss4 instructions?

airSlate SignNow simplifies the process of completing ss4 instructions by allowing you to fill out, sign, and send the form electronically. This not only saves time but also helps eliminate errors that can occur with manual submissions.

-

Are there any costs associated with airSlate SignNow for ss4 instructions?

airSlate SignNow offers a variety of pricing plans, making it affordable for any business needing to follow ss4 instructions. You can start with a free trial to explore features before committing to a plan.

-

What features does airSlate SignNow offer for ss4 instructions?

AirSlate SignNow includes features such as customizable templates, in-person signing, and secure cloud storage that enhance your experience while following ss4 instructions. These tools ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other tools while using ss4 instructions?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow while adhering to ss4 instructions. This helps you manage documents easily alongside other tools you may already be using.

-

What are the benefits of using airSlate SignNow with ss4 instructions?

Using airSlate SignNow with ss4 instructions allows for faster processing and improved accuracy when filling out the SS-4 form. The platform's electronic signature capabilities help ensure that all parties can sign off quickly and securely.

-

How can I ensure compliance while following ss4 instructions?

AirSlate SignNow helps ensure compliance by providing templates and guidance that align with official ss4 instructions. Furthermore, electronic signatures are legally binding, making your documents compliant across jurisdictions.

Get more for Instructions Ss 4 Form

- Padrinolimousinecom form

- Palau community collge how to request form

- Rcmp grc 6423e form

- Loan application westpac form

- Home loan application form security bank

- Bencor new fica rollover form fillable1pdf 2013 ford focus brochure

- Verification form 14 15 aggregate blue ridge community and blueridgectc

- Vendor information form

Find out other Instructions Ss 4 Form

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe