Mt 50 2019-2026

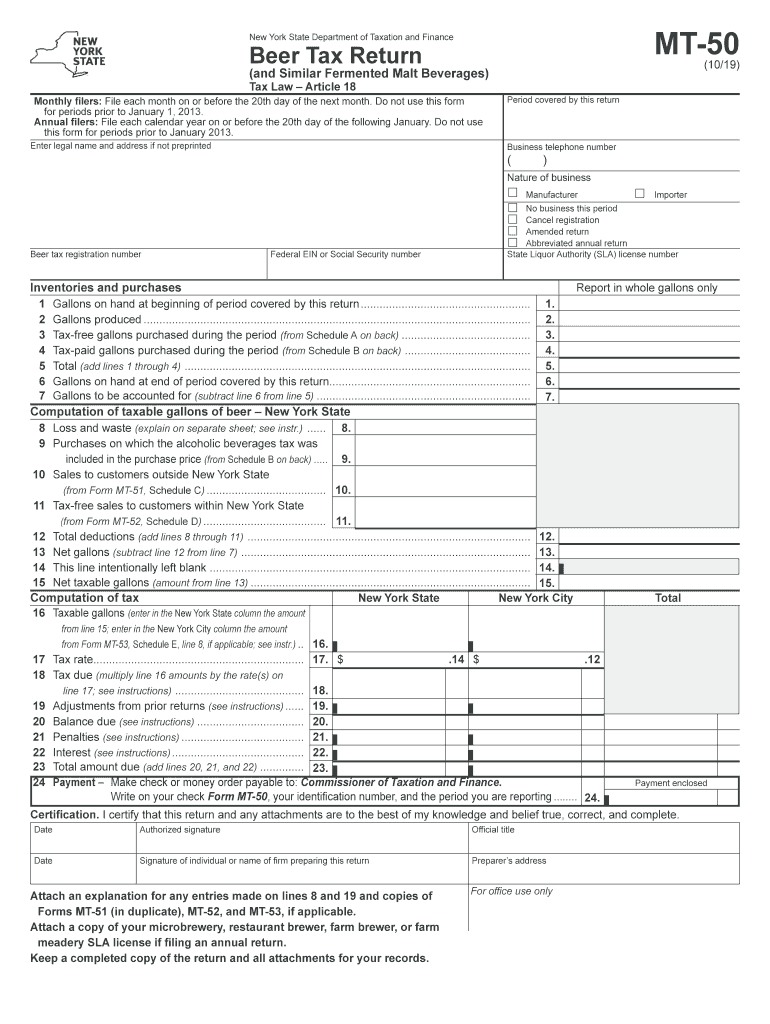

What is the MT-50?

The MT-50 is a form used in New York State to report and pay the excise tax on specific products, primarily alcoholic beverages. This tax is levied on manufacturers, distributors, and importers of beer, wine, and spirits. The form captures essential information about the quantity and type of products distributed, ensuring compliance with state tax regulations. Understanding the MT-50 is crucial for businesses involved in the production and sale of alcoholic beverages in New York.

Steps to Complete the MT-50

Filling out the MT-50 involves several key steps to ensure accuracy and compliance. Begin by gathering relevant information about your business, including your New York State sales tax identification number and details about the products you are reporting. Next, accurately document the quantities of each product type, as well as the applicable tax rates. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted either online or via mail, depending on your preference.

How to Obtain the MT-50

The MT-50 form can be obtained through the New York State Department of Taxation and Finance website. It is available in a downloadable PDF format, which can be printed and filled out by hand. Additionally, businesses may access the form through various tax preparation software that supports New York tax forms. Ensure that you are using the most current version of the MT-50 to avoid any compliance issues.

Legal Use of the MT-50

The MT-50 must be used in accordance with New York State tax laws. This means accurately reporting all taxable products and ensuring timely payment of any excise taxes owed. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand their legal obligations regarding the MT-50 to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the MT-50 vary based on the reporting period. Typically, businesses are required to file the form quarterly, with specific due dates set by the New York State Department of Taxation and Finance. It is crucial to stay informed about these deadlines to avoid late fees and penalties. Mark your calendar with the relevant dates to ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The MT-50 can be submitted through various methods to accommodate different business needs. Businesses have the option to file online via the New York State Department of Taxation and Finance website, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own guidelines, so it is important to follow the instructions provided for each option.

Penalties for Non-Compliance

Non-compliance with the MT-50 filing requirements can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. Businesses should be aware of the consequences of failing to file or pay taxes on time. Maintaining accurate records and adhering to filing deadlines is essential to avoid these penalties and ensure smooth operations.

Quick guide on how to complete beer tax return mt 50

Complete Mt 50 effortlessly on any device

Online document management has gained signNow traction among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Mt 50 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

How to modify and eSign Mt 50 with ease

- Obtain Mt 50 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Mt 50 and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct beer tax return mt 50

Create this form in 5 minutes!

How to create an eSignature for the beer tax return mt 50

How to create an eSignature for your Beer Tax Return Mt 50 online

How to make an eSignature for the Beer Tax Return Mt 50 in Google Chrome

How to create an eSignature for signing the Beer Tax Return Mt 50 in Gmail

How to make an electronic signature for the Beer Tax Return Mt 50 from your smartphone

How to create an electronic signature for the Beer Tax Return Mt 50 on iOS devices

How to make an electronic signature for the Beer Tax Return Mt 50 on Android devices

People also ask

-

What is the Mt 50 pricing plan for airSlate SignNow?

The Mt 50 pricing plan offers a competitive rate for businesses looking to utilize airSlate SignNow's eSignature solutions. This plan is tailored for teams needing to manage up to 50 documents per month, making it an ideal choice for small to medium-sized businesses. With the Mt 50 plan, you can enjoy all the essential features of airSlate SignNow without breaking the bank.

-

What features are included in the Mt 50 plan?

The Mt 50 plan provides access to a variety of features designed to streamline your document workflows. Users can take advantage of advanced eSignature capabilities, customizable templates, and secure cloud storage, all within a user-friendly interface. Additionally, the Mt 50 plan allows for seamless document tracking and management, ensuring a smooth signing process.

-

How can the Mt 50 plan benefit my business?

The Mt 50 plan from airSlate SignNow can signNowly enhance your business's efficiency by simplifying the document signing process. With its intuitive design and quick turnaround times, you can reduce administrative overhead and accelerate contract execution. This means more time for your team to focus on core business activities, improving overall productivity.

-

Can I integrate airSlate SignNow with other software using the Mt 50 plan?

Yes, the Mt 50 plan supports integrations with various popular software applications. This includes tools like Google Drive, Salesforce, and Microsoft Office, enabling you to streamline your workflows further. By integrating airSlate SignNow with your existing systems, you can enhance collaboration and ensure that your documents are always accessible.

-

Is there a free trial available for the Mt 50 plan of airSlate SignNow?

Yes, airSlate SignNow offers a free trial for the Mt 50 plan, allowing you to explore its features and benefits without any commitment. This trial period gives you the opportunity to test the platform and see how it fits into your business processes. Sign up today to experience the ease of eSigning with the Mt 50 plan.

-

What types of documents can I eSign with the Mt 50 plan?

With the Mt 50 plan, you can eSign a wide range of document types, including contracts, agreements, and forms. Whether you need to send a simple document or more complex contracts, airSlate SignNow accommodates various formats. This flexibility ensures that you can handle all your signing needs efficiently.

-

How secure is document signing with the Mt 50 plan?

Document signing with the Mt 50 plan is highly secure, utilizing industry-standard encryption protocols. airSlate SignNow ensures that your documents are protected during transmission and storage, giving you peace of mind. Additionally, the platform complies with legal requirements for electronic signatures, ensuring that your signed documents are valid and enforceable.

Get more for Mt 50

- Housing statement form

- Maine unemployment wage verification form

- Anguilla tourist visa application form anguilla visa anguilla visahq

- Form coventry provider

- Coventry appeals form

- Provider demographic change form coventry health care of

- Kaiser permanente cobra enrollment form pdf meba mymeba

- Cc 305 form

Find out other Mt 50

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself