Ny Mt 15 2019

What is the NY MT 15?

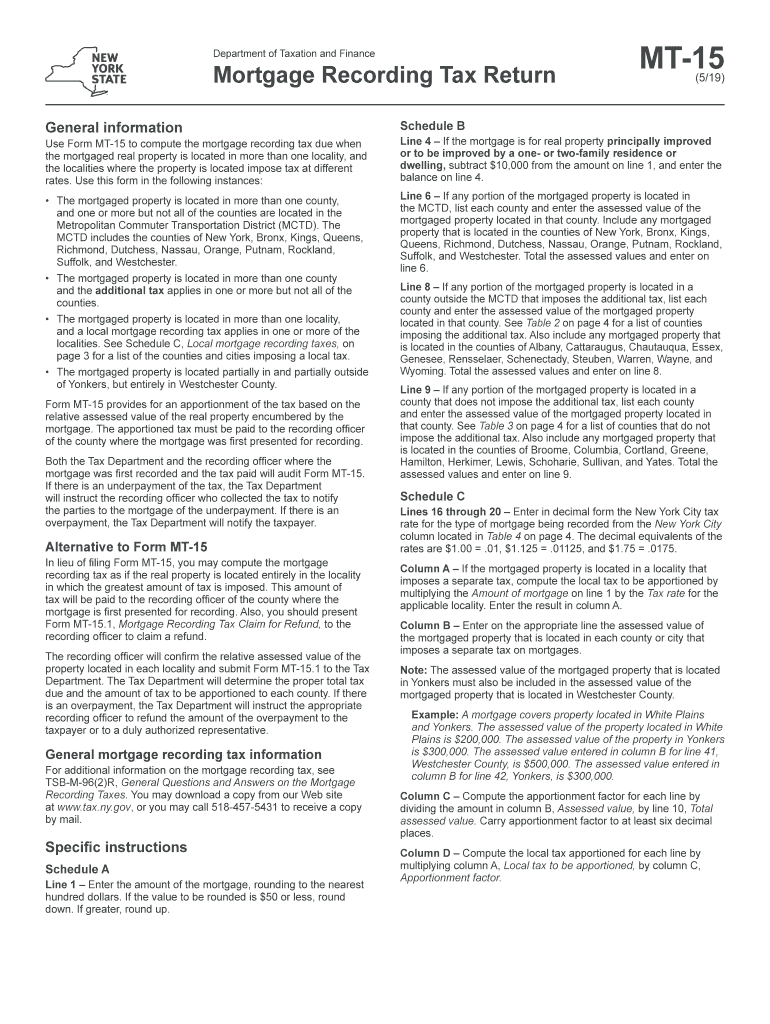

The NY MT 15 is a form used in New York State for reporting mortgage recording taxes. This form is essential for property owners and lenders involved in real estate transactions. It serves to document the amount of mortgage tax owed when a mortgage is recorded with the county clerk. Understanding the NY MT 15 is crucial for compliance with state tax regulations and for ensuring that all required taxes are accurately reported and paid.

How to use the NY MT 15

To use the NY MT 15, individuals must complete the form with accurate information regarding the mortgage transaction. This includes details such as the names of the parties involved, the amount of the mortgage, and the property address. Once completed, the form must be submitted to the appropriate county clerk's office along with the required payment for the mortgage recording tax. Proper use of this form helps avoid penalties and ensures compliance with state laws.

Steps to complete the NY MT 15

Completing the NY MT 15 involves several key steps:

- Gather necessary information, including borrower and lender details, mortgage amount, and property location.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the mortgage recording tax based on the mortgage amount and current tax rates.

- Review the form for accuracy before submission.

- Submit the completed form and payment to the county clerk's office.

Legal use of the NY MT 15

The NY MT 15 must be used in accordance with New York State laws governing mortgage recording taxes. This includes adhering to deadlines for submission and ensuring that the information provided is truthful and complete. Failure to comply with these legal requirements can result in penalties, including fines or additional taxes owed. It is important for users to be aware of their obligations under state law when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the NY MT 15 are typically aligned with the recording of the mortgage. It is essential to submit the form promptly to avoid late fees or penalties. Users should check with their local county clerk's office for specific deadlines, as these can vary by location. Keeping track of important dates related to mortgage transactions helps ensure compliance with all tax obligations.

Required Documents

When completing the NY MT 15, certain documents are required to support the information provided. These may include:

- The mortgage agreement detailing the terms of the loan.

- Identification of the parties involved in the transaction.

- Any additional documentation required by the county clerk's office.

Having these documents ready can facilitate a smoother filing process and help ensure that all necessary information is included on the form.

Quick guide on how to complete form mt 51519mortgage recording tax returnmt15

Finish Ny Mt 15 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Ny Mt 15 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest method to modify and electronically sign Ny Mt 15 without hassle

- Locate Ny Mt 15 and then click Retrieve Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Signature tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Finish button to store your modifications.

- Choose how you want to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ny Mt 15 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mt 51519mortgage recording tax returnmt15

Create this form in 5 minutes!

How to create an eSignature for the form mt 51519mortgage recording tax returnmt15

How to generate an eSignature for the Form Mt 51519mortgage Recording Tax Returnmt15 online

How to create an eSignature for your Form Mt 51519mortgage Recording Tax Returnmt15 in Chrome

How to make an electronic signature for signing the Form Mt 51519mortgage Recording Tax Returnmt15 in Gmail

How to create an eSignature for the Form Mt 51519mortgage Recording Tax Returnmt15 right from your mobile device

How to make an eSignature for the Form Mt 51519mortgage Recording Tax Returnmt15 on iOS devices

How to make an electronic signature for the Form Mt 51519mortgage Recording Tax Returnmt15 on Android

People also ask

-

What is the ny mt 15 form, and why is it important?

The ny mt 15 form is a crucial document used for specific tax purposes in New York State. It serves as a notification for taxpayers to report their tax obligations accurately. Understanding the ny mt 15 can help businesses comply with tax regulations efficiently.

-

How does airSlate SignNow support the ny mt 15 form signing process?

airSlate SignNow offers a seamless platform for signing the ny mt 15 form electronically. With its user-friendly interface, businesses can easily send and eSign documents, streamlining the process. This feature ensures that the ny mt 15 is processed quickly and securely.

-

What pricing plans does airSlate SignNow offer for businesses needing the ny mt 15?

airSlate SignNow provides various pricing plans tailored to different business needs, all ideal for managing documents like the ny mt 15. Each plan ensures access to essential features for eSigning and document management. You can choose a plan that best fits your budget and eSigning requirements.

-

What are the key features of airSlate SignNow relevant to the ny mt 15?

Key features of airSlate SignNow include customizable templates, secure eSigning, and document tracking, all essential for handling the ny mt 15 form. The platform also offers automated workflows that simplify the process, enabling businesses to manage their eSignatures effectively. These features ensure compliance and efficiency while filling out the ny mt 15.

-

How can I integrate airSlate SignNow for use with the ny mt 15 form?

Integrating airSlate SignNow with existing tools is simple and supports various applications. This flexibility allows users to automate the process of managing the ny mt 15 form alongside other business operations. Detailed integration guidelines are provided for a smooth transition.

-

What benefits does airSlate SignNow offer for businesses dealing with the ny mt 15?

Using airSlate SignNow for the ny mt 15 provides numerous benefits, including time savings and improved accuracy in document handling. The platform's security features ensure that sensitive tax documents are protected. Additionally, the ease of eSigning expedites the overall process.

-

Is airSlate SignNow compliant with regulations for the ny mt 15 form?

Yes, airSlate SignNow is compliant with legal regulations required for signing documents like the ny mt 15 form. The platform employs state-of-the-art security measures to ensure that all eSignatures are valid and legally binding. This compliance is crucial for businesses navigating tax responsibilities.

Get more for Ny Mt 15

- Field trip and in state travel permission form keller isd schools

- Will county illinois summons in forceible en detainer form

- Co summons form

- Verification of no income voni chasebrexton form

- Notice of confidential information within court filing eighteenth flcourts18

- Genetics the science of heredity chapter test genetics the dgs k12 il form

- Eye exam formpdf up140 jacksn k12 il

- Caprapbsohscninet form ca1 ni ca no rev 0511 1 audit hscbusiness hscni

Find out other Ny Mt 15

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online