Form MT 15 11014Mortgage Recording Tax Claim for 2020-2026

What is the Form MT 15 11014 Mortgage Recording Tax Claim For

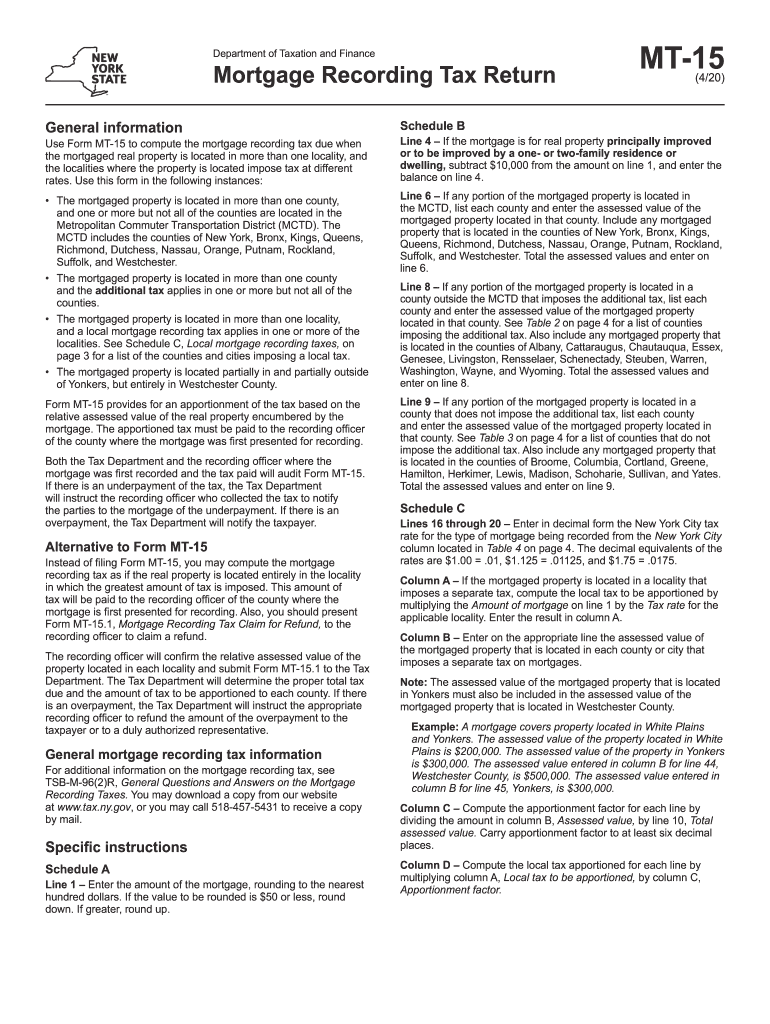

The Form MT 15 11014 is a specific document used in the United States for claiming a refund of the mortgage recording tax. This form is essential for individuals or entities that have paid this tax when recording a mortgage and seek reimbursement under applicable state laws. The form outlines the necessary details regarding the mortgage transaction and the amount of tax paid, allowing for a structured approach to filing a claim.

Steps to Complete the Form MT 15 11014 Mortgage Recording Tax Claim For

Completing the Form MT 15 11014 involves several key steps to ensure accuracy and compliance. First, gather all relevant documentation, including proof of payment of the mortgage recording tax. Next, fill out the form by providing details such as the name of the taxpayer, the property address, and the amount of tax paid. It is crucial to double-check all entries for accuracy. After completing the form, sign and date it before submission. Finally, retain a copy of the form and any supporting documents for your records.

Legal Use of the Form MT 15 11014 Mortgage Recording Tax Claim For

The legal use of the Form MT 15 11014 is governed by state regulations regarding mortgage recording taxes. The form must be used in accordance with the laws that dictate eligibility for refunds. It serves as a formal request for reimbursement, and its proper completion is vital for ensuring that claims are processed legally. Failure to comply with the legal requirements can result in denial of the claim, making it essential to understand the applicable laws.

Required Documents for the Form MT 15 11014 Mortgage Recording Tax Claim For

When filing the Form MT 15 11014, certain documents are required to support your claim. These typically include proof of payment of the mortgage recording tax, such as a receipt or bank statement, and any relevant mortgage documents. Additionally, if the claim is being made by an entity, documentation proving the entity's legal status may also be necessary. Ensuring that all required documents are included will facilitate a smoother review process.

Form Submission Methods for the MT 15 11014 Mortgage Recording Tax Claim For

The Form MT 15 11014 can be submitted through various methods, depending on state regulations. Common submission methods include online filing through designated state portals, mailing the completed form to the appropriate tax authority, or in-person submission at local offices. Each method may have specific requirements or processing times, so it is advisable to check the guidelines provided by the relevant state agency.

Eligibility Criteria for the Form MT 15 11014 Mortgage Recording Tax Claim For

Eligibility for filing the Form MT 15 11014 typically requires that the taxpayer has paid the mortgage recording tax and is the party entitled to the refund. Specific criteria may vary by state, but generally, the claimant must be the individual or entity that recorded the mortgage. It is important to review the eligibility requirements carefully to ensure that your claim meets all necessary conditions.

Quick guide on how to complete form mt 1511014mortgage recording tax claim for

Complete Form MT 15 11014Mortgage Recording Tax Claim For effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the right form and safely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage Form MT 15 11014Mortgage Recording Tax Claim For on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Form MT 15 11014Mortgage Recording Tax Claim For with ease

- Obtain Form MT 15 11014Mortgage Recording Tax Claim For and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate the printing of new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Form MT 15 11014Mortgage Recording Tax Claim For and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mt 1511014mortgage recording tax claim for

Create this form in 5 minutes!

How to create an eSignature for the form mt 1511014mortgage recording tax claim for

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is mt recording in the context of airSlate SignNow?

MT recording refers to the process of capturing and managing document transactions in airSlate SignNow. This feature enables users to easily access all signed and pending documents, ensuring a streamlined workflow and enhanced organization in your business operations.

-

How can mt recording benefit my business?

MT recording offers signNow advantages, including improved efficiency and accurate tracking of document statuses. By utilizing mt recording, businesses can minimize delays and errors, enhancing overall productivity and customer satisfaction in the signing process.

-

Is there a pricing plan that includes mt recording?

Yes, airSlate SignNow offers various pricing plans that include mt recording as part of the solution. Customers can choose a plan that best fits their needs, ensuring access to essential features like mt recording without breaking the bank.

-

What features does mt recording include?

The mt recording feature includes capabilities such as real-time tracking, notifications for document completion, and secure storage of all records. These features work together to enhance document management and facilitate smoother operations for businesses.

-

Can I integrate mt recording with other tools?

Absolutely! airSlate SignNow allows seamless integration of mt recording with various third-party applications, enhancing your existing workflow. This ensures that you can manage documents more efficiently by connecting with your favorite tools like CRM and project management software.

-

How does mt recording ensure document security?

MT recording in airSlate SignNow ensures document security through encryption and secure access controls. This protects sensitive information and maintains compliance with industry standards, giving you peace of mind about the safety of your recorded documents.

-

Is mt recording easy to use for non-technical users?

Yes, mt recording is designed to be user-friendly and accessible for all users, regardless of technical background. airSlate SignNow's intuitive interface allows anyone to manage document recording with ease, fostering an inclusive environment for your team.

Get more for Form MT 15 11014Mortgage Recording Tax Claim For

Find out other Form MT 15 11014Mortgage Recording Tax Claim For

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast