268 Tax 2020-2026

Understanding the 268 Tax

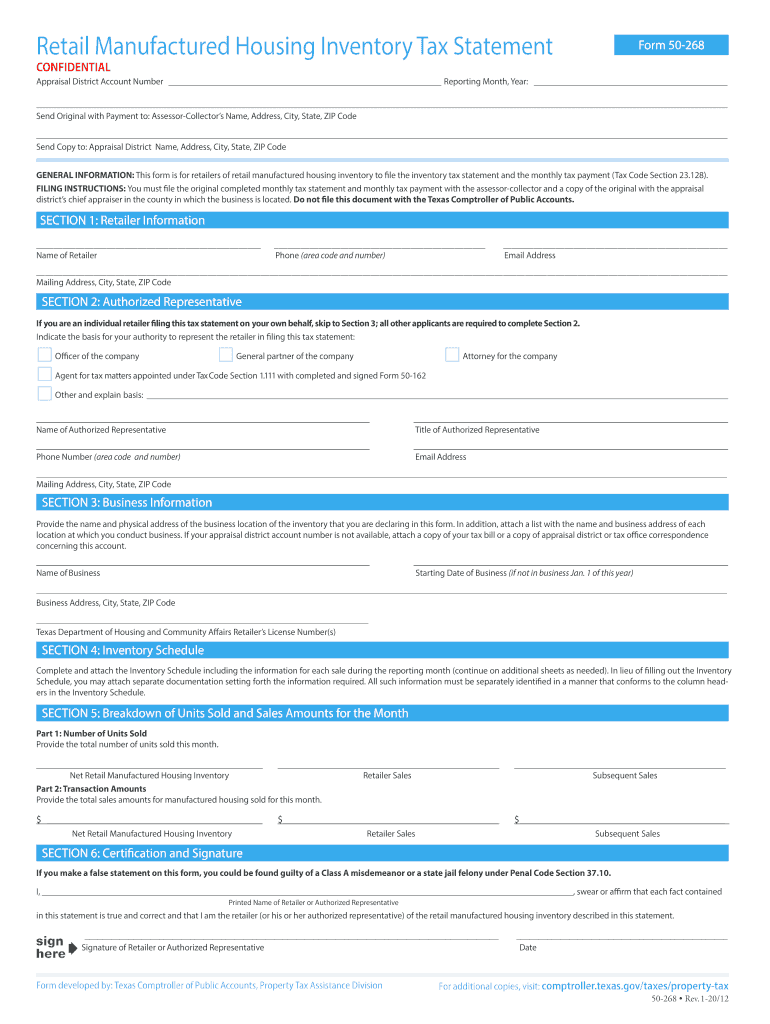

The 268 Tax, also known as the manufactured housing statement, is a crucial document for individuals and businesses involved in the retail of manufactured homes in Texas. This tax form is essential for reporting the sale or transfer of manufactured housing units. It serves to ensure that all transactions comply with state regulations and that the appropriate taxes are collected. The form outlines necessary details such as the buyer's and seller's information, the manufactured home's specifications, and the sales price, making it a vital component in the tax assessment process.

Steps to Complete the 268 Tax

Completing the 268 Tax requires careful attention to detail. Here are the steps to ensure accurate submission:

- Gather necessary information, including the buyer's and seller's names, addresses, and contact information.

- Provide details about the manufactured home, such as the model, year, and identification number.

- Indicate the sales price and any applicable taxes.

- Review the completed form for accuracy and completeness.

- Sign and date the form to validate the information provided.

Legal Use of the 268 Tax

The legal use of the 268 Tax is governed by state regulations that mandate its completion for any sale or transfer of manufactured homes. This form must be filed to ensure compliance with Texas tax laws. Failure to submit the form can lead to penalties, including fines or additional tax assessments. It is important to understand that the form serves as a legal record of the transaction, providing protection for both the buyer and seller.

Required Documents for the 268 Tax

When completing the 268 Tax, certain documents are required to support the information provided. These documents may include:

- Proof of ownership, such as the title or previous registration of the manufactured home.

- Identification documents for both the buyer and seller.

- Any prior tax documents related to the manufactured home.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with legal requirements.

Form Submission Methods

The 268 Tax can be submitted through various methods, making it convenient for users. These methods include:

- Online submission through the Texas Comptroller's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can depend on personal preference or specific circumstances related to the transaction.

Penalties for Non-Compliance

Non-compliance with the requirements of the 268 Tax can result in significant penalties. Individuals or businesses that fail to file the form on time may face:

- Fines imposed by the state.

- Interest on unpaid taxes.

- Potential legal action for repeated violations.

Understanding these penalties emphasizes the importance of timely and accurate completion of the manufactured housing statement.

Quick guide on how to complete 268 retail manufactured housing inventory tax statement

Easily Set Up 268 Tax on Any Device

Managing documents online has gained popularity among both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage 268 Tax on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Effortlessly Edit and eSign 268 Tax

- Find 268 Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require reprinting copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign 268 Tax and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 268 retail manufactured housing inventory tax statement

Create this form in 5 minutes!

How to create an eSignature for the 268 retail manufactured housing inventory tax statement

How to generate an eSignature for your 268 Retail Manufactured Housing Inventory Tax Statement in the online mode

How to create an eSignature for the 268 Retail Manufactured Housing Inventory Tax Statement in Google Chrome

How to create an eSignature for signing the 268 Retail Manufactured Housing Inventory Tax Statement in Gmail

How to create an eSignature for the 268 Retail Manufactured Housing Inventory Tax Statement straight from your smartphone

How to create an eSignature for the 268 Retail Manufactured Housing Inventory Tax Statement on iOS devices

How to generate an eSignature for the 268 Retail Manufactured Housing Inventory Tax Statement on Android devices

People also ask

-

What is 268 Tax and how does it relate to airSlate SignNow?

268 Tax refers to a specific tax regulation that businesses may need to comply with when managing their documents. airSlate SignNow provides an efficient platform for eSigning and managing documents related to 268 Tax compliance, ensuring that your business stays organized and meets all necessary requirements.

-

How can airSlate SignNow help with 268 Tax documentation?

airSlate SignNow streamlines the process of creating, sending, and signing documents required for 268 Tax compliance. With customizable templates and automated workflows, you can easily manage all your tax-related documentation, saving you time and reducing the risk of errors.

-

What are the pricing options for airSlate SignNow related to 268 Tax services?

airSlate SignNow offers various pricing plans that cater to different business needs, including those focused on 268 Tax documentation. You can choose from individual, business, or enterprise plans, each providing features tailored to optimize your tax document management at a competitive price.

-

Does airSlate SignNow integrate with accounting software for 268 Tax purposes?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, enhancing your ability to manage 268 Tax documentation efficiently. This integration ensures that all your financial documents are synchronized, making it easier to track compliance and maintain accurate records.

-

What features does airSlate SignNow offer for managing 268 Tax documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows, all of which are crucial for managing 268 Tax documents. These capabilities make it simple to prepare, send, and store your tax-related paperwork securely and efficiently.

-

Is airSlate SignNow secure for handling sensitive 268 Tax information?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect sensitive 268 Tax information. You can confidently manage your tax documents knowing that your data is secure and accessible only to authorized users.

-

Can I access airSlate SignNow on mobile devices for 268 Tax management?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage your 268 Tax documents on the go. Whether you're in the office or away, you can easily create, send, and sign documents from your smartphone or tablet.

Get more for 268 Tax

- Modest means program of the schenectady county bar association form

- Form 50 131 texas comptroller of public accounts window state tx

- Form 1957 bill of sale or even trade bill of sale bill of sale or even trade bill of sale

- Where do i mail form dtf 171

- Florida family law rules of procedure form 12984 response by parenting coordinator 12984 response by parenting coordinator

- Application form omron foundation inc

- Download fill any pdf form

- Dfs up 121 fill any pdf form

Find out other 268 Tax

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed