Publication 2019

What is the Publication

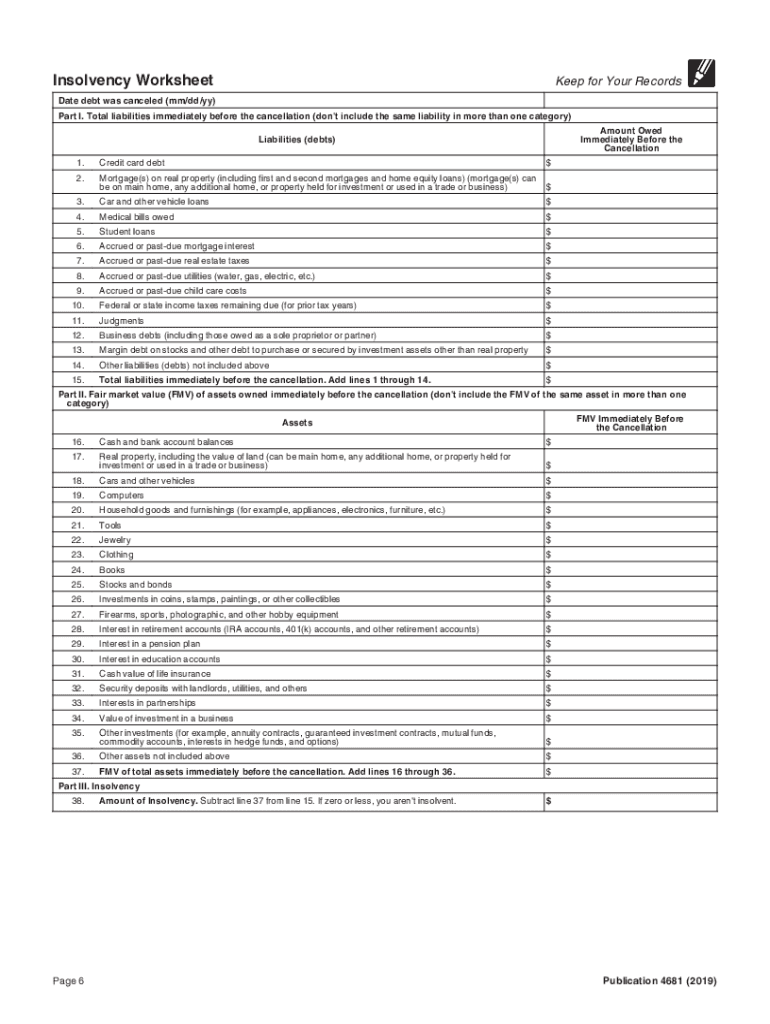

The 2 is an IRS publication that provides essential information regarding the tax implications of certain types of income. Specifically, it addresses the reporting requirements for individuals who receive cancellation of debt income, which may be taxable under federal law. Understanding this publication is crucial for taxpayers to ensure compliance with IRS regulations and to accurately report their income during tax filing.

How to use the Publication

To effectively utilize the 2, taxpayers should first review the guidelines outlined in the publication. This includes understanding the types of debts that may be canceled and the circumstances under which they must be reported. Taxpayers should then gather any relevant documentation, such as Form 1099-C, which reports cancellation of debt income. Following the instructions in the publication will help ensure that the income is reported correctly on the tax return.

Steps to complete the Publication

Completing the 2 involves several key steps:

- Review the publication to understand the types of canceled debts that must be reported.

- Collect necessary documentation, including any relevant IRS forms.

- Fill out the required sections based on the information provided in the publication.

- Ensure accuracy in reporting to avoid potential penalties.

- Submit the completed form along with your tax return by the specified deadline.

Legal use of the Publication

The 2 serves as an authoritative source for understanding the legal obligations of taxpayers regarding canceled debt income. It outlines the conditions under which this income is taxable and provides guidance on how to report it correctly. Compliance with the instructions in this publication is essential to avoid legal issues with the IRS and to ensure that taxpayers fulfill their tax responsibilities.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 2. Taxpayers must be aware of the reporting requirements for canceled debts, including any exceptions that may apply. The publication also details how to handle situations where the debt was discharged in bankruptcy or if the taxpayer qualifies for any exemptions. Adhering to these guidelines helps ensure accurate tax reporting and compliance with federal tax laws.

Filing Deadlines / Important Dates

Taxpayers must be mindful of the filing deadlines associated with the 2. Generally, tax returns are due on April fifteenth of each year, but specific extensions may apply for individuals who need more time. It is important to submit the completed publication along with the tax return by the deadline to avoid late penalties and interest on any taxes owed.

Quick guide on how to complete 2019 publication 4681 canceled debts foreclosures repossessions and abandonments for individuals

Effortlessly Prepare Publication on Any Device

Digital document management has gained traction among companies and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any hold-ups. Handle Publication on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Publication with Ease

- Locate Publication and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Publication and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 publication 4681 canceled debts foreclosures repossessions and abandonments for individuals

Create this form in 5 minutes!

How to create an eSignature for the 2019 publication 4681 canceled debts foreclosures repossessions and abandonments for individuals

How to generate an eSignature for the 2019 Publication 4681 Canceled Debts Foreclosures Repossessions And Abandonments For Individuals in the online mode

How to create an electronic signature for the 2019 Publication 4681 Canceled Debts Foreclosures Repossessions And Abandonments For Individuals in Chrome

How to generate an eSignature for putting it on the 2019 Publication 4681 Canceled Debts Foreclosures Repossessions And Abandonments For Individuals in Gmail

How to create an electronic signature for the 2019 Publication 4681 Canceled Debts Foreclosures Repossessions And Abandonments For Individuals straight from your mobile device

How to generate an eSignature for the 2019 Publication 4681 Canceled Debts Foreclosures Repossessions And Abandonments For Individuals on iOS devices

How to make an eSignature for the 2019 Publication 4681 Canceled Debts Foreclosures Repossessions And Abandonments For Individuals on Android OS

People also ask

-

What is the cost of using airSlate SignNow for the 2015 4681 service?

The pricing for airSlate SignNow's 2015 4681 service is competitive and designed to accommodate businesses of all sizes. You can choose from various plans that offer flexible monthly or annual subscriptions, ensuring that you only pay for what you need. Additionally, there are discounts available for annual commitments, making it an affordable option for eSigning documents.

-

What features are included in the 2015 4681 offering?

The 2015 4681 service from airSlate SignNow includes essential features such as document templates, automated workflows, and mobile access. These features allow users to seamlessly create, send, and eSign documents from any device, making it convenient and efficient. Additionally, the service provides advanced security measures to protect your documents throughout the signing process.

-

How does airSlate SignNow benefit businesses using the 2015 4681 service?

Using the 2015 4681 service by airSlate SignNow offers businesses signNow advantages such as time-saving automation and enhanced convenience. It streamlines the document signing process, reducing the need for physical paperwork, and lowers operational costs. These benefits translate to increased productivity and faster turnaround times for agreements.

-

Can I integrate airSlate SignNow's 2015 4681 service with my existing software?

Yes, airSlate SignNow's 2015 4681 service integrates seamlessly with various popular software applications, including CRM and project management tools. This interoperability allows you to embed eSigning capabilities directly into your workflow, enhancing efficiency and user experience. Integration can be configured with ease to suit your business needs.

-

Is customer support available for the 2015 4681 service?

Absolutely, airSlate SignNow provides robust customer support for users of the 2015 4681 service. You can access resources like live chat, email support, and a comprehensive knowledge base that addresses common issues and questions. This commitment to customer care ensures that users can swiftly resolve any concerns and get back to business.

-

What types of documents can be signed with the 2015 4681 service?

With the 2015 4681 service, you can eSign a wide array of documents including contracts, agreements, and forms. Whether you need simple signatures or complex multi-party signing, airSlate SignNow facilitates all types of document transactions. This versatility makes it ideal for various industries, ensuring compliance and efficiency.

-

Is the 2015 4681 service compliant with legal standards?

Yes, the 2015 4681 service from airSlate SignNow complies with all relevant legal standards for electronic signatures, including the ESIGN Act and UETA. This compliance ensures that your eSigned documents are legally binding and accepted in courts. By choosing airSlate SignNow, you can confidently conduct business knowing your agreements meet legal requirements.

Get more for Publication

- Insulation installation california energy commission state of ww cash4appliances form

- Outdoor lighting summary of allowed outdoor lighting power ww cash4appliances form

- U002 form

- Hyatthouse thirdparty creditcard authorization form

- Domestic intake worksheet pdf fulton county superior court form

- Manteca sunrise kiwanis joe buckman memorial scholarship form

- Counseling practicum interview rating form syracuse university soe syr

- Imm 5484 document checklist for a temporary resident visa form

Find out other Publication

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease