Publication 2018

What is the Publication

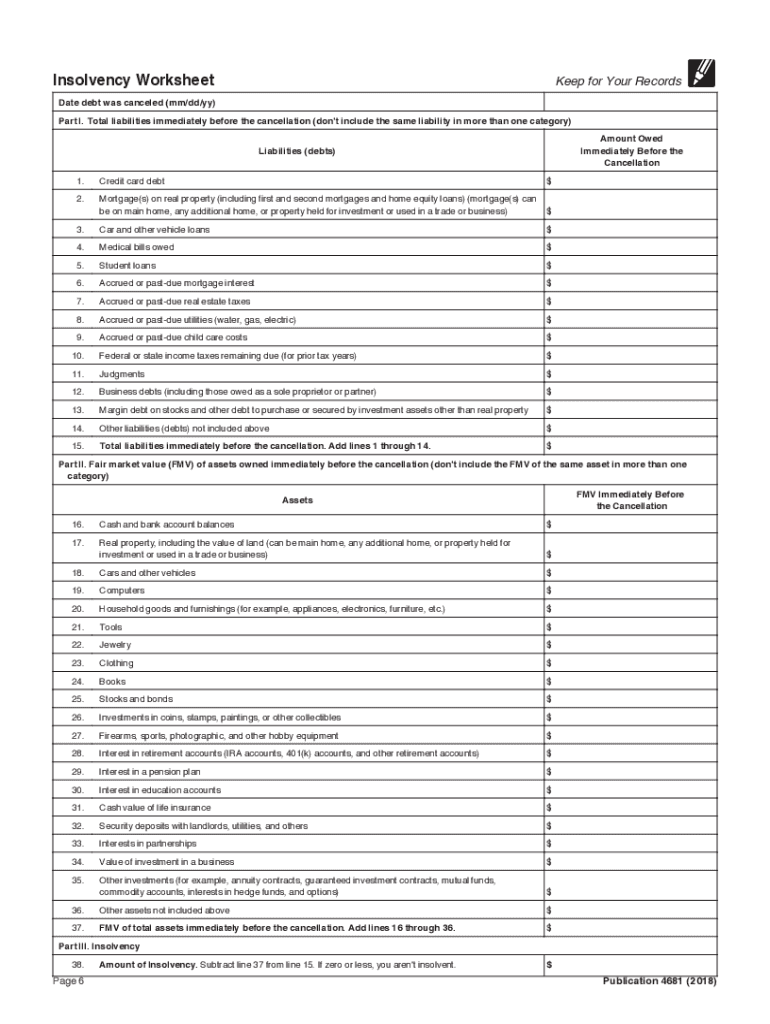

The 2 form, officially known as the IRS Publication 4681, serves as a critical resource for taxpayers dealing with casualty, disaster, and theft losses. This publication outlines the necessary guidelines and procedures for reporting such losses on your tax return. It provides detailed information on how to calculate losses, the types of losses that qualify, and the documentation required to substantiate claims. Understanding this publication is essential for ensuring compliance with IRS regulations while maximizing potential deductions.

How to use the Publication

To effectively use the 2 form, taxpayers should first familiarize themselves with the specific types of losses covered. The publication includes examples that illustrate how to determine the amount of loss and the necessary steps to report it accurately. Taxpayers can reference the publication when completing their tax returns, ensuring they include all relevant information regarding casualty and theft losses. It is advisable to keep the publication handy while preparing tax documents to ensure all guidelines are followed.

Steps to complete the Publication

Completing the 2 involves several key steps:

- Identify the type of loss: Determine whether the loss is due to a casualty, disaster, or theft.

- Calculate the loss amount: Use the guidelines in the publication to assess the financial impact of the loss.

- Gather documentation: Collect all necessary records, including receipts, photographs, and police reports, to support your claim.

- Fill out the form: Accurately complete the relevant sections of your tax return, incorporating the information from the publication.

- File your return: Submit your completed tax return by the appropriate deadline, ensuring that all loss claims are included.

Legal use of the Publication

The IRS Publication 4681 is legally binding when used correctly in the context of tax reporting. Taxpayers must adhere to the guidelines set forth in the publication to ensure that their claims for casualty and theft losses are valid. This includes following the prescribed methods for calculating losses and maintaining proper documentation. Failure to comply with these regulations may result in penalties or disallowance of the claimed deductions.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the 2 form. Typically, individual tax returns are due on April 15 of each year. If taxpayers need additional time, they can file for an extension, which generally allows for an extra six months. However, it is crucial to note that any taxes owed must still be paid by the original due date to avoid penalties and interest. Keeping track of these important dates ensures that taxpayers remain compliant and avoid unnecessary complications.

Required Documents

When preparing to use the 2 form, certain documents are essential to substantiate claims for casualty and theft losses. Required documents include:

- Proof of ownership: Receipts, titles, or other documentation that verifies ownership of the property.

- Evidence of loss: Photos, police reports, or insurance claims that demonstrate the extent of the loss.

- Financial records: Documentation of the property's value before and after the loss, including appraisals or market analyses.

Having these documents organized and accessible will facilitate a smoother filing process and support the accuracy of the claims made.

Quick guide on how to complete 4681 2018 2019 form

Complete Publication seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Publication from any device with the airSlate SignNow apps available for Android or iOS and simplify your document-related processes today.

The easiest way to edit and electronically sign Publication with minimal effort

- Obtain Publication and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that task.

- Create your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Publication to ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4681 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the 4681 2018 2019 form

How to generate an electronic signature for the 4681 2018 2019 Form in the online mode

How to make an electronic signature for the 4681 2018 2019 Form in Google Chrome

How to create an eSignature for putting it on the 4681 2018 2019 Form in Gmail

How to generate an electronic signature for the 4681 2018 2019 Form from your smart phone

How to create an eSignature for the 4681 2018 2019 Form on iOS devices

How to make an eSignature for the 4681 2018 2019 Form on Android

People also ask

-

What is airSlate SignNow's approach to document Publication?

airSlate SignNow offers a streamlined process for document Publication, enabling users to easily create, send, and eSign important documents. Our platform simplifies the entire workflow, ensuring that your Publication process is efficient and secure, catering to various business needs.

-

How does airSlate SignNow help with the Publication of legal documents?

With airSlate SignNow, the Publication of legal documents is made straightforward. Our software ensures compliance and security, allowing you to send legally binding documents for eSignature, thus facilitating faster transactions and reducing paperwork.

-

What are the pricing options for airSlate SignNow regarding document Publication?

airSlate SignNow provides flexible pricing plans that cater to different business sizes and needs, focusing on the Publication of documents. Whether you're a small business or a larger enterprise, our affordable plans ensure you get the best value while managing your document Publication effectively.

-

Can I integrate airSlate SignNow with other tools for document Publication?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft Office, enhancing your document Publication process. These integrations allow users to manage and send documents from their preferred platforms, increasing efficiency.

-

What features does airSlate SignNow offer for enhancing document Publication?

airSlate SignNow includes features like customizable templates, bulk sending, and real-time tracking to enhance your document Publication experience. These tools help streamline workflows, reduce errors, and ensure timely Publication of your important documents.

-

Is airSlate SignNow secure for sensitive document Publication?

Absolutely. airSlate SignNow prioritizes security with advanced encryption and compliance standards, making it a safe choice for sensitive document Publication. You can trust our platform to protect your information while ensuring the integrity of the Publication process.

-

How does airSlate SignNow improve collaboration during the Publication process?

airSlate SignNow fosters collaboration by allowing multiple users to review and sign documents simultaneously, making the Publication process smoother. This collaborative feature ensures that all stakeholders can contribute, reducing delays and enhancing productivity.

Get more for Publication

- Pinnacle bank personal financial statement form

- Business tax rental applicationcertificate of use city of west palm wpb form

- Cu annual fire inspection fee amp business tax receipt application secure miamibeachfl form

- Bpo broker price opinion form in pdf

- Ds 260 form sample

- Ds 5507 application form filled out

- Umuc diploma form

- Ls01 form

Find out other Publication

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast