Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments, for Individuals 2020

What is Publication 4681: Canceled Debts, Foreclosures, Repossessions, and Abandonments for Individuals

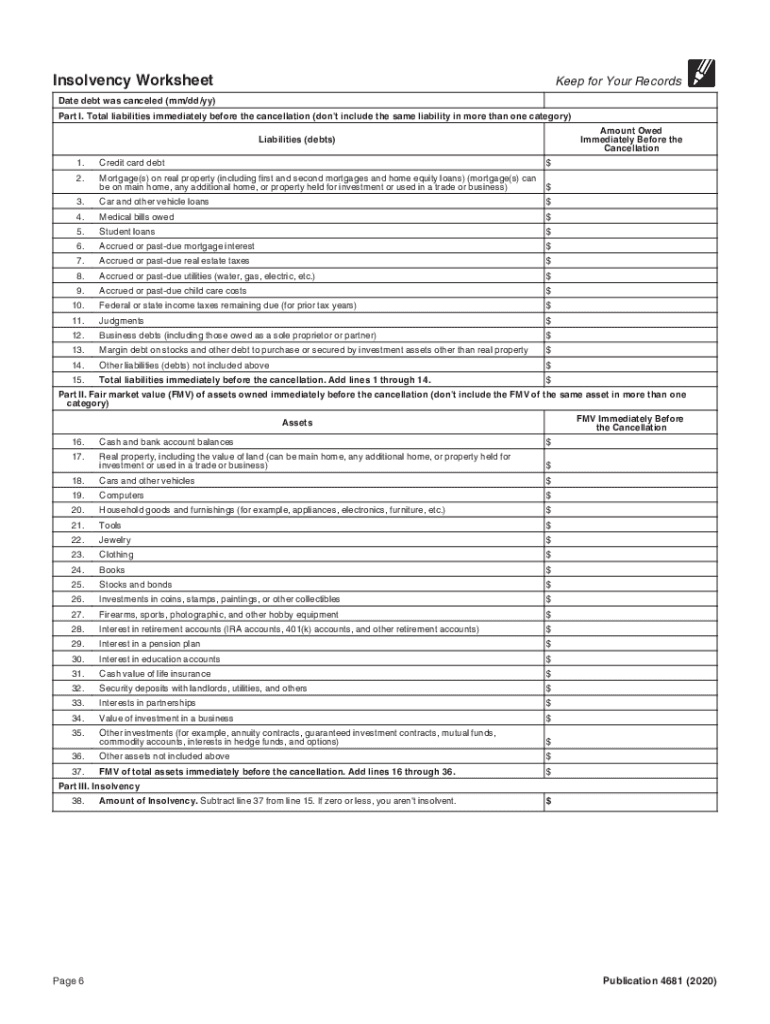

Publication 4681 provides essential information for individuals dealing with canceled debts, foreclosures, repossessions, and abandonments. This IRS document outlines how these financial events can affect your tax obligations. When a debt is canceled, the amount may be considered taxable income, which could impact your overall tax liability. Understanding the implications of these situations is crucial for accurate tax reporting and compliance.

How to Use Publication 4681 Effectively

To utilize Publication 4681 effectively, individuals should review the guidelines thoroughly. Begin by identifying whether any canceled debts or property losses apply to your situation. The publication explains how to report these events on your tax return, including the necessary forms and calculations. Familiarizing yourself with the examples provided can clarify how to apply the information to your specific circumstances.

Steps to Complete Publication 4681

Completing the requirements outlined in Publication 4681 involves several key steps:

- Gather all relevant documentation regarding canceled debts, foreclosures, or repossessions.

- Review the guidelines in the publication to determine how these events affect your taxes.

- Complete the necessary tax forms, including any additional schedules required for reporting canceled debts.

- Ensure that all calculations are accurate and that you have included any necessary supporting documents.

Key Elements of Publication 4681

Key elements of Publication 4681 include definitions of terms related to canceled debts and property losses. The publication also outlines the tax implications of these events, including how to calculate the amount of taxable income from canceled debts. Additionally, it provides guidance on potential exclusions and exceptions that may apply, helping individuals navigate their tax responsibilities effectively.

IRS Guidelines for Publication 4681

The IRS guidelines for Publication 4681 emphasize the importance of accurate reporting of canceled debts and property losses. Individuals should be aware of the specific forms required and any deadlines that may apply. The guidelines also outline the consequences of failing to report canceled debts, which can lead to penalties or increased scrutiny from the IRS.

Eligibility Criteria for Using Publication 4681

Eligibility to use Publication 4681 generally applies to individuals who have experienced canceled debts, foreclosures, repossessions, or abandonments. This includes homeowners facing foreclosure or individuals who have had debts forgiven. It is important to assess your situation against the criteria outlined in the publication to determine if you should report these events on your tax return.

Quick guide on how to complete 2020 publication 4681 canceled debts foreclosures repossessions and abandonments for individuals

Effortlessly Prepare Publication 4681 Canceled Debts, Foreclosures, Repossessions, And Abandonments, for Individuals on Any Gadget

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without interruptions. Oversee Publication 4681 Canceled Debts, Foreclosures, Repossessions, And Abandonments, for Individuals on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to modify and electronically sign Publication 4681 Canceled Debts, Foreclosures, Repossessions, And Abandonments, for Individuals with ease

- Find Publication 4681 Canceled Debts, Foreclosures, Repossessions, And Abandonments, for Individuals and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for this function.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the information carefully and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and electronically sign Publication 4681 Canceled Debts, Foreclosures, Repossessions, And Abandonments, for Individuals and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 publication 4681 canceled debts foreclosures repossessions and abandonments for individuals

Create this form in 5 minutes!

How to create an eSignature for the 2020 publication 4681 canceled debts foreclosures repossessions and abandonments for individuals

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is publication 4681 and how does it relate to e-signatures?

Publication 4681 provides critical information regarding the requirements and regulations for electronic signatures, ensuring compliance for businesses. By using airSlate SignNow, you can align your e-signature processes with the guidelines outlined in publication 4681, making your document signing both secure and compliant.

-

How can airSlate SignNow help me comply with publication 4681?

airSlate SignNow offers features that are designed to meet the requirements set forth in publication 4681, such as secure authentication and audit trails. These functionalities ensure that your electronically signed documents hold up legally, adhering to the standards necessary for compliance.

-

What pricing plans does airSlate SignNow offer for businesses needing publication 4681 compliance?

airSlate SignNow provides several pricing plans that cater to varying business needs while ensuring compliance with publication 4681. Each plan includes essential features that help in maintaining the legal integrity of your electronic signatures at an affordable cost.

-

Does airSlate SignNow integrate with other tools to support publication 4681 processes?

Yes, airSlate SignNow seamlessly integrates with a variety of tools, such as CRM systems and document management software, to enhance your workflow consistency with publication 4681. This integration supports an efficient e-signature process while ensuring that you meet all regulatory requirements.

-

What unique features does airSlate SignNow offer for managing documents under publication 4681?

airSlate SignNow includes features like customizable templates, real-time tracking, and advanced security options, all of which assist businesses in adhering to publication 4681. These tools help streamline the e-signature process while maintaining compliance and mitigating risks.

-

Is airSlate SignNow user-friendly for small businesses focusing on publication 4681?

Absolutely! airSlate SignNow is designed with simplicity in mind, making it easy for small businesses to manage their e-signature needs while complying with publication 4681. Its intuitive interface ensures that even users with limited technical knowledge can easily navigate the platform.

-

What are the benefits of using airSlate SignNow with respect to publication 4681?

Using airSlate SignNow helps businesses enjoy multiple benefits like time savings, improved efficiency, and legal compliance under publication 4681. By digitizing your e-signature process, you can accelerate transactions and enhance customer satisfaction while ensuring your documents are compliant.

Get more for Publication 4681 Canceled Debts, Foreclosures, Repossessions, And Abandonments, for Individuals

Find out other Publication 4681 Canceled Debts, Foreclosures, Repossessions, And Abandonments, for Individuals

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors