Form Wa 2020-2026

What is the Form WA

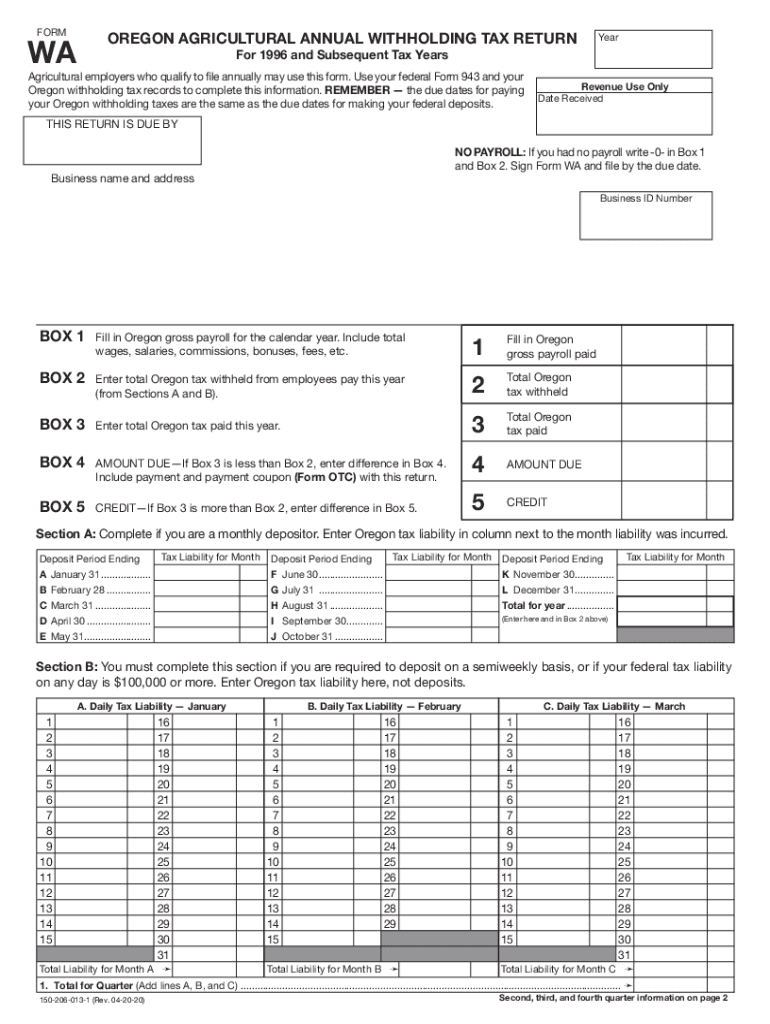

The Form WA is a crucial document used in Oregon for reporting agricultural income and expenses, specifically related to the Oregon agricultural tax. This form is essential for individuals and businesses engaged in agricultural activities within the state. It allows taxpayers to report their earnings and claim any applicable deductions, ensuring compliance with state tax regulations. Understanding the purpose and requirements of the Form WA is vital for accurate tax reporting and to avoid potential penalties.

How to use the Form WA

Using the Form WA involves several steps to ensure accurate completion and submission. First, gather all necessary financial information related to your agricultural activities, including income, expenses, and any relevant documentation. Next, carefully fill out the form, ensuring all fields are completed accurately. It is important to review the instructions provided with the form to understand specific requirements and calculations. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines set by the Oregon Department of Revenue.

Steps to complete the Form WA

Completing the Form WA requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Gather all relevant financial documents, including income statements and expense records.

- Access the Form WA from the Oregon Department of Revenue website or obtain a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your agricultural income in the designated section, ensuring accuracy in your figures.

- List all eligible deductions and expenses related to your agricultural operations.

- Review the completed form for any errors or omissions before submission.

Legal use of the Form WA

The legal use of the Form WA is governed by Oregon state tax laws. It is essential for taxpayers to understand that submitting this form accurately and on time is not only a legal requirement but also a means to ensure compliance with tax obligations. The form must be signed and dated, affirming that the information provided is true and correct to the best of the taxpayer's knowledge. Failure to comply with these legal requirements can result in penalties or audits by the Oregon Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Form WA are critical for taxpayers to meet to avoid penalties. Typically, the form is due on the same date as the Oregon income tax return, which is generally April 15 of each year. However, it is advisable to check for any updates or changes to deadlines as they may vary. Taxpayers should also be aware of any extensions that may apply, allowing for additional time to file the form without incurring penalties.

Required Documents

To complete the Form WA accurately, certain documents are required. These typically include:

- Income statements from agricultural sales and services.

- Receipts for all deductible expenses related to agricultural operations.

- Previous tax returns, if applicable, for reference and consistency.

- Any additional documentation requested by the Oregon Department of Revenue.

Who Issues the Form

The Form WA is issued by the Oregon Department of Revenue, which is responsible for administering tax laws and ensuring compliance within the state. This department provides guidelines and resources for taxpayers to understand their obligations and the proper use of the form. For any questions or clarifications regarding the form, taxpayers can contact the department directly for assistance.

Quick guide on how to complete about form 943 a agricultural employers record of federal

Effortlessly Prepare Form Wa on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Form Wa on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and Electronically Sign Form Wa with Ease

- Obtain Form Wa and click on Get Form to begin.

- Utilize our tools to fill out your document.

- Select important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form Wa and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 943 a agricultural employers record of federal

Create this form in 5 minutes!

How to create an eSignature for the about form 943 a agricultural employers record of federal

How to create an electronic signature for your About Form 943 A Agricultural Employers Record Of Federal in the online mode

How to make an electronic signature for your About Form 943 A Agricultural Employers Record Of Federal in Chrome

How to make an eSignature for signing the About Form 943 A Agricultural Employers Record Of Federal in Gmail

How to make an eSignature for the About Form 943 A Agricultural Employers Record Of Federal right from your mobile device

How to create an electronic signature for the About Form 943 A Agricultural Employers Record Of Federal on iOS

How to make an electronic signature for the About Form 943 A Agricultural Employers Record Of Federal on Android devices

People also ask

-

What is the primary benefit of using airSlate SignNow for WA businesses?

AirSlate SignNow provides WA businesses with a robust and intuitive eSignature solution that streamlines document workflows. This saves time and reduces costs associated with paperwork management. With features aimed at enhancing productivity, businesses can focus more on their core activities.

-

How much does airSlate SignNow cost for users in WA?

Our pricing for WA users is competitive and designed to fit various business sizes. We offer different plans tailored to meet the needs of small to large organizations. Additionally, we provide a free trial, allowing you to explore our features before committing financially.

-

What features does airSlate SignNow offer for document signing in WA?

AirSlate SignNow offers a host of features including customizable templates, easy document sharing, and seamless eSignature integration. WA users can take advantage of our mobile-friendly platform, making it easy to sign documents anytime, anywhere. This flexibility enhances business efficiency.

-

Can airSlate SignNow integrate with other software used in WA?

Yes, airSlate SignNow supports integration with various software commonly used by WA businesses, including CRM systems, cloud storage services, and productivity tools. This allows for a seamless transition of data and improves overall workflow. Effortless integration enhances the user experience.

-

Is airSlate SignNow compliant with WA state regulations?

Absolutely! AirSlate SignNow complies with all WA state regulations regarding eSignatures and document management. Our platform adheres to the highest security standards, ensuring your documents are securely signed and stored while meeting legal requirements.

-

How does airSlate SignNow improve efficiency for WA organizations?

AirSlate SignNow streamlines the signing process for WA organizations, signNowly reducing the time it takes to send and receive signed documents. With automated reminders and real-time tracking, businesses can manage their document workflows more effectively. This leads to higher productivity and quicker decision-making.

-

What industries in WA benefit most from using airSlate SignNow?

Various industries in WA, including healthcare, real estate, and finance, benefit immensely from using airSlate SignNow. The platform's ability to facilitate contract management and regulatory compliance makes it ideal for these sectors. Each industry finds tailored features that enhance their operational efficiency.

Get more for Form Wa

- Affidavit acknowledging form

- Lpc associate applicationpdf ncblpc nc board of licensed ncblpc form

- Hmea online job application forms

- Aagla form 2010 2019

- Subcontractor agreement sgc homes form

- Cancellationwithdrawal request form algonquin residence

- Hawaiian air medical waiver form

- High school emergency contact form

Find out other Form Wa

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT