Vat1614a 2017

What is the Vat1614a

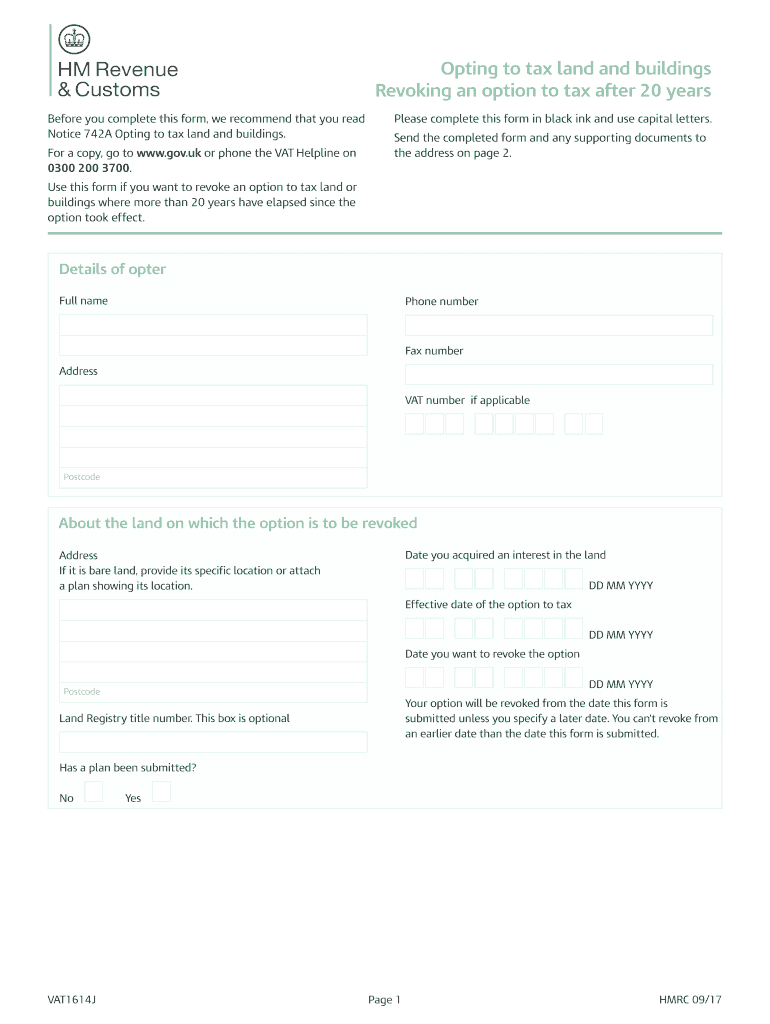

The Vat1614a form, also known as the option to tax form, is a document used in the United States for businesses to notify tax authorities of their decision to opt for VAT taxation on specific properties or transactions. This form is essential for businesses that wish to reclaim VAT on purchases related to these properties. By completing the Vat1614a, businesses can clarify their tax status and ensure compliance with VAT regulations.

How to use the Vat1614a

Using the Vat1614a form involves several steps to ensure proper completion and submission. First, gather all necessary information regarding the property or transaction for which you are opting to tax. Next, accurately fill out the form, providing details such as the property address, the date of the option to tax, and any relevant business information. Once completed, the form must be submitted to the appropriate tax authority, either online or by mail, depending on local regulations.

Steps to complete the Vat1614a

Completing the Vat1614a form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including business registration and property details.

- Fill in the form with accurate information, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form to the relevant tax authority, keeping a copy for your records.

Legal use of the Vat1614a

The legal use of the Vat1614a form is governed by specific tax regulations. It is crucial for businesses to understand that submitting this form signifies their intent to opt for VAT taxation, which has implications for their tax obligations. Compliance with local and federal tax laws is essential to avoid penalties and ensure that the option to tax is recognized by tax authorities.

Key elements of the Vat1614a

Several key elements are essential to the Vat1614a form. These include:

- Property Information: Details about the property being taxed.

- Business Details: Information about the business making the declaration.

- Date of Option: The effective date when the option to tax is applied.

- Signature: A declaration that the information provided is accurate.

Form Submission Methods

The Vat1614a form can be submitted through various methods, depending on the regulations of the local tax authority. Common submission methods include:

- Online Submission: Many jurisdictions allow electronic filing through their official tax websites.

- Mail: The form can be printed and sent via postal service to the appropriate tax office.

- In-Person: Some businesses may choose to submit the form in person at local tax offices.

Quick guide on how to complete vat1614a v2 2017 2019 form

Finish Vat1614a effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to generate, modify, and eSign your documents swiftly without holdups. Handle Vat1614a on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to adjust and eSign Vat1614a without hassle

- Find Vat1614a and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then hit the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in several clicks from any device you choose. Modify and eSign Vat1614a and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat1614a v2 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the vat1614a v2 2017 2019 form

How to generate an electronic signature for the Vat1614a V2 2017 2019 Form online

How to make an eSignature for the Vat1614a V2 2017 2019 Form in Chrome

How to generate an electronic signature for putting it on the Vat1614a V2 2017 2019 Form in Gmail

How to make an eSignature for the Vat1614a V2 2017 2019 Form from your smart phone

How to create an eSignature for the Vat1614a V2 2017 2019 Form on iOS

How to generate an eSignature for the Vat1614a V2 2017 2019 Form on Android devices

People also ask

-

What is Vat1614a and how does it relate to airSlate SignNow?

Vat1614a refers to a specific tax form that businesses may need to handle in their documentation processes. With airSlate SignNow, you can efficiently manage and eSign documents related to Vat1614a, ensuring compliance and streamlining your workflow.

-

How does airSlate SignNow simplify the process of managing Vat1614a documents?

airSlate SignNow simplifies the management of Vat1614a documents by providing an intuitive interface for eSigning and sharing. You can easily upload your Vat1614a forms, send them for signatures, and track their status, all in one secure platform.

-

What are the pricing options for using airSlate SignNow for Vat1614a documentation?

airSlate SignNow offers various pricing plans to cater to different business needs, including competitive options for handling Vat1614a documentation. You can choose a plan that fits your budget and provides the necessary features to manage your VAT-related documents effectively.

-

Can I integrate airSlate SignNow with other software to manage Vat1614a forms?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications, allowing you to manage your Vat1614a forms alongside other business tools. This integration enhances your workflow and ensures that all your documentation is in sync.

-

What features does airSlate SignNow offer for handling Vat1614a?

airSlate SignNow provides several features for managing Vat1614a, including customizable templates, automated workflows, and secure cloud storage. These features ensure that your VAT documentation process is efficient, compliant, and easy to manage.

-

Is airSlate SignNow secure for storing Vat1614a documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your Vat1614a documents. You can trust that your sensitive information is safe while using our eSigning platform.

-

How can airSlate SignNow help my business save time with Vat1614a documentation?

By using airSlate SignNow for your Vat1614a documentation, you can signNowly reduce the time spent on manual paperwork. The platform automates many processes such as sending reminders for signatures and tracking document status, allowing your team to focus on more critical tasks.

Get more for Vat1614a

Find out other Vat1614a

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document