Opting to Tax Land and Buildings 2020-2026

What is the Opting To Tax Land And Buildings

The Opting To Tax Land And Buildings is a provision that allows property owners to elect to charge VAT on the sale or lease of certain properties. This election can be beneficial for businesses that are VAT registered, as it allows them to recover VAT on related expenses. The decision to opt to tax can impact both the seller and the buyer, making it essential to understand the implications before proceeding.

How to use the Opting To Tax Land And Buildings

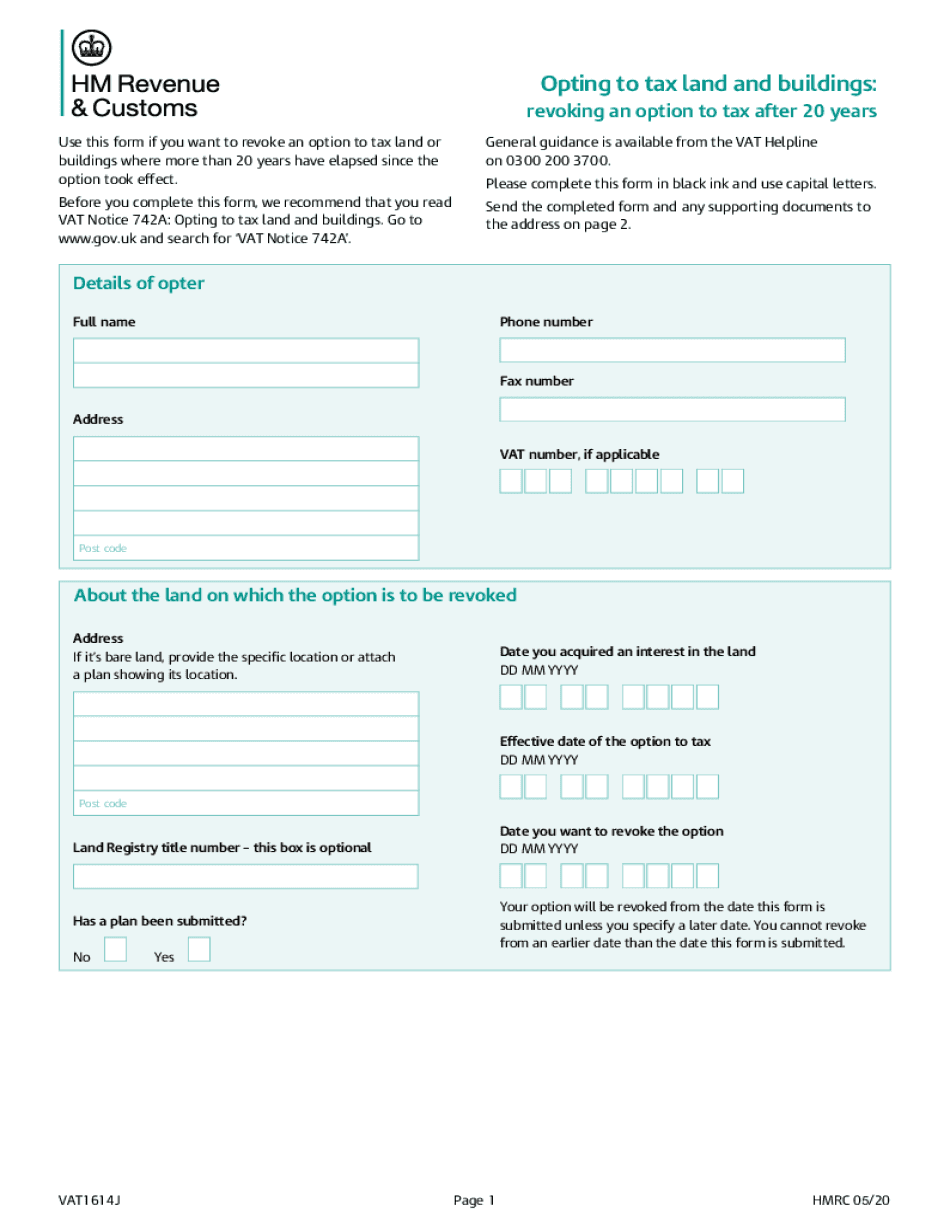

To effectively use the Opting To Tax Land And Buildings, a property owner must formally notify HM Revenue and Customs (HMRC) of their intention to opt to tax. This notification should include details about the property and the effective date of the election. Once the election is made, the property owner can begin charging VAT on transactions related to that property, which can enhance cash flow by allowing for VAT recovery on related purchases.

Steps to complete the Opting To Tax Land And Buildings

Completing the Opting To Tax Land And Buildings involves several key steps:

- Determine eligibility: Ensure the property qualifies for the election.

- Notify HMRC: Submit the appropriate notification form to HMRC, specifying the property and effective date.

- Charge VAT: Begin charging VAT on sales or leases of the property.

- Keep records: Maintain accurate records of all transactions involving the property for compliance purposes.

Legal use of the Opting To Tax Land And Buildings

The legal framework surrounding the Opting To Tax Land And Buildings is governed by VAT regulations. Property owners must adhere to these regulations to ensure that their election is valid. This includes understanding the time limits for making the election and the potential consequences of failing to comply with the rules. Legal advice may be beneficial to navigate complex scenarios.

IRS Guidelines

The IRS provides guidelines regarding the treatment of VAT in relation to property transactions. It is essential for property owners to understand how these guidelines apply to their specific circumstances, particularly regarding deductions and the impact on taxable income. Consulting with a tax professional can help clarify these regulations and ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Opting To Tax Land And Buildings are crucial to ensure that the election is made in a timely manner. Property owners should be aware of the specific dates by which they must notify HMRC of their intention to opt to tax. Missing these deadlines can result in the inability to charge VAT on the property, affecting financial planning and cash flow.

Required Documents

When opting to tax land and buildings, certain documents are required to support the election. These may include:

- The completed notification form to HMRC.

- Evidence of VAT registration.

- Documentation related to the property, such as purchase agreements or leases.

Having these documents prepared in advance can streamline the process and ensure compliance with legal requirements.

Quick guide on how to complete opting to tax land and buildings

Effortlessly Prepare Opting To Tax Land And Buildings on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and securely keep them online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly with no holdups. Manage Opting To Tax Land And Buildings on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to Modify and eSign Opting To Tax Land And Buildings with Ease

- Obtain Opting To Tax Land And Buildings and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Opting To Tax Land And Buildings to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct opting to tax land and buildings

Create this form in 5 minutes!

How to create an eSignature for the opting to tax land and buildings

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the vat5l paper form used for?

The vat5l paper form is primarily used for reporting VAT returns in accordance with tax regulations. By utilizing the vat5l paper form, businesses can ensure compliance and streamline their tax reporting processes. This form is essential for accurate financial documentation and maintaining records for audits.

-

How does airSlate SignNow simplify the vat5l paper form process?

airSlate SignNow makes handling the vat5l paper form efficient by offering a digital platform for eSigning and document management. Users can fill out and sign their vat5l paper form online, eliminating the hassles of printing and manual signatures. This saves time and reduces the risk of errors in submissions.

-

Is there a cost associated with using airSlate SignNow for vat5l paper form submissions?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. These plans include features specifically designed for streamlining the vat5l paper form submission process. By investing in an airSlate SignNow plan, users gain access to an effective and cost-efficient solution for managing their VAT documentation.

-

Can I integrate airSlate SignNow with other software for handling vat5l paper forms?

Absolutely! airSlate SignNow provides integrations with popular software applications to enhance the use of the vat5l paper form. This means you can seamlessly connect your existing tools for accounting or document management, thus optimizing your workflow and improving efficiency.

-

What are the benefits of using airSlate SignNow for my vat5l paper form?

Using airSlate SignNow for your vat5l paper form provides numerous benefits, including increased efficiency and reduced processing time. The platform's user-friendly interface allows for quick navigation, ensuring that your VAT documents are ready for submission faster. Additionally, you'll gain access to secure storage and tracking for your forms.

-

Is airSlate SignNow compliant with legal standards for the vat5l paper form?

Yes, airSlate SignNow is designed to comply with all legal requirements for electronic signatures, including those related to the vat5l paper form. The platform ensures that your eSigned documents are legally binding and meet the latest compliance standards. This keeps your business secure while handling sensitive tax information.

-

Can I track the status of my vat5l paper form submissions with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their vat5l paper form submissions in real-time. You can see when the forms are sent, viewed, and signed, ensuring transparency in the document workflow. This feature helps businesses stay organized and ensures nothing falls through the cracks.

Get more for Opting To Tax Land And Buildings

- Form 720 rev december 2022 quarterly federal excise tax return

- Docsliborgdoc4110687the art advisory panel of the commissioner of internal revenue form

- About form 8889 health savings accounts hsasinternalfederal form 8889 health savings accounts hsas 2020federal form 8889 health

- Forms ampamp publications nm taxation and revenue department

- 2022 form 5498 sa hsa archer msa or medicare advantage msa information

- Tax form 940pr fill in and calculate online

- Form 2015 indiana department of revenue estimated tax

- 22 internal revenue service department of the treasury irs tax forms

Find out other Opting To Tax Land And Buildings

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors