Revoke an Option to Tax After 20 Years Have Passed GOV UK 2020

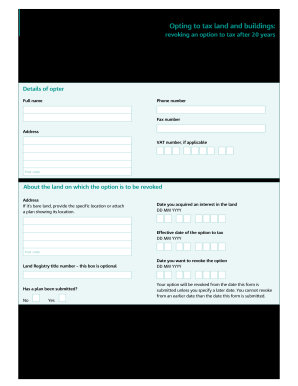

Understanding the vat1614j Form

The vat1614j form is a critical document used in the context of tax and VAT regulations. It serves as a request to revoke an option to tax after a specified period, typically 20 years. This form is essential for businesses that have previously opted to tax certain properties and now wish to reverse that decision. Understanding the implications of this form is vital for maintaining compliance with tax laws and ensuring that businesses do not incur unnecessary tax liabilities.

Steps to Complete the vat1614j Form

Completing the vat1614j form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the property and the original option to tax. This includes details such as the property address, VAT registration number, and the date the option to tax was initially made. Next, fill out the form with precise information, ensuring that all fields are completed. After filling out the form, review it for any errors before submission. Finally, submit the form to the appropriate tax authority, keeping a copy for your records.

Legal Use of the vat1614j Form

The legal use of the vat1614j form is governed by specific tax regulations that outline the conditions under which a business can revoke an option to tax. It is crucial to understand that this revocation can only occur after the stipulated period has elapsed, typically 20 years. Compliance with these regulations is essential to avoid penalties or disputes with tax authorities. Businesses should consult with a tax professional to ensure that all legal requirements are met when using this form.

Required Documents for Submitting vat1614j

When submitting the vat1614j form, certain documents may be required to support the request for revocation. These documents typically include proof of the original option to tax, such as copies of previous correspondence with tax authorities, and any relevant property documentation. Additionally, it may be beneficial to include a cover letter explaining the reason for the revocation. Ensuring that all supporting documents are accurate and complete can facilitate a smoother review process by the tax authority.

Filing Deadlines for vat1614j

Filing deadlines for the vat1614j form are crucial for compliance. Generally, the form must be submitted within a specific timeframe after the 20-year period has elapsed. It is important for businesses to be aware of these deadlines to avoid late submissions, which can lead to penalties. Keeping track of important dates and maintaining a calendar can help ensure timely filing and compliance with tax regulations.

IRS Guidelines Related to vat1614j

The IRS provides guidelines that are relevant to the vat1614j form, particularly in relation to the tax implications of revoking an option to tax. These guidelines outline the necessary steps and considerations for businesses, ensuring they remain compliant with federal tax laws. Familiarizing oneself with these guidelines can help businesses navigate the complexities of tax regulations and avoid potential pitfalls.

Quick guide on how to complete revoke an option to tax after 20 years have passed govuk

Complete Revoke An Option To Tax After 20 Years Have Passed GOV UK with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Revoke An Option To Tax After 20 Years Have Passed GOV UK on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Revoke An Option To Tax After 20 Years Have Passed GOV UK effortlessly

- Find Revoke An Option To Tax After 20 Years Have Passed GOV UK and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the document or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Revoke An Option To Tax After 20 Years Have Passed GOV UK to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revoke an option to tax after 20 years have passed govuk

Create this form in 5 minutes!

How to create an eSignature for the revoke an option to tax after 20 years have passed govuk

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the vat1614j feature in airSlate SignNow?

The vat1614j feature in airSlate SignNow facilitates the electronic signing of documents related to VAT compliance. This feature ensures that all documents are managed efficiently and securely, helping businesses meet VAT obligations without hassle.

-

How does airSlate SignNow support VAT compliance with vat1614j?

With the vat1614j feature, airSlate SignNow helps businesses streamline their VAT documentation process. By providing secure eSigning options, businesses can ensure compliance with VAT regulations and reduce the risk of errors and delays.

-

What are the pricing plans for airSlate SignNow's vat1614j feature?

AirSlate SignNow offers flexible pricing plans that include the vat1614j feature to suit various business needs. Pricing is competitive, and businesses can select a plan based on their document signing volume and required features.

-

Can I integrate airSlate SignNow's vat1614j feature with other software?

Yes, airSlate SignNow's vat1614j feature integrates seamlessly with a variety of third-party applications. This enables users to incorporate document signing and management directly into their existing workflows and tools, enhancing productivity.

-

What are the benefits of using airSlate SignNow for vat1614j documents?

Using airSlate SignNow for vat1614j documents offers several benefits, including improved efficiency, reduced processing time, and enhanced security for sensitive documents. Businesses can track the signing process in real-time, ensuring accountability and transparency.

-

Is airSlate SignNow's vat1614j feature user-friendly?

Absolutely! The vat1614j feature in airSlate SignNow is designed with user experience in mind. Its intuitive interface allows users to easily send and eSign VAT-related documents without prior training or technical expertise.

-

How does airSlate SignNow ensure the security of vat1614j documents?

AirSlate SignNow employs advanced security protocols to protect vat1614j documents. This includes encryption, secure data storage, and compliance with industry standards to ensure that sensitive information remains safe throughout the signing process.

Get more for Revoke An Option To Tax After 20 Years Have Passed GOV UK

- Unitedhealthcare community plan provider disclosure form provider entity 7 2015docx

- Ret 54 application for retirement new york state teachers form

- Temporary food permit application grayson county form

- Nrcc mch 04 form

- Form char410 open to public

- Diabetes mellitus disability benefits questionnaire form

- Temporary dumpster rental form temporary dumpster rental form 737125830

- Form 8582 cr rev december passive activity credit limitations 492615198

Find out other Revoke An Option To Tax After 20 Years Have Passed GOV UK

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy