Form Pit 8453 2019-2026

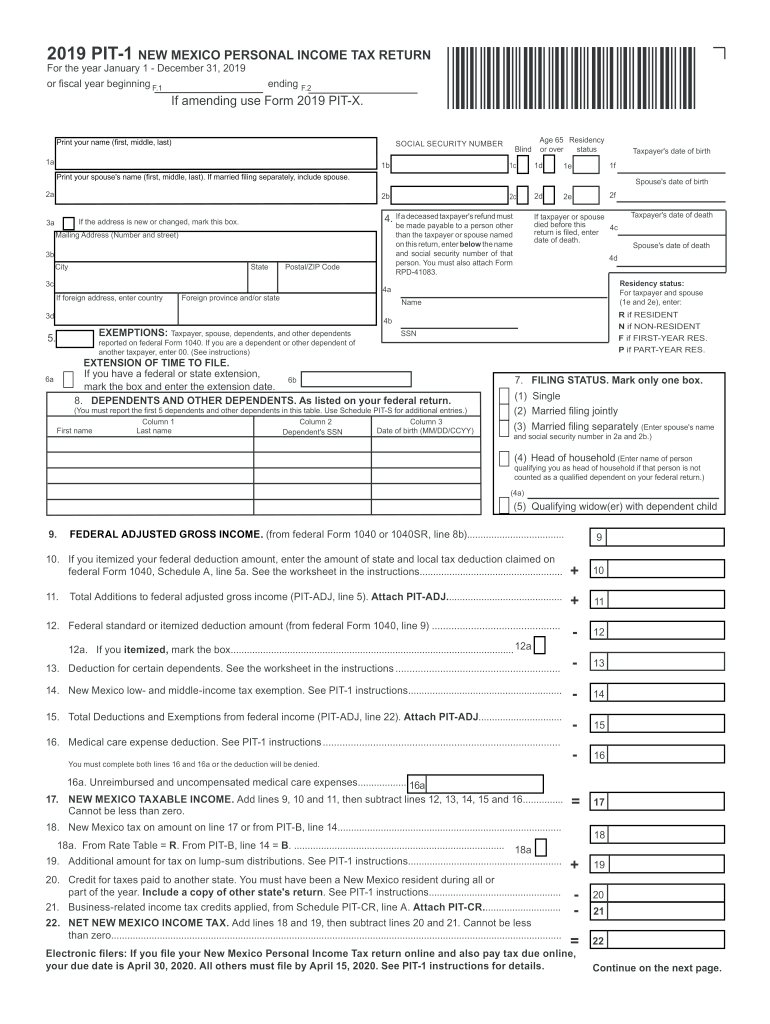

What is the Form PIT 8453?

The Form PIT 8453 is a crucial document used by taxpayers in New Mexico to authorize the electronic filing of their personal income tax returns. This form serves as a declaration that the taxpayer has reviewed their return and agrees to its submission through electronic means. By utilizing this form, taxpayers can ensure compliance with state regulations while enjoying the convenience of digital filing.

Steps to Complete the Form PIT 8453

Completing the Form PIT 8453 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your Social Security number, the tax year, and details from your income tax return. Next, fill out the form by entering your personal information and verifying the accuracy of your tax return data. It is essential to review all entries for correctness before signing the form. Finally, submit the completed form electronically along with your tax return to ensure timely processing.

Legal Use of the Form PIT 8453

The legal use of the Form PIT 8453 is governed by New Mexico state tax laws. This form must be signed by the taxpayer to validate the electronic submission of their tax return. The signature signifies that the taxpayer acknowledges the accuracy of the information provided and agrees to the terms of electronic filing. Compliance with these legal requirements is essential to avoid potential penalties and ensure that the tax return is processed without issues.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines associated with the Form PIT 8453. Typically, the filing deadline for personal income tax returns in New Mexico aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to submit the Form PIT 8453 and the accompanying tax return by this deadline to avoid late fees and penalties.

Form Submission Methods

The Form PIT 8453 can be submitted electronically as part of the e-filing process for New Mexico personal income tax returns. This method is efficient and allows for quicker processing compared to traditional paper filing. Taxpayers should ensure they are using a certified e-filing software that supports the submission of this form. For those who prefer not to file electronically, the form can also be printed and mailed to the appropriate state tax office, although this method may result in longer processing times.

Required Documents

To complete the Form PIT 8453, taxpayers should have several documents on hand. These include their completed income tax return, W-2 forms, 1099 forms, and any other relevant income documentation. Additionally, having identification details, such as a driver's license number or Social Security number, is essential for filling out the form accurately. Ensuring all necessary documents are available will facilitate a smooth filing process.

Examples of Using the Form PIT 8453

There are various scenarios in which taxpayers might use the Form PIT 8453. For instance, an individual who is self-employed and filing their taxes electronically will need to complete this form to authorize the submission of their return. Similarly, a taxpayer who has received income from multiple sources, such as freelance work or rental properties, will also utilize this form to ensure their tax return is filed correctly and legally. These examples illustrate the form's importance in facilitating accurate and efficient tax filing in New Mexico.

Quick guide on how to complete 2014 pit 1 new mexico personal income tax return pdffiller

Complete Form Pit 8453 effortlessly on any device

Online document handling has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and store it securely online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form Pit 8453 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Form Pit 8453 with ease

- Locate Form Pit 8453 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your adjustments.

- Select how you wish to share your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form Pit 8453 and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 pit 1 new mexico personal income tax return pdffiller

Create this form in 5 minutes!

How to create an eSignature for the 2014 pit 1 new mexico personal income tax return pdffiller

How to generate an electronic signature for your 2014 Pit 1 New Mexico Personal Income Tax Return Pdffiller in the online mode

How to generate an eSignature for the 2014 Pit 1 New Mexico Personal Income Tax Return Pdffiller in Google Chrome

How to make an electronic signature for signing the 2014 Pit 1 New Mexico Personal Income Tax Return Pdffiller in Gmail

How to generate an electronic signature for the 2014 Pit 1 New Mexico Personal Income Tax Return Pdffiller straight from your smart phone

How to generate an electronic signature for the 2014 Pit 1 New Mexico Personal Income Tax Return Pdffiller on iOS

How to create an electronic signature for the 2014 Pit 1 New Mexico Personal Income Tax Return Pdffiller on Android OS

People also ask

-

What are the new mexico tax forms 2019 that I need to file?

The new mexico tax forms 2019 include both personal income tax forms and various business-related forms. It's essential to identify which specific forms you need based on your income type, residency status, and business structure. You can find detailed information about these forms on the New Mexico Taxation and Revenue Department's website.

-

How can airSlate SignNow help me with new mexico tax forms 2019?

airSlate SignNow simplifies the process of preparing and submitting new mexico tax forms 2019 by allowing you to eSign documents quickly and securely. With our intuitive platform, you can easily manage your tax documents, ensuring compliance and saving valuable time during tax season. Our service enhances productivity, making tax filing straightforward.

-

Are there any fees to use airSlate SignNow for new mexico tax forms 2019?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our competitive pricing ensures that you have access to essential features for managing new mexico tax forms 2019 without breaking the bank. We recommend checking our website for the latest pricing structure and available discounts.

-

Can I integrate airSlate SignNow with other tax software for new mexico tax forms 2019?

Absolutely! airSlate SignNow can integrate with several popular tax software applications to streamline the process for your new mexico tax forms 2019. This integration ensures that you can manage your documents seamlessly, reducing the chances of errors and improving efficiency in preparing your tax filings.

-

What features does airSlate SignNow offer for handling new mexico tax forms 2019?

airSlate SignNow provides features like eSigning, document sharing, template creation, and real-time tracking for new mexico tax forms 2019. These features help ensure that your documents are processed quickly and securely, making the overall tax filing process much more efficient. Additionally, our user-friendly interface makes it easy for anyone to use.

-

Is airSlate SignNow secure for managing new mexico tax forms 2019?

Yes, airSlate SignNow prioritizes security in managing new mexico tax forms 2019. We utilize industry-standard encryption and compliance measures to protect your sensitive information during transmission and storage. You can confidently eSign and manage your tax documents without worrying about unauthorized access.

-

What benefits do I get from using airSlate SignNow for new mexico tax forms 2019?

Using airSlate SignNow for new mexico tax forms 2019 offers you signNow benefits, including increased efficiency, cost savings, and enhanced accuracy in document management. The ease of eSigning and sharing documents helps ensure that everything is completed on time, reducing last-minute stress. Our solution is tailored to meet your needs while remaining budget-friendly.

Get more for Form Pit 8453

- Charter member application form

- Navpers 1070 613 form

- Terry ennis scholarship application the washington coaches washcoach form

- Nameplate services form

- Bl instruction form evergreen shipping agency philippines

- Massage consultation form

- Revenue verification form

- Initial returnnotice of change by an ontario corporation form 1 forms ssb gov on

Find out other Form Pit 8453

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template