Form 512 E Oklahoma Return of Organization Exempt from Income Tax 2022-2026

What is the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

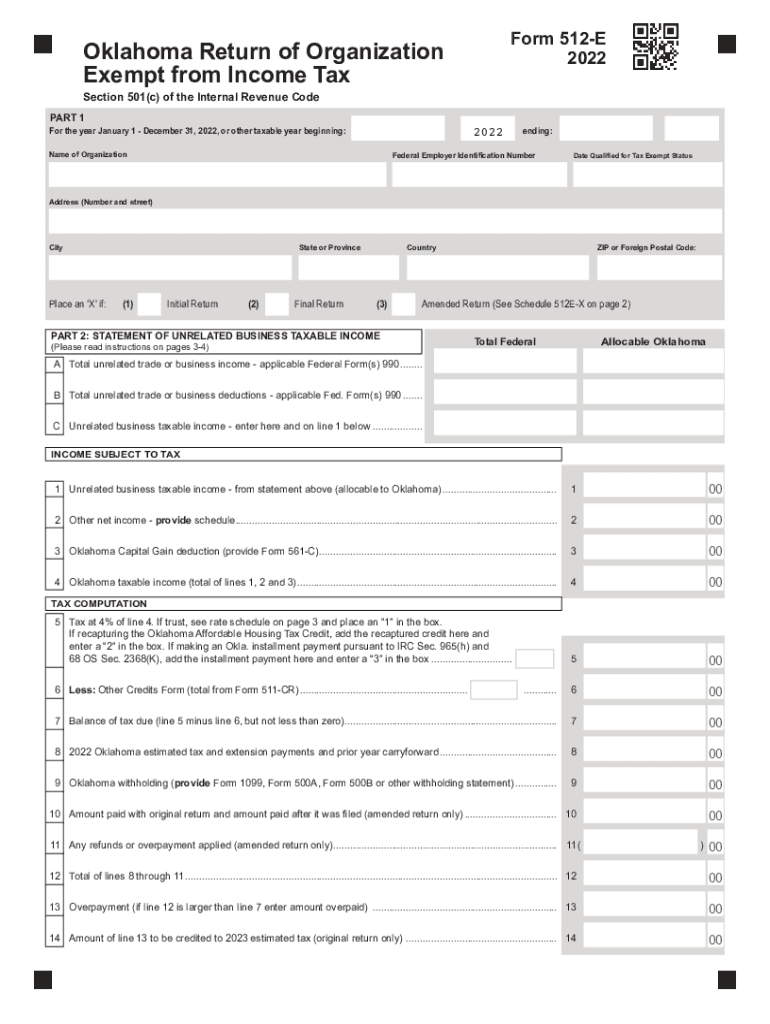

The Form 512 E is a specific tax return used by organizations in Oklahoma that are exempt from income tax. This form is primarily for non-profit entities, including charities, educational institutions, and certain religious organizations. By filing this form, these organizations can report their financial activities to the state, ensuring compliance with Oklahoma tax regulations. Understanding the purpose of Form 512 E is crucial for organizations to maintain their tax-exempt status and fulfill their legal obligations.

How to use the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

Using the Form 512 E involves several steps to ensure accurate completion and submission. First, organizations must gather all necessary financial documents, including income statements and expense reports. Next, they should carefully fill out the form, providing detailed information about their financial activities. It is important to review the completed form for accuracy before submission. Finally, organizations can submit the form either electronically or via mail, depending on their preference and the guidelines provided by the Oklahoma Tax Commission.

Steps to complete the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

Completing the Form 512 E requires a systematic approach. Here are the essential steps:

- Gather all relevant financial documentation, including income and expenditure records.

- Download the Form 512 E from the Oklahoma Tax Commission website or obtain a physical copy.

- Fill out the form, ensuring all sections are completed accurately, including organizational details and financial information.

- Review the form for any errors or omissions.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

The legal use of Form 512 E is governed by Oklahoma tax laws. Organizations must file this form to demonstrate their compliance with state regulations regarding tax-exempt status. Failure to file or inaccuracies in the form can lead to penalties or loss of tax-exempt status. It is essential for organizations to understand the legal implications of this form and ensure that it is completed and submitted correctly to maintain their compliance.

Eligibility Criteria

To be eligible to file Form 512 E, an organization must meet specific criteria set by the Oklahoma Tax Commission. Generally, this includes being recognized as a non-profit entity under federal tax law, such as 501(c)(3) organizations. Additionally, the organization must operate primarily for charitable, educational, or religious purposes. Ensuring eligibility is vital for maintaining tax-exempt status and avoiding complications during the filing process.

Filing Deadlines / Important Dates

Organizations must adhere to specific deadlines when filing Form 512 E. Typically, the form is due on the fifteenth day of the fifth month following the end of the organization's fiscal year. For organizations with a fiscal year ending December 31, this means the form is due by May 15. It is crucial for organizations to be aware of these deadlines to avoid late fees and maintain compliance with Oklahoma tax regulations.

Quick guide on how to complete 2021 form 512 e oklahoma return of organization exempt from income tax

Prepare Form 512 E Oklahoma Return Of Organization Exempt From Income Tax effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without interruptions. Manage Form 512 E Oklahoma Return Of Organization Exempt From Income Tax on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign Form 512 E Oklahoma Return Of Organization Exempt From Income Tax with ease

- Locate Form 512 E Oklahoma Return Of Organization Exempt From Income Tax and select Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Form 512 E Oklahoma Return Of Organization Exempt From Income Tax and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 512 e oklahoma return of organization exempt from income tax

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 512 e oklahoma return of organization exempt from income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for handling oklahoma form 512 instructions?

airSlate SignNow offers a user-friendly platform to efficiently manage oklahoma form 512 instructions. Key features include customizable templates, secure e-signatures, and real-time tracking, making the process streamlined and hassle-free for businesses.

-

How can airSlate SignNow improve my workflow for oklahoma form 512 instructions?

Using airSlate SignNow can signNowly enhance your workflow by automating the document signing process for oklahoma form 512 instructions. This allows your team to focus on core tasks, reducing manual entry and saving time, while ensuring compliance and security.

-

Is there a mobile app for airSlate SignNow to manage oklahoma form 512 instructions on the go?

Yes, airSlate SignNow provides a mobile app that allows you to manage oklahoma form 512 instructions anytime, anywhere. The app is designed to enhance flexibility and convenience, enabling users to send, sign, and store documents directly from their mobile devices.

-

What integrations does airSlate SignNow offer for managing oklahoma form 512 instructions?

airSlate SignNow integrates seamlessly with various business applications to optimize your workflows involving oklahoma form 512 instructions. Popular integrations include Google Drive, Salesforce, and Microsoft Office, helping to enhance collaboration and document management.

-

What is the pricing structure for airSlate SignNow related to oklahoma form 512 instructions?

airSlate SignNow offers flexible pricing plans that cater to different user needs, making it cost-effective for handling oklahoma form 512 instructions. Monthly and annual subscriptions are available, and you can choose a plan that best fits your business requirements.

-

How secure is airSlate SignNow for managing sensitive documents like oklahoma form 512 instructions?

Security is a top priority for airSlate SignNow when managing documents, including oklahoma form 512 instructions. The platform employs strong encryption protocols, secure servers, and complies with industry regulations to ensure your data remains protected at all times.

-

Can I customize the oklahoma form 512 instructions template within airSlate SignNow?

Absolutely! airSlate SignNow provides customization options for the oklahoma form 512 instructions template. Users can easily edit fields, add branding elements, and adjust the design to suit their specific business needs.

Get more for Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

- Tenant consent to background and reference check south carolina form

- South carolina month form

- Residential rental lease agreement south carolina form

- Tenant welcome letter south carolina form

- Warning of default on commercial lease south carolina form

- Warning of default on residential lease south carolina form

- Landlord tenant closing statement to reconcile security deposit south carolina form

- Sc name change 497325783 form

Find out other Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template