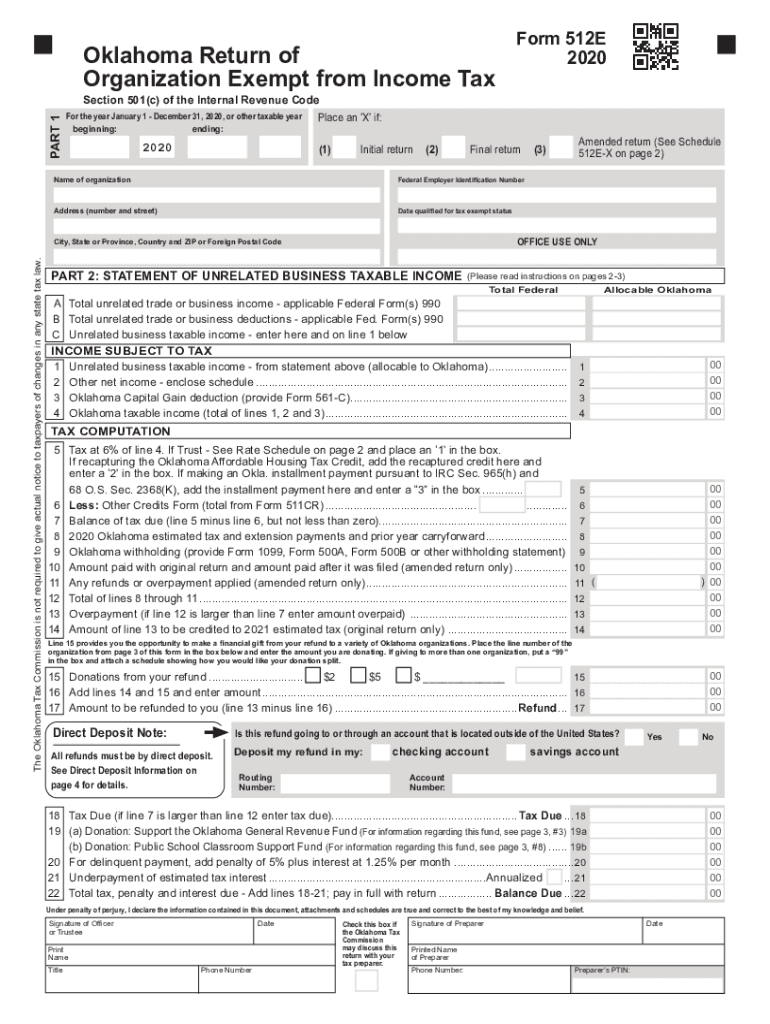

Form 512E Oklahoma Return of Organization Exempt from Income Tax 2020

What is the Form 512E Oklahoma Return Of Organization Exempt From Income Tax

The Form 512E is a crucial document for organizations in Oklahoma seeking exemption from income tax. This form is specifically designed for entities that qualify under certain criteria, such as non-profit organizations, religious institutions, and charitable foundations. By submitting the Form 512E, these organizations can ensure compliance with state tax regulations while benefiting from tax-exempt status. Understanding the purpose and requirements of this form is essential for any organization aiming to operate without the burden of income tax in Oklahoma.

How to use the Form 512E Oklahoma Return Of Organization Exempt From Income Tax

Using the Form 512E involves several steps to ensure accurate completion and submission. Organizations must first gather all necessary information, including their legal name, address, and tax identification number. It is important to provide details about the organization’s structure and activities to demonstrate eligibility for tax exemption. Once the form is filled out, it should be reviewed for accuracy. Organizations can then submit the form to the Oklahoma Tax Commission, either online or by mail, depending on their preference. Ensuring that all required information is included will help prevent delays in processing.

Steps to complete the Form 512E Oklahoma Return Of Organization Exempt From Income Tax

Completing the Form 512E involves a systematic approach:

- Gather necessary documentation, including your organization’s bylaws and financial statements.

- Fill out the form with accurate information, ensuring that all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Oklahoma Tax Commission, either electronically or via postal mail.

- Keep a copy of the submitted form and any correspondence for your records.

Legal use of the Form 512E Oklahoma Return Of Organization Exempt From Income Tax

The legal use of the Form 512E is governed by state tax laws that outline eligibility criteria for tax exemption. Organizations must ensure they meet the specific requirements set forth by the Oklahoma Tax Commission to utilize this form legally. This includes demonstrating that the organization operates for charitable, religious, or educational purposes. Failure to comply with these legal stipulations can result in penalties or denial of tax-exempt status, making it imperative for organizations to understand their obligations when using the Form 512E.

Filing Deadlines / Important Dates

Filing deadlines for the Form 512E are critical to maintaining compliance and ensuring tax-exempt status. Organizations typically need to submit the form by a specific date, which may vary based on their fiscal year. It is advisable to check the Oklahoma Tax Commission’s guidelines for the most current deadlines. Missing these deadlines can lead to complications, including potential penalties or loss of tax-exempt status, underscoring the importance of timely filing.

Required Documents

When completing the Form 512E, organizations must provide several required documents to support their application for tax exemption. These documents may include:

- Bylaws or governing documents of the organization.

- Financial statements or budgets that outline the organization’s financial activities.

- Proof of the organization’s activities that align with tax-exempt purposes.

- Any additional documentation requested by the Oklahoma Tax Commission.

Quick guide on how to complete 2020 form 512e oklahoma return of organization exempt from income tax

Complete Form 512E Oklahoma Return Of Organization Exempt From Income Tax effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Form 512E Oklahoma Return Of Organization Exempt From Income Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 512E Oklahoma Return Of Organization Exempt From Income Tax without hassle

- Obtain Form 512E Oklahoma Return Of Organization Exempt From Income Tax and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize crucial parts of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 512E Oklahoma Return Of Organization Exempt From Income Tax and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 512e oklahoma return of organization exempt from income tax

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 512e oklahoma return of organization exempt from income tax

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Oklahoma form 512E 2018 fillable?

The Oklahoma form 512E 2018 fillable is a document used for reporting and calculating Oklahoma state taxes. It allows users to complete the necessary tax information digitally, greatly simplifying the process. By using an efficient solution like airSlate SignNow, you can fill out this form with ease and record your tax details accurately.

-

How can I fill out the Oklahoma form 512E 2018 fillable using airSlate SignNow?

To fill out the Oklahoma form 512E 2018 fillable using airSlate SignNow, simply upload your document to the platform. You can then add the required information directly into the form fields and save your changes. airSlate SignNow also allows you to eSign the document, streamlining your tax filing process.

-

Is there a cost associated with using airSlate SignNow for the Oklahoma form 512E 2018 fillable?

Yes, there is a cost associated with using airSlate SignNow, but it offers flexible pricing plans to fit various business needs. The investment in an airSlate SignNow subscription can save you time and improve efficiency when handling documents like the Oklahoma form 512E 2018 fillable. Check our pricing page for more details.

-

What features does airSlate SignNow offer for the Oklahoma form 512E 2018 fillable?

airSlate SignNow offers several features to enhance your experience with the Oklahoma form 512E 2018 fillable, including document editing, eSignature capabilities, and form templates. These features ensure that filling out and signing your documents is quick and efficient. The user-friendly interface makes it accessible for anyone.

-

Can I integrate airSlate SignNow with other applications while filling out the Oklahoma form 512E 2018 fillable?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow while filling out the Oklahoma form 512E 2018 fillable. You can connect it with CRM systems, cloud storage services, and other software tools, ensuring that your document management process is efficient and streamlined.

-

What are the benefits of using airSlate SignNow for the Oklahoma form 512E 2018 fillable?

Using airSlate SignNow for the Oklahoma form 512E 2018 fillable offers multiple benefits, including increased efficiency and reduced paperwork. The platform allows you to fill out and eSign documents from anywhere, making it easier to manage your taxes. Additionally, it enhances collaboration if multiple parties need to sign the document.

-

Is my data secure when using airSlate SignNow for the Oklahoma form 512E 2018 fillable?

Absolutely! airSlate SignNow prioritizes data security and privacy, especially when dealing with sensitive documents like the Oklahoma form 512E 2018 fillable. The platform employs industry-standard encryption and compliance measures, ensuring that your information remains safe throughout the entire process.

Get more for Form 512E Oklahoma Return Of Organization Exempt From Income Tax

- Washington subcontractors form

- Option to purchase addendum to residential lease lease or rent to own washington form

- Washington prenuptial premarital agreement with financial statements washington form

- Washington prenuptial premarital agreement without financial statements washington form

- Amendment to prenuptial or premarital agreement washington form

- Financial statements only in connection with prenuptial premarital agreement washington form

- Wa revocation form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children washington form

Find out other Form 512E Oklahoma Return Of Organization Exempt From Income Tax

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free