Ok 512 Instructions 2021-2025 Form

Understanding the Oklahoma Form 512E

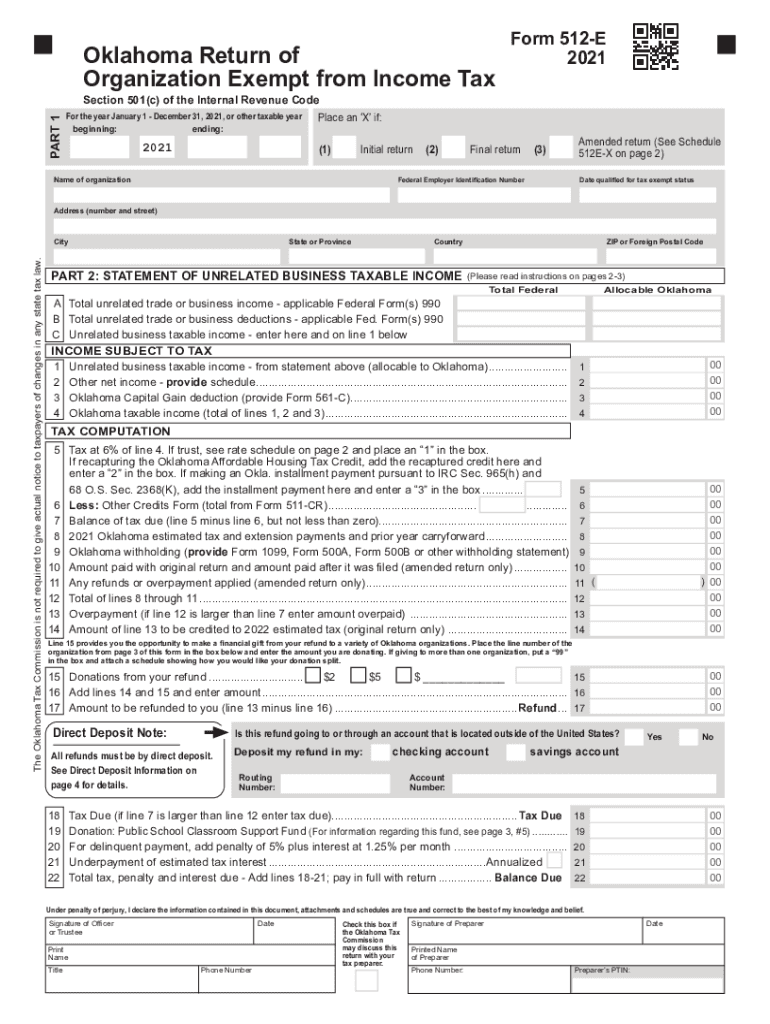

The Oklahoma Form 512E, also known as the Return of Organization Exempt from Oklahoma Corporate Income Tax, is designed for organizations that qualify for exemption from corporate income tax in Oklahoma. This form is essential for entities such as non-profits, religious organizations, and other exempt entities to report their financial activities to the Oklahoma Tax Commission. By filing this form, organizations can maintain compliance with state tax regulations while ensuring their exempt status is recognized.

Steps to Complete the Oklahoma Form 512E

Completing the Oklahoma Form 512E involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by providing detailed information about the organization, including its name, address, and tax identification number. Ensure that all income and expenditures are accurately reported, as this information is crucial for determining tax exemption eligibility. Finally, review the completed form for any errors before submission.

Required Documents for Filing

When preparing to file the Oklahoma Form 512E, certain documents are required to support the information provided. These documents typically include:

- Financial statements for the reporting period

- Proof of tax-exempt status, such as IRS determination letters

- Records of any income received and expenses incurred

- Any additional documentation that supports the organization's exempt activities

Having these documents ready will facilitate a smoother filing process and help avoid potential delays or issues with the Oklahoma Tax Commission.

Filing Deadlines for the Oklahoma Form 512E

It is important to be aware of the filing deadlines associated with the Oklahoma Form 512E to maintain compliance. Generally, the form must be submitted by the fifteenth day of the fourth month following the close of the organization's fiscal year. For organizations operating on a calendar year basis, this typically means a deadline of April 15. Missing this deadline could result in penalties or complications regarding the organization's tax-exempt status.

Legal Use of the Oklahoma Form 512E

The legal use of the Oklahoma Form 512E is critical for organizations seeking to maintain their tax-exempt status. Filing this form correctly ensures compliance with state laws and regulations governing tax-exempt entities. Organizations must adhere to the guidelines set forth by both the Oklahoma Tax Commission and the Internal Revenue Service (IRS) regarding the reporting of income and expenditures. Failure to file the form or inaccuracies in reporting can lead to loss of exempt status and potential penalties.

Examples of Organizations Using the Oklahoma Form 512E

Various types of organizations utilize the Oklahoma Form 512E to report their financial activities. Common examples include:

- Non-profit organizations focused on charitable activities

- Religious institutions that operate without profit motives

- Educational organizations that qualify for tax exemptions

- Civic leagues and social clubs dedicated to promoting community welfare

These organizations benefit from filing the form as it helps them maintain their tax-exempt status while fulfilling legal obligations.

Quick guide on how to complete oklahoma form 512 2021

Complete oklahoma form 512 2021 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, as it allows you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without hassle. Manage ok form 512 instructions 2021 on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign oklahoma form 512 instructions 2021 without stress

- Find ok 512 instructions 2021 and then click Get Form to begin.

- Utilize the resources we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Modify and electronically sign oklahoma 512 instructions 2021 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma form 512e

Related searches to oklahoma 512e

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form exempt income tax

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask oklahoma form 512e 2021

-

What are the key features of airSlate SignNow related to OK Form 512 Instructions 2021?

airSlate SignNow offers robust features that are essential for handling OK Form 512 instructions 2021, including document eSigning, customizable templates, and automated workflows. Users can securely manage their documents, ensuring compliance with the guidelines stipulated in the OK Form 512 instructions 2021. This streamlines the process, making it efficient and user-friendly.

-

How does airSlate SignNow simplify the completion of OK Form 512 instructions 2021?

With airSlate SignNow, completing OK Form 512 instructions 2021 becomes hassle-free due to its intuitive interface and real-time collaboration tools. Users can fill out forms online, track changes, and obtain legally binding signatures quickly. This eliminates the need for manual paperwork and reduces errors associated with traditional methods.

-

Is airSlate SignNow suitable for small businesses handling OK Form 512 instructions 2021?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, including small enterprises dealing with OK Form 512 instructions 2021. The platform offers cost-effective plans that provide essential features without overwhelming smaller teams, allowing them to manage their signing processes efficiently.

-

Can I integrate airSlate SignNow with other tools for OK Form 512 instructions 2021?

Yes, airSlate SignNow allows seamless integration with various applications, enhancing your workflow for OK Form 512 instructions 2021. You can connect it with popular CRM systems, cloud storage solutions, and productivity tools to create a streamlined documentation process. This integration maximizes productivity and keeps all essential documents in sync.

-

What are the benefits of using airSlate SignNow for OK Form 512 instructions 2021?

Using airSlate SignNow for OK Form 512 instructions 2021 brings several benefits, such as increased speed, reduced costs, and enhanced security of your documents. The ability to store and access forms digitally ensures compliance while also providing an audit trail for each signed document. This leads to improved efficiency and less room for errors in your business transactions.

-

What is the pricing structure for airSlate SignNow focused on OK Form 512 instructions 2021?

airSlate SignNow offers flexible pricing plans that cater to different business needs when managing OK Form 512 instructions 2021. Plans range from basic to premium, allowing users to select features based on their requirements. Each plan includes value for money with essential eSigning capabilities and support, making it an affordable choice for businesses.

-

How secure is airSlate SignNow when dealing with OK Form 512 instructions 2021?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents such as OK Form 512 instructions 2021. The platform employs advanced encryption and secure cloud storage to protect data. Additionally, it complies with industry standards, ensuring that your information remains confidential and secure throughout the signing process.

Get more for oklahoma form 512 instructions

Find out other form 512 instructions 2021

- How To Electronic signature Missouri Orthodontists Separation Agreement

- How Do I Electronic signature Missouri Orthodontists Separation Agreement

- How Do I Electronic signature Montana Orthodontists Separation Agreement

- Electronic signature Missouri Orthodontists Separation Agreement Mobile

- Help Me With Electronic signature Missouri Orthodontists Separation Agreement

- How Can I Electronic signature Missouri Orthodontists Separation Agreement

- Electronic signature Missouri Orthodontists Separation Agreement Now

- Can I Electronic signature Missouri Orthodontists Separation Agreement

- Help Me With Electronic signature Montana Orthodontists Separation Agreement

- Electronic signature Montana Orthodontists Business Associate Agreement Online

- Electronic signature Missouri Orthodontists Separation Agreement Later

- How Can I Electronic signature Montana Orthodontists Separation Agreement

- Electronic signature Montana Orthodontists Business Associate Agreement Computer

- Electronic signature Missouri Orthodontists Separation Agreement Myself

- Electronic signature Montana Orthodontists Business Associate Agreement Mobile

- Electronic signature Montana Orthodontists Business Associate Agreement Now

- Electronic signature Montana Orthodontists Business Associate Agreement Later

- Can I Electronic signature Montana Orthodontists Separation Agreement

- Electronic signature Missouri Orthodontists Separation Agreement Free

- Electronic signature Montana Orthodontists Business Associate Agreement Myself