Sc1040x 2019-2026

What is the SC1040X?

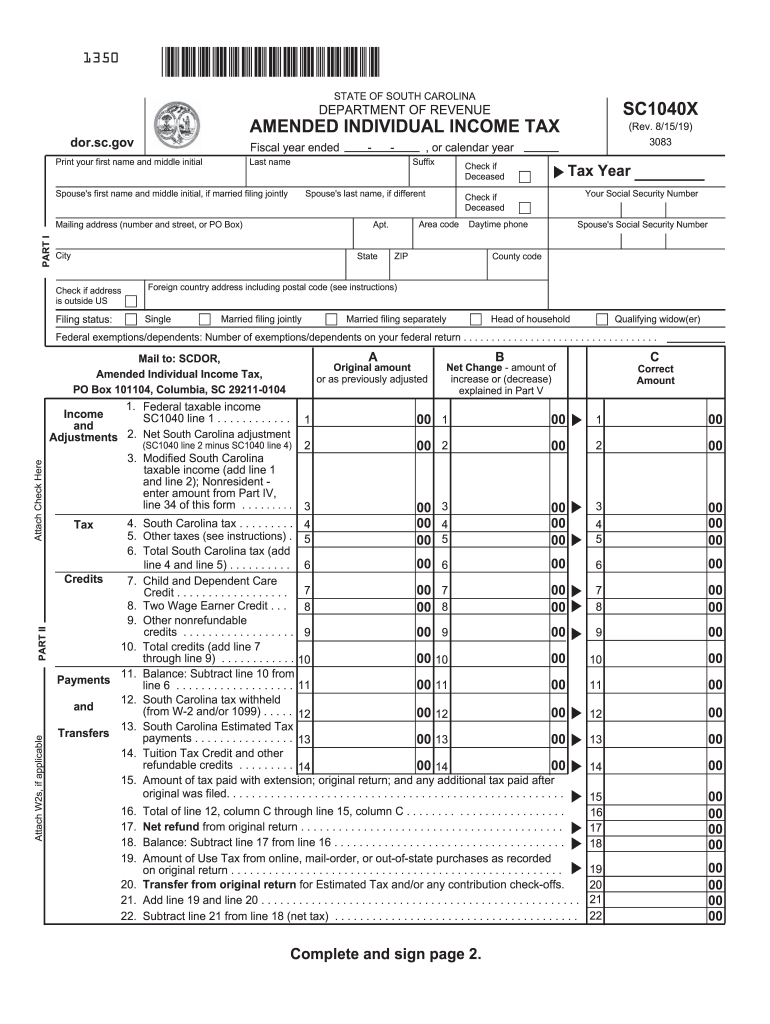

The SC1040X is the official form used for amending an individual income tax return in South Carolina. Taxpayers utilize this form to correct errors or make changes to their previously filed SC1040 or SC1040NR forms. It is essential for ensuring that the information reported to the South Carolina Department of Revenue is accurate and up to date. The SC1040X allows individuals to adjust their income, deductions, credits, and other relevant tax details.

How to Use the SC1040X

To effectively use the SC1040X, taxpayers should first gather all relevant documentation related to their original tax return. This includes W-2s, 1099s, and any other supporting materials that pertain to the changes being made. Once the necessary documents are collected, the taxpayer can fill out the SC1040X, ensuring that all modifications are clearly indicated. It is important to provide a detailed explanation of the changes in the designated section of the form to facilitate the review process by the South Carolina Department of Revenue.

Steps to Complete the SC1040X

Completing the SC1040X involves several key steps:

- Obtain the SC1040X form from the South Carolina Department of Revenue website or a tax professional.

- Fill in your personal information, including your name, Social Security number, and address.

- Indicate the tax year you are amending and the original SC1040 or SC1040NR form number.

- Detail the changes being made in the appropriate sections, including any adjustments to income or deductions.

- Provide a clear explanation of why you are amending your return.

- Sign and date the form before submitting it.

Legal Use of the SC1040X

The SC1040X is legally recognized as a valid method for amending tax returns in South Carolina. To ensure compliance with state tax laws, it is crucial that taxpayers follow the guidelines set forth by the South Carolina Department of Revenue. This includes submitting the SC1040X within the designated time frame and ensuring that all information is accurate and truthful. Failure to comply with these regulations may result in penalties or delays in processing the amended return.

Filing Deadlines / Important Dates

Taxpayers should be aware of the deadlines associated with filing the SC1040X. Generally, the amended return must be filed within three years from the original due date of the return, including extensions. Keeping track of these deadlines is essential to avoid potential penalties and to ensure that any refunds or adjustments are processed in a timely manner. It is advisable to check the South Carolina Department of Revenue's website for any updates or changes to these dates.

Required Documents

When filing the SC1040X, taxpayers must include certain documents to support their amendments. These documents may include:

- Copies of the original SC1040 or SC1040NR forms.

- W-2s, 1099s, or other income statements relevant to the changes.

- Any additional documentation that substantiates the adjustments being made, such as receipts or tax credit forms.

Form Submission Methods

The SC1040X can be submitted in several ways. Taxpayers may choose to file the form electronically through the South Carolina Department of Revenue's online portal, which can expedite processing times. Alternatively, the form can be mailed to the appropriate address provided on the form or submitted in person at a local Department of Revenue office. It is important to retain copies of all submitted documents for personal records.

Quick guide on how to complete sc1040x

Complete Sc1040x effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Manage Sc1040x on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to edit and eSign Sc1040x effortlessly

- Obtain Sc1040x and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, either by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Sc1040x and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc1040x

Create this form in 5 minutes!

How to create an eSignature for the sc1040x

How to generate an electronic signature for your Sc1040x in the online mode

How to create an electronic signature for the Sc1040x in Chrome

How to make an eSignature for signing the Sc1040x in Gmail

How to make an electronic signature for the Sc1040x straight from your smartphone

How to make an electronic signature for the Sc1040x on iOS devices

How to generate an eSignature for the Sc1040x on Android

People also ask

-

Does South Carolina have state income tax?

Yes, South Carolina does have a state income tax. The state applies a progressive tax rate, meaning that the rate increases as income rises. This tax is applicable to individuals and businesses, ensuring that even those with higher income brackets contribute fairly.

-

What are the tax rates for South Carolina state income tax?

South Carolina's state income tax rates range from 0% to 7%, depending on your taxable income. The tax brackets are adjusted periodically, so it's important to stay informed about the current rates. Understanding whether South Carolina has state income tax and how it affects you is essential for effective financial planning.

-

How can airSlate SignNow help with tax documentation in South Carolina?

airSlate SignNow provides an efficient way to manage, send, and eSign important tax documents. By using our platform, you can streamline the process of preparing documents needed for filing state income tax in South Carolina. Our user-friendly interface helps save time, ensuring compliance with state regulations.

-

What features does airSlate SignNow offer to facilitate signings for tax documents?

AirSlate SignNow offers various features aimed at simplifying the signing process for tax documents. Features like templates, in-person signing, and mobile accessibility ensure that you can sign anytime and anywhere. Understanding how airSlate SignNow can enhance your document workflow is crucial, especially when handling time-sensitive tax documentation.

-

Is airSlate SignNow cost-effective for businesses in South Carolina?

Yes, airSlate SignNow is a cost-effective solution for businesses, including those operating in South Carolina. Our pricing plans cater to various business sizes and needs, allowing you to choose what works best for your budget. This affordability makes it easy to stay compliant with South Carolina's state income tax regulations without overspending.

-

Can airSlate SignNow integrate with other financial software relevant to South Carolina residents?

Absolutely, airSlate SignNow can integrate with various financial software, making tax preparation easier for South Carolina residents. Integrations with popular programs streamline your document management, ensuring you have all necessary papers organized when addressing state income tax filings. This connectivity enhances efficiency across your financial processes.

-

What benefits does eSigning offer for tax documents related to South Carolina state income tax?

eSigning tax documents offers numerous benefits, especially for South Carolina state income tax. It eliminates the need for physical signatures, saving time and reducing the chance of errors. Additionally, eSigned documents are legally binding, ensuring reliability and compliance with South Carolina's financial regulations.

Get more for Sc1040x

Find out other Sc1040x

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself