Form 944 PR

What is the Form 944 PR

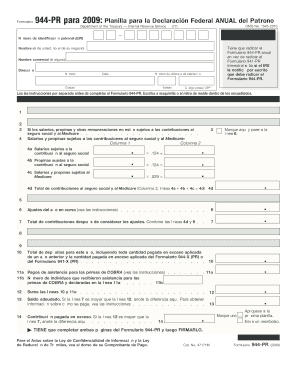

The Form 944 PR is a specific tax form used by employers in Puerto Rico to report annual payroll taxes. This form is designed for small businesses that owe less than a certain amount in payroll taxes annually, allowing them to file once a year instead of quarterly. It simplifies the tax reporting process for eligible employers, ensuring compliance with the Internal Revenue Service (IRS) requirements while reducing the frequency of filing obligations.

How to use the Form 944 PR

Using the Form 944 PR involves several steps. First, employers must determine their eligibility based on the amount of payroll taxes owed. If eligible, they can obtain the form from the IRS website or through authorized tax professionals. Once the form is acquired, employers should carefully fill it out, ensuring all required information is accurate and complete. After completion, the form must be submitted to the IRS by the specified deadline, typically by January 31 of the following year.

Steps to complete the Form 944 PR

Completing the Form 944 PR requires attention to detail. Follow these steps:

- Gather necessary information, including the total wages paid and the amount of taxes withheld.

- Fill out the identification section, providing your business name, address, and Employer Identification Number (EIN).

- Report the total payroll and tax amounts in the designated sections.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Sign and date the form before submission.

Legal use of the Form 944 PR

The legal use of the Form 944 PR is governed by IRS regulations. It is crucial for employers to ensure that the information reported is truthful and complete, as inaccuracies can lead to penalties or legal repercussions. Employers must also retain copies of the submitted form and any supporting documentation for at least four years, as the IRS may request these records for verification.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form 944 PR. The form is due annually on January 31 for the previous tax year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, employers should be aware of any changes in deadlines communicated by the IRS, as these can vary based on legislative updates or other factors.

Form Submission Methods (Online / Mail / In-Person)

The Form 944 PR can be submitted through various methods. Employers have the option to file electronically using IRS e-file services, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. In-person submission is generally not an option for this form, as the IRS encourages electronic or mail submissions for processing efficiency.

Quick guide on how to complete 2009 form 944 pr

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or hide sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 944 PR

Create this form in 5 minutes!

How to create an eSignature for the 2009 form 944 pr

How to create an electronic signature for the 2009 Form 944 Pr in the online mode

How to make an electronic signature for your 2009 Form 944 Pr in Google Chrome

How to generate an electronic signature for signing the 2009 Form 944 Pr in Gmail

How to generate an eSignature for the 2009 Form 944 Pr straight from your smartphone

How to make an eSignature for the 2009 Form 944 Pr on iOS devices

How to generate an electronic signature for the 2009 Form 944 Pr on Android OS

People also ask

-

What is Form 944 PR?

Form 944 PR is a tax form used by certain employers in Puerto Rico to report and pay employment taxes. It is designed for businesses with a low volume of taxable payroll. Understanding how to properly complete and submit Form 944 PR is crucial for compliance purposes.

-

How can airSlate SignNow help with Form 944 PR?

airSlate SignNow provides a user-friendly platform to easily send and eSign Form 944 PR documents. With customizable templates and secure electronic signatures, businesses can streamline their tax reporting process while ensuring compliance. Using airSlate SignNow for Form 944 PR simplifies your workflow and saves time.

-

What pricing options does airSlate SignNow offer for Form 944 PR users?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes looking to manage Form 944 PR. Plans are designed to be cost-effective and include features like unlimited eSignatures and document storage. Visit our pricing page to find the perfect plan for your needs.

-

Are there any features in airSlate SignNow specifically for Form 944 PR?

Yes, airSlate SignNow includes features tailored for Form 944 PR users such as document templates, real-time tracking, and reminders for submissions. These features help ensure that your forms are filled out correctly and submitted on time. The platform is designed to facilitate efficient tax document management.

-

Can airSlate SignNow integrate with other software for Form 944 PR?

Absolutely! airSlate SignNow offers integrations with various accounting and HR software to enhance your management of Form 944 PR. This makes it easier to pull employee data and automate the reporting process, thereby reducing manual entry and errors.

-

Is airSlate SignNow compliant with legal standards for Form 944 PR?

Yes, airSlate SignNow adheres to legal standards and regulations necessary for handling Form 944 PR. The platform ensures that all electronic signatures are legally binding and secure, providing peace of mind when submitting important tax documents.

-

How does airSlate SignNow enhance the security of Form 944 PR submissions?

airSlate SignNow employs advanced security measures, including SSL encryption and multi-factor authentication, to protect your Form 944 PR submissions. This commitment to security ensures that sensitive tax documents are kept confidential and secure throughout the signing process.

Get more for Form 944 PR

- Seller of travel discount programs surety bonds california form

- Entity addresses form

- Clear form agencycourt trainingpresentation request please fax your completed request to 916 653 7625 agency name address city

- Annual report annual report for storm form

- Post webinar questions and answers form

- Kroger direct deposit form

- Instructions for filling out form 8868

- Form 1042 s foreign persons u s source income subject to withholding

Find out other Form 944 PR

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online