Instructions for Filling Out Form 8868 2025-2026

What is Form 8868?

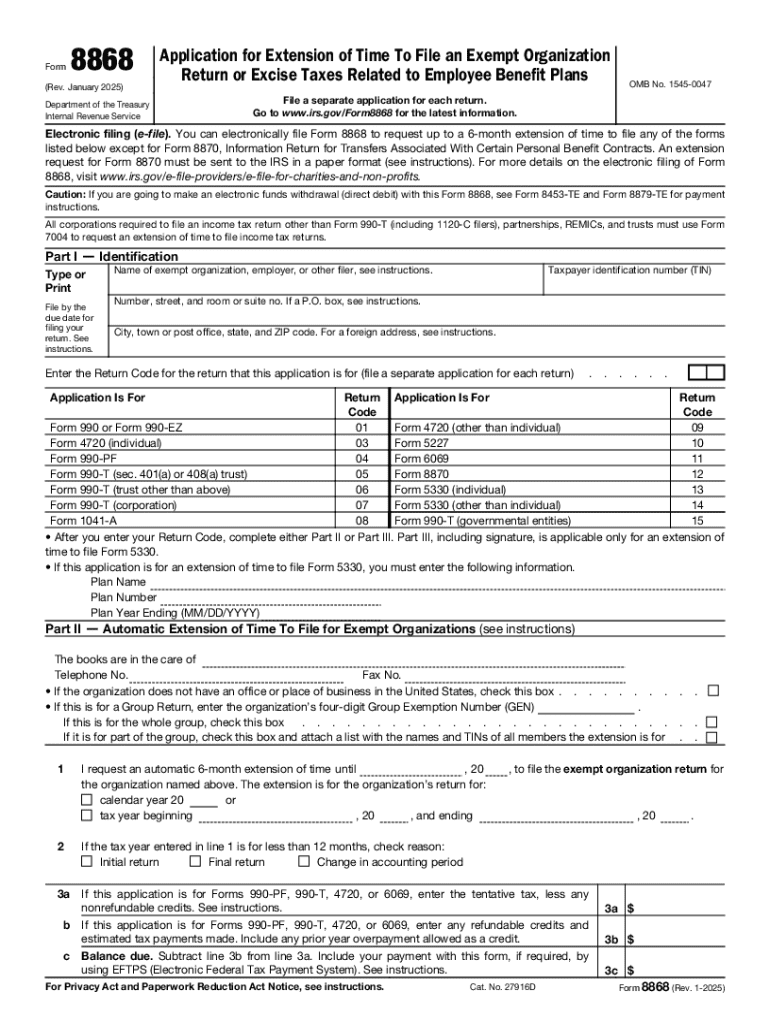

Form 8868 is an IRS document used to apply for an extension of time to file certain tax returns for organizations exempt from income tax. This form is particularly relevant for non-profit organizations, as it allows them to request additional time to submit their annual information returns, such as Form 990 or Form 990-PF. By filing Form 8868, organizations can avoid penalties associated with late submissions, ensuring compliance with IRS regulations.

Steps to Complete Form 8868

Filling out Form 8868 involves several straightforward steps:

- Gather necessary information, including the organization's name, address, and Employer Identification Number (EIN).

- Determine the type of extension needed: a six-month extension for Form 990 or a three-month extension for Form 990-PF.

- Complete the form by entering the required details, ensuring accuracy in all fields.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference and requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 8868 is crucial to avoid penalties. The form must be submitted by the original due date of the return for which the extension is requested. For most organizations, this is typically the 15th day of the fifth month after the end of the tax year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Required Documents

To successfully complete Form 8868, organizations should have the following documents ready:

- The organization's most recent tax return, if applicable.

- Any correspondence from the IRS regarding previous filings.

- Details of any changes in the organization's structure or activities that may affect its tax status.

IRS Guidelines for Form 8868

The IRS provides specific guidelines for completing and submitting Form 8868. Organizations must ensure they are eligible to file for an extension and that they comply with the requirements outlined in the IRS instructions. This includes understanding the implications of filing the form, such as maintaining tax-exempt status and adhering to reporting obligations.

Penalties for Non-Compliance

Failing to file Form 8868 on time can result in significant penalties. Organizations that do not submit their tax returns by the due date may face a penalty of $20 per day for each day the return is late, up to a maximum of $10,000. Additionally, non-compliance can jeopardize an organization's tax-exempt status, leading to further complications and potential liabilities.

Handy tips for filling out Instructions For Filling Out Form 8868 online

Quick steps to complete and e-sign Instructions For Filling Out Form 8868 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a HIPAA and GDPR compliant solution for optimum simpleness. Use signNow to electronically sign and send Instructions For Filling Out Form 8868 for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct instructions for filling out form 8868

Create this form in 5 minutes!

How to create an eSignature for the instructions for filling out form 8868

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 8868 fillable download form?

The IRS 8868 fillable download form is an application for an automatic extension of time to file certain tax returns. This form allows organizations to request additional time to submit their returns, ensuring compliance with IRS regulations. Using a fillable version simplifies the process, making it easier to complete and submit.

-

How can I access the IRS 8868 fillable download?

You can easily access the IRS 8868 fillable download through our platform. Simply navigate to the forms section, locate the IRS 8868 form, and download it in a fillable format. This ensures you can fill it out electronically, saving time and reducing errors.

-

Is there a cost associated with the IRS 8868 fillable download?

The IRS 8868 fillable download is available at no cost when using airSlate SignNow. Our platform provides this form as part of our commitment to offering cost-effective solutions for businesses. You can download and fill it out without any hidden fees.

-

What features does airSlate SignNow offer for the IRS 8868 fillable download?

airSlate SignNow offers several features for the IRS 8868 fillable download, including electronic signatures, document tracking, and cloud storage. These features enhance the efficiency of managing your tax documents and ensure that you can easily access and submit your forms. Additionally, our user-friendly interface makes the process straightforward.

-

Can I integrate the IRS 8868 fillable download with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, enhancing your workflow. You can connect with popular tools like Google Drive, Dropbox, and more to streamline your document management process. This integration ensures that your IRS 8868 fillable download fits smoothly into your existing systems.

-

What are the benefits of using airSlate SignNow for the IRS 8868 fillable download?

Using airSlate SignNow for the IRS 8868 fillable download offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform allows you to fill out and eSign documents quickly, reducing the risk of errors. Additionally, your data is protected with advanced security measures, giving you peace of mind.

-

How do I eSign the IRS 8868 fillable download using airSlate SignNow?

To eSign the IRS 8868 fillable download, simply upload the completed form to airSlate SignNow. You can then add your signature electronically, making the process quick and efficient. This feature eliminates the need for printing and scanning, streamlining your filing process.

Get more for Instructions For Filling Out Form 8868

Find out other Instructions For Filling Out Form 8868

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer