Tax Tables Form

What is the Tax Tables

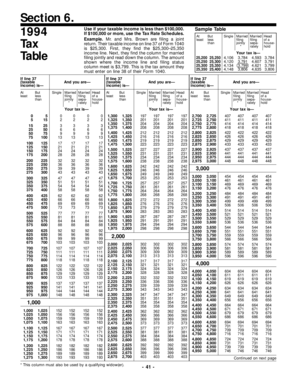

The Tax Tables provide a structured overview of the various tax rates applicable to different income levels for individuals and businesses in the United States. These tables are essential for taxpayers to determine their tax liability based on their income bracket. The tables are updated annually by the IRS to reflect changes in tax laws and inflation adjustments. Understanding these tables helps taxpayers accurately calculate their taxes owed and ensures compliance with federal regulations.

How to use the Tax Tables

Using the Tax Tables involves a straightforward process. First, identify your filing status, which may include options such as single, married filing jointly, or head of household. Next, locate your taxable income within the appropriate table. The Tax Tables will indicate the corresponding tax amount based on your income level. This method allows for a quick reference to determine the amount of tax owed without complex calculations.

Steps to complete the Tax Tables

Completing the Tax Tables requires several steps to ensure accuracy. Begin by gathering all necessary financial documents, including W-2 forms and any other income statements. Then, calculate your total taxable income by deducting allowable expenses and exemptions. Once you have your taxable income, refer to the Tax Tables corresponding to your filing status. Finally, record the tax amount indicated in the tables on your tax return form.

Legal use of the Tax Tables

The legal use of the Tax Tables is governed by IRS regulations, which stipulate how taxpayers must report their income and calculate their tax liabilities. Using these tables correctly ensures compliance with federal tax laws, helping to avoid potential penalties. It is essential for taxpayers to understand that inaccuracies in reporting can lead to audits or fines, making the proper application of the Tax Tables crucial for lawful tax filing.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Tax Tables, including updates on tax rates, filing requirements, and deadlines. These guidelines are published annually and are accessible through the IRS website. Taxpayers are encouraged to review these guidelines to stay informed about any changes that may affect their tax obligations. Adhering to IRS guidelines not only ensures compliance but also helps taxpayers maximize their deductions and credits.

Filing Deadlines / Important Dates

Filing deadlines for tax returns are critical for compliance. Typically, individual taxpayers must submit their returns by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to be aware of these dates to avoid late filing penalties. Additionally, taxpayers should keep track of any changes in deadlines that may occur due to legislative updates or emergencies.

Examples of using the Tax Tables

Examples of using the Tax Tables can clarify how they function in practice. For instance, if a single filer has a taxable income of $50,000, they would locate this figure in the appropriate Tax Table for single filers. The table would indicate the tax owed based on that income level. Another example is for married couples filing jointly; if their combined taxable income is $100,000, they would follow the same process using the married filing jointly table. These examples illustrate the practical application of the Tax Tables in determining tax liability.

Quick guide on how to complete 1994 tax tables

Easily Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline your document-centric operations today.

How to Edit and Electronically Sign [SKS] Effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Tables

Create this form in 5 minutes!

How to create an eSignature for the 1994 tax tables

How to generate an eSignature for the 1994 Tax Tables online

How to create an electronic signature for the 1994 Tax Tables in Google Chrome

How to generate an eSignature for signing the 1994 Tax Tables in Gmail

How to make an electronic signature for the 1994 Tax Tables from your mobile device

How to make an electronic signature for the 1994 Tax Tables on iOS

How to create an electronic signature for the 1994 Tax Tables on Android devices

People also ask

-

What are Tax Tables and how can they benefit my business?

Tax Tables are structured guides that detail various tax rates and brackets which businesses must adhere to. They help ensure compliance with tax regulations, enable accurate calculations, and simplify the tax filing process. By using airSlate SignNow, you can easily integrate these Tax Tables into your document workflows, making tax-related processes more efficient.

-

How does airSlate SignNow integrate with Tax Tables?

airSlate SignNow allows seamless integration with various accounting and tax software that utilize Tax Tables. This integration simplifies the process of filling out tax-related forms and ensures that the information is always current. You can save time and reduce errors by leveraging our automated workflows alongside Tax Tables.

-

Are there any fees associated with using Tax Tables in airSlate SignNow?

Using Tax Tables within airSlate SignNow is included in our competitive pricing plans, which are designed to be cost-effective for businesses of all sizes. You can choose from various subscription tiers that best meet your needs, without any hidden fees. This transparency helps you budget more effectively for your documentation and compliance efforts.

-

What features related to Tax Tables does airSlate SignNow offer?

airSlate SignNow offers a range of features that enhance the management of Tax Tables, such as customizable document templates, eSignature capabilities, and automated reminders for tax deadlines. These features ensure that your tax documentation is compliant and efficiently managed. Additionally, you can access real-time updates to ensure you're always using the most recent Tax Tables.

-

How can airSlate SignNow improve my tax filing efficiency?

By utilizing airSlate SignNow with Tax Tables, you streamline your tax filing process signNowly. The automation of document workflows minimizes manual errors, ensures accurate data entry, and saves time during busy tax seasons. This efficiency allows your team to focus on strategic tasks rather than getting bogged down in paperwork.

-

Can small businesses benefit from using Tax Tables with airSlate SignNow?

Absolutely! Small businesses can greatly benefit from using Tax Tables with airSlate SignNow by ensuring compliance and reducing the risk of penalties due to incorrect filings. Our platform is designed to be user-friendly and affordable, making it an ideal solution for small businesses looking to optimize their tax processes. With access to customizable workflows, you can tailor your tax documentation to meet your business needs.

-

Is there customer support for queries related to Tax Tables?

Yes, airSlate SignNow provides comprehensive customer support for all queries, including those related to Tax Tables. Our support team is equipped to assist you with any questions you may have about integrating or utilizing Tax Tables within our platform. We also provide resources and documentation to help you navigate tax-related features effectively.

Get more for Tax Tables

- Illinois department of revenue schedule cr attach to your form il 1040 credit for tax paid to other states read this information

- Illinois department of revenue schedule m other additions and subtractions for individuals attach to your form il 1040 il 10998630

- You may contribute any whole dollar form

- 962301110 illinois department of revenue schedule 4255 attach this schedule to your return form

- Illinois department of revenue schedule inl year ending illinois net loss adjustment for cooperatives month attach to your form

- 031601110 illinois department of revenue il 477 replacement tax investment credits attach to form il 1120 il 1065 il 1120 st il

- Il 505 b tax illinois form

- For tax years ending on or after december 31 form

Find out other Tax Tables

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple