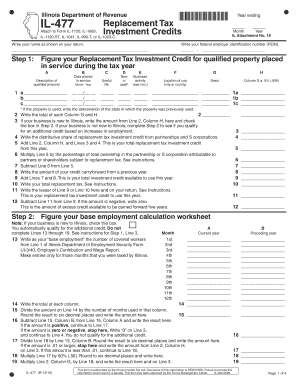

*031601110* Illinois Department of Revenue IL 477 Replacement Tax Investment Credits Attach to Form IL 1120, IL 1065, IL 1120 ST

Understanding the Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits

The *031601110* form, known as the Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits, is essential for businesses seeking to claim investment credits on various tax forms. This form allows taxpayers to report and claim credits related to investments made in qualified property or facilities. The investment credits can significantly reduce the overall tax liability for eligible businesses.

This form is attached to several tax filings, including Form IL 1120, IL 1065, IL 1120 ST, IL 1041, IL 990 T, or IL 1023 C. Understanding the purpose and requirements of this form is crucial for compliance and maximizing potential tax benefits.

Steps to Complete the IL 477 Replacement Tax Investment Credits Form

Completing the *031601110* form involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to your investments. This includes invoices, receipts, and any other records that support your claims for investment credits.

Next, fill out the form by providing detailed information about the investments, including the type of property, date of acquisition, and the total amount invested. Be sure to calculate the credits accurately based on the guidelines provided by the Illinois Department of Revenue. Once completed, attach the form to the appropriate tax return, ensuring that all information is consistent across documents.

Eligibility Criteria for the IL 477 Replacement Tax Investment Credits

To qualify for the *031601110* credits, businesses must meet specific eligibility criteria set forth by the Illinois Department of Revenue. Generally, the investments must be made in qualified property used in the operation of a business in Illinois. This includes tangible property such as machinery, equipment, and certain improvements to real estate.

Additionally, the business must be subject to the Illinois Replacement Tax and must have filed the appropriate tax forms for the year in which the investment was made. It is important for businesses to review these criteria carefully to ensure they qualify for the credits before filing.

Required Documents for Filing the IL 477 Form

When preparing to file the *031601110* form, several documents are required to substantiate your claims. These documents typically include:

- Invoices or receipts for the purchased property

- Proof of payment for the investments

- Documentation showing the use of the property in the business

- Any prior tax filings that relate to the investment credits

Having these documents ready will streamline the filing process and help ensure that your claims are supported by adequate evidence.

Filing Deadlines for the IL 477 Replacement Tax Investment Credits

Timely submission of the *031601110* form is critical for claiming investment credits. The filing deadlines align with the due dates for the associated tax returns, such as Form IL 1120, IL 1065, IL 1041, IL 990 T, or IL 1023 C. Generally, these returns are due on the 15th day of the fourth month following the end of the tax year.

For businesses operating on a calendar year, this means the deadline is typically April 15. However, if you are filing for a fiscal year, be sure to check the specific due date for your tax year to avoid penalties.

Legal Use of the IL 477 Replacement Tax Investment Credits

The *031601110* form is legally recognized by the Illinois Department of Revenue for claiming investment credits. Proper use of this form is essential for compliance with state tax laws. Businesses must ensure that all information provided is accurate and truthful, as any discrepancies could lead to audits or penalties.

Understanding the legal implications of claiming these credits is important for maintaining good standing with tax authorities. Consulting with a tax professional can provide additional guidance on the legal use of the form and help navigate any complexities in the filing process.

Quick guide on how to complete 031601110 illinois department of revenue il 477 replacement tax investment credits attach to form il 1120 il 1065 il 1120 st il

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest way to edit and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just a few seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits Attach To Form IL 1120, IL 1065, IL 1120 ST

Create this form in 5 minutes!

How to create an eSignature for the 031601110 illinois department of revenue il 477 replacement tax investment credits attach to form il 1120 il 1065 il 1120 st il

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits?

The *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits are designed to incentivize businesses in Illinois by providing tax credits for investments. These credits can be attached to various forms such as IL 1120, IL 1065, IL 1120 ST, IL 1041, IL 990 T, or IL 1023 C, helping businesses reduce their tax liabilities.

-

How can I attach the *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits to my tax forms?

To attach the *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits to your tax forms, you need to complete the relevant sections on forms IL 1120, IL 1065, IL 1120 ST, IL 1041, IL 990 T, or IL 1023 C. Ensure that all required documentation is included to support your claim for the credits.

-

What are the benefits of using airSlate SignNow for submitting tax forms?

Using airSlate SignNow for submitting tax forms, including those related to the *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits, streamlines the process. It allows for easy document signing and sharing, ensuring that your forms are submitted accurately and on time, which can help avoid penalties.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost is competitive and provides a cost-effective solution for managing tax documents, including those related to the *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting software, making it easier to manage your tax documents and credits like the *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits. This integration helps streamline your workflow and enhances productivity.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features for document signing, including customizable templates, secure eSignatures, and real-time tracking. These features ensure that your documents related to the *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits are signed and processed efficiently.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents by employing advanced encryption and secure cloud storage. This ensures that sensitive information, including details related to the *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits, is protected from unauthorized access.

Get more for *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits Attach To Form IL 1120, IL 1065, IL 1120 ST

- Life documents planning package including will power of attorney and living will vermont form

- General durable power of attorney for property and finances or financial effective upon disability vermont form

- Essential legal life documents for baby boomers vermont form

- General durable power of attorney for property and finances or financial effective immediately vermont form

- Revocation of general durable power of attorney vermont form

- Essential legal life documents for newlyweds vermont form

- Vt legal documents form

- Essential legal life documents for new parents vermont form

Find out other *031601110* Illinois Department Of Revenue IL 477 Replacement Tax Investment Credits Attach To Form IL 1120, IL 1065, IL 1120 ST

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online