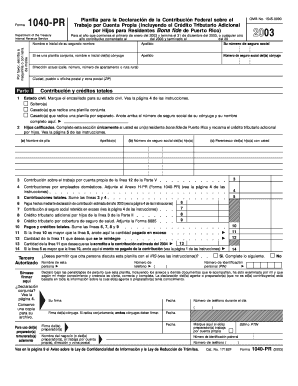

Form 1040 PR Fill in Version

What is the Form 1040 PR Fill in Version

The Form 1040 PR is a tax return form specifically designed for residents of Puerto Rico. It allows individuals to report income and calculate their tax liability to the Puerto Rico Department of Treasury. This form is essential for those who earn income in Puerto Rico and need to comply with local tax regulations. The 1040 PR fill in version provides a structured format that helps taxpayers accurately complete their tax returns while ensuring compliance with applicable laws.

How to use the Form 1040 PR Fill in Version

Using the Form 1040 PR fill in version involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, access the form through an authorized source, ensuring it is the most current version. Fill in the required fields, including personal information, income details, and deductions. Finally, review the completed form for accuracy before submission. Utilizing electronic signing solutions can streamline this process, making it easier to manage and submit your tax return securely.

Steps to complete the Form 1040 PR Fill in Version

Completing the Form 1040 PR fill in version involves a systematic approach:

- Gather all relevant documents, such as income statements and deduction records.

- Obtain the latest version of the Form 1040 PR from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages, dividends, and other earnings.

- Claim any applicable deductions or credits to reduce your tax liability.

- Review the form for any errors or omissions before finalizing it.

- Sign and date the form, then submit it according to the instructions provided.

Legal use of the Form 1040 PR Fill in Version

The legal use of the Form 1040 PR fill in version is governed by the tax laws of Puerto Rico. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Ensuring compliance with local regulations is crucial, as failure to do so may result in penalties or legal repercussions. Utilizing a reliable electronic signing platform can help maintain the integrity and legality of the submitted form, providing necessary certifications and compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 PR are critical for taxpayers to keep in mind. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April 15. However, taxpayers should verify specific dates each year, as they may vary due to weekends or holidays. It is essential to file on time to avoid penalties and ensure compliance with tax obligations.

Required Documents

To complete the Form 1040 PR fill in version accurately, certain documents are required. These typically include:

- W-2 forms from employers detailing yearly earnings.

- 1099 forms for other income sources, such as freelance work or interest.

- Documentation for any deductions or credits being claimed, such as receipts or tax statements.

- Identification documents, including a valid Social Security number.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040 PR can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through authorized tax software that supports e-filing.

- Mailing a completed paper form to the Puerto Rico Department of Treasury.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can enhance efficiency and ensure timely processing of your tax return.

Quick guide on how to complete 2003 form 1040 pr fill in version

Prepare Form 1040 PR Fill in Version effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a superb eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle Form 1040 PR Fill in Version on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Form 1040 PR Fill in Version effortlessly

- Obtain Form 1040 PR Fill in Version and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information using tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), or invite link, or download it to your computer.

Stop worrying about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 1040 PR Fill in Version to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2003 form 1040 pr fill in version

How to create an electronic signature for your 2003 Form 1040 Pr Fill In Version in the online mode

How to create an eSignature for your 2003 Form 1040 Pr Fill In Version in Chrome

How to create an eSignature for putting it on the 2003 Form 1040 Pr Fill In Version in Gmail

How to generate an electronic signature for the 2003 Form 1040 Pr Fill In Version right from your mobile device

How to make an electronic signature for the 2003 Form 1040 Pr Fill In Version on iOS

How to make an eSignature for the 2003 Form 1040 Pr Fill In Version on Android devices

People also ask

-

What is the 1040 pr and how does airSlate SignNow support it?

The 1040 pr is a critical tax form used for reporting personal income to the IRS. airSlate SignNow provides a streamlined way to eSign and send the 1040 pr and other related documents securely and efficiently, ensuring you meet deadlines hassle-free.

-

How much does airSlate SignNow cost for handling 1040 pr documents?

airSlate SignNow offers cost-effective pricing plans tailored to various business sizes and needs. You can choose a plan that suits your requirements for processing 1040 pr documents without breaking your budget, making it an economical solution.

-

What features does airSlate SignNow offer for the 1040 pr?

airSlate SignNow includes features such as easy document uploads, customizable templates, and secure eSigning, all beneficial for managing your 1040 pr. These features empower you to complete necessary tax documents efficiently and accurately.

-

Can I integrate airSlate SignNow with other tools for processing 1040 pr?

Yes, airSlate SignNow seamlessly integrates with various tools and software you already use. This integration allows you to enhance your document workflow for the 1040 pr, making the entire process smoother and more automated.

-

What are the benefits of using airSlate SignNow for my 1040 pr?

Using airSlate SignNow for your 1040 pr offers numerous benefits, including time savings and enhanced security. You'll be able to eSign documents quickly while ensuring that sensitive information remains protected, providing peace of mind.

-

Is there customer support available for issues related to the 1040 pr?

Absolutely! airSlate SignNow provides reliable customer support to assist you with any issues related to your 1040 pr. Their team is available to ensure that your experience with the platform is smooth and that you get the help you need promptly.

-

How does airSlate SignNow ensure the security of my 1040 pr documents?

airSlate SignNow employs advanced security protocols, including encryption and secure cloud storage, to protect your 1040 pr documents. You can trust that your sensitive tax information is kept safe from unauthorized access.

Get more for Form 1040 PR Fill in Version

- Podiatry foot screening form rev beverly hospital

- Idaho salvage vehicle statement itd 3311 idaho salvage vehicle statement itd 3311 itd idaho form

- Pitt county schools 10212 x grievance forms pitt k12 nc

- Caddra teacher assessment form

- Form snap iv

- Untitled form 504 standard condominium purchase and sale agreement 10 29 04 1

- Workers comp form ct mileage form

- Student complaint form cedar valley college cedarvalleycollege

Find out other Form 1040 PR Fill in Version

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History