8844 2018

What is the 8844

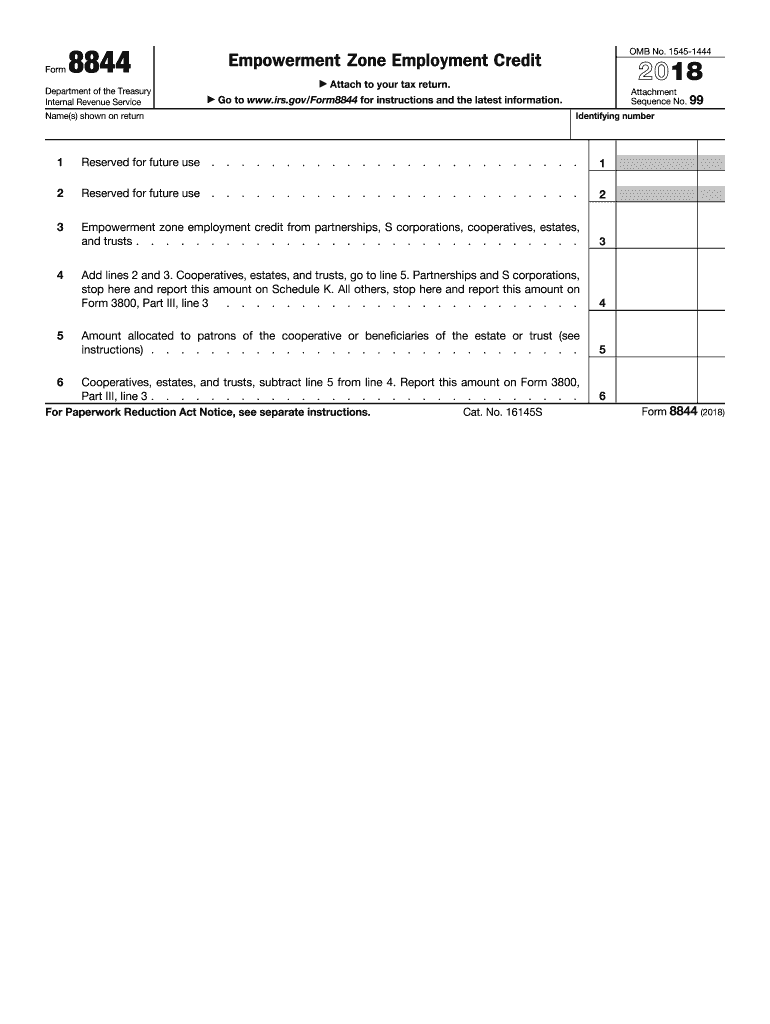

The 2 form, officially known as the IRS Form 8844, is utilized to claim the Empowerment Zone Employment Credit. This credit is designed to incentivize businesses to hire individuals from designated empowerment zones, which are economically distressed areas in the United States. By providing tax relief, the form encourages job creation and economic development in these communities.

How to use the 8844

To effectively use the 2 form, businesses must first determine their eligibility based on the location of their operations and the demographics of their workforce. After confirming eligibility, employers can complete the form by detailing the number of qualified employees hired during the tax year. Accurate reporting is essential, as this will directly impact the amount of credit the business can claim.

Steps to complete the 8844

Completing the 2 form involves several key steps:

- Gather necessary information about the business and employees, including names, Social Security numbers, and employment dates.

- Verify that the employees qualify under the Empowerment Zone criteria.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the credit based on the number of qualified employees and applicable rates.

- Submit the completed form along with the business's tax return.

Legal use of the 8844

The legal use of the 2 form hinges on compliance with IRS guidelines. Businesses must adhere to the specific requirements set forth for the Empowerment Zone Employment Credit. This includes maintaining accurate records of employee eligibility and ensuring that the form is submitted within the designated tax filing period. Failure to comply with these regulations can result in penalties or disqualification from claiming the credit.

Eligibility Criteria

Eligibility for the 2 form is based on several factors. Employers must operate within a designated empowerment zone and hire individuals who meet specific criteria, such as being residents of the zone or belonging to certain demographic groups. Additionally, the employees must work a minimum number of hours and be employed for a specified duration to qualify for the credit.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of filing deadlines related to the 2 form. Typically, the form should be filed alongside the business's annual tax return. For most businesses, this means submitting the form by April fifteenth of the following year. However, if an extension is filed, the deadline may be extended accordingly. Keeping track of these dates ensures that businesses do not miss the opportunity to claim the credit.

Quick guide on how to complete 8844

Manage 8844 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle 8844 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign 8844 with ease

- Find 8844 and select Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or hide sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 8844 and ensure excellent communication at every stage of your document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8844

Create this form in 5 minutes!

How to create an eSignature for the 8844

How to make an eSignature for the 8844 in the online mode

How to make an eSignature for the 8844 in Chrome

How to make an electronic signature for signing the 8844 in Gmail

How to make an eSignature for the 8844 straight from your smart phone

How to generate an electronic signature for the 8844 on iOS

How to create an electronic signature for the 8844 on Android devices

People also ask

-

What is the 2017 8844 and how does it relate to airSlate SignNow?

The 2017 8844 is a crucial form used in various business transactions, and airSlate SignNow simplifies its handling. By utilizing our platform, users can easily send and eSign the 2017 8844 document, ensuring compliance and efficiency. Our solution offers a secure and user-friendly way to manage this important form.

-

What are the pricing options for using airSlate SignNow with the 2017 8844?

airSlate SignNow offers competitive pricing plans tailored to your business needs, all while facilitating the eSigning of the 2017 8844. Whether you’re a solo user or a large enterprise, we have a plan that fits your budget. Our cost-effective solution ensures you get maximum value when managing crucial documents like the 2017 8844.

-

What features does airSlate SignNow offer for managing the 2017 8844?

airSlate SignNow provides several features to streamline the process of handling the 2017 8844, including customizable templates, real-time tracking, and automated reminders. Users can securely eSign and share the document with ease. These features enhance productivity and ensure that your 2017 8844 is processed quickly and efficiently.

-

How can airSlate SignNow benefit my business with the 2017 8844?

Using airSlate SignNow for the 2017 8844 can signNowly enhance your operational efficiency by digitizing document workflows. This reduces paper usage and speeds up the signing process, allowing for quicker turnaround times. Your business can enjoy better organization, streamlined processes, and improved collaboration with stakeholders.

-

Does airSlate SignNow integrate with other software when handling the 2017 8844?

Yes, airSlate SignNow seamlessly integrates with various software tools to enhance your experience when managing the 2017 8844. You can connect with CRMs, cloud storage solutions, and project management apps, making it easier to incorporate eSigning into your existing workflows. These integrations help maintain efficiency while handling important forms.

-

Is airSlate SignNow user-friendly for signing the 2017 8844?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to eSign and manage the 2017 8844. Our intuitive interface allows users to quickly navigate through the signing process, ensuring that you can complete your documents with minimal hassle and maximum efficiency.

-

What security measures are in place for the 2017 8844 on airSlate SignNow?

airSlate SignNow prioritizes security, especially when handling sensitive documents like the 2017 8844. We use advanced encryption protocols and secure cloud storage to protect your information. Our platform ensures that every transaction is compliant with industry standards, giving you peace of mind while managing your documents.

Get more for 8844

- Cda badging application draft12072016 1withemployeeidanduscisnodoc form

- Geologist examination illinois department of financial and form

- Alcoholdrug evaluation form

- State form 54266 r2 6 15 form 236

- Maryland officer inclusion for workers compensation 2015 2019 form

- Physical agility test confirmation form 2015 2019

- Form shared housing 2014 2019

- Authorization to requestrelease student records 550 2 montgomeryschoolsmd form

Find out other 8844

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors