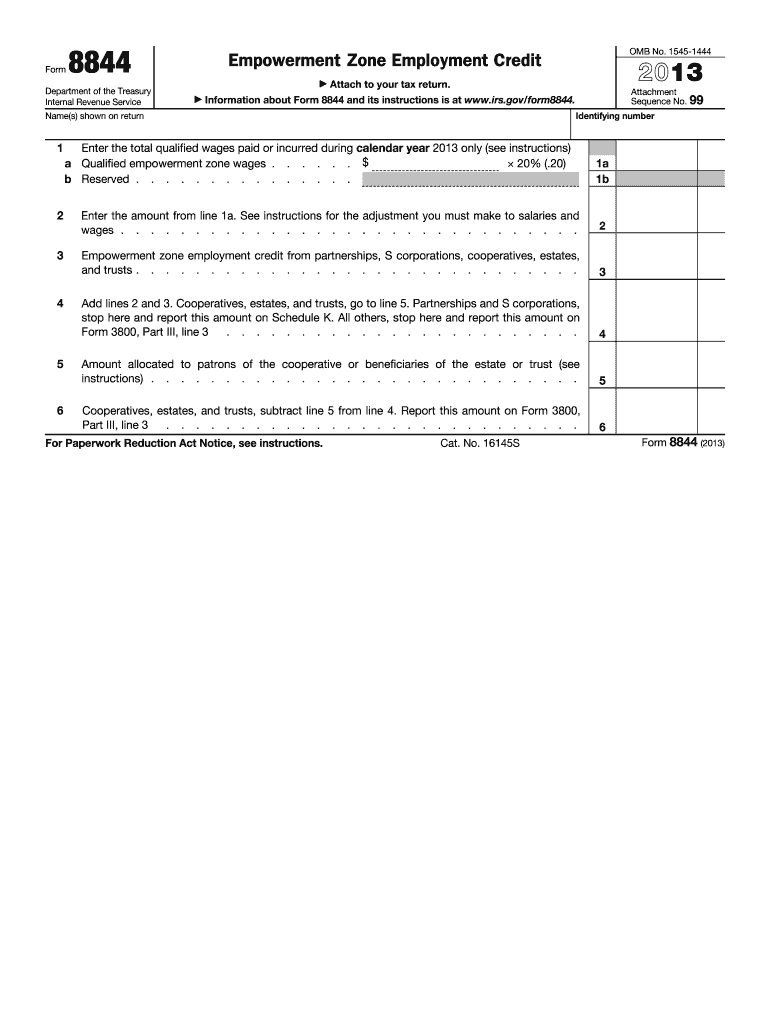

Irs Form 8844 Without Instructions 2013

What is the IRS Form 8844 Without Instructions

The IRS Form 8844 is a tax form used by eligible taxpayers to claim the Indian Employment Credit. This credit is designed to encourage businesses to hire and retain qualified individuals who are members of federally recognized Indian tribes. The form allows for a reduction in tax liability based on wages paid to these employees. While the form itself is straightforward, it is important to understand the eligibility criteria and the specific details required for completion to ensure compliance with IRS regulations.

How to Use the IRS Form 8844 Without Instructions

Using the IRS Form 8844 requires careful attention to detail. Taxpayers must first determine their eligibility for the Indian Employment Credit. Once eligibility is confirmed, the form should be filled out with accurate information regarding the taxpayer's business and the qualified employees. It is essential to provide the correct amounts for wages paid, as this will directly impact the credit amount claimed. After completing the form, it should be submitted along with the taxpayer's annual tax return.

Steps to Complete the IRS Form 8844 Without Instructions

Completing the IRS Form 8844 involves several key steps:

- Gather necessary information about your business and qualified employees.

- Verify the eligibility of employees as members of a federally recognized tribe.

- Enter the total wages paid to eligible employees in the appropriate sections of the form.

- Calculate the credit amount based on the wages reported.

- Review the completed form for accuracy before submission.

Legal Use of the IRS Form 8844 Without Instructions

The legal use of IRS Form 8844 is contingent upon meeting the requirements set forth by the IRS. Taxpayers must ensure that they are correctly identifying eligible employees and accurately reporting wages. Misrepresentation or errors in the form can lead to penalties or denial of the credit. It is advisable to maintain proper documentation to support claims made on the form, as this can be crucial in the event of an audit.

Eligibility Criteria for the IRS Form 8844 Without Instructions

To qualify for the Indian Employment Credit using IRS Form 8844, taxpayers must meet specific eligibility criteria:

- The business must be located on or near a reservation.

- Employees must be enrolled members of a federally recognized Indian tribe.

- Wages must be paid for work performed within the reservation or in a related business.

Filing Deadlines / Important Dates for the IRS Form 8844 Without Instructions

Filing deadlines for IRS Form 8844 align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of each year. If additional time is needed, taxpayers can file for an extension, but it is important to ensure that the form is submitted before the extended deadline to avoid penalties.

Form Submission Methods for the IRS Form 8844 Without Instructions

IRS Form 8844 can be submitted in various ways. Taxpayers can file the form electronically through tax preparation software, which often includes e-filing options. Alternatively, the form can be printed and mailed to the appropriate IRS address. It is crucial to check for the most current submission guidelines to ensure compliance with IRS requirements.

Quick guide on how to complete 2012 irs form 8844 without instructions 2013

Accomplish Irs Form 8844 Without Instructions effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Irs Form 8844 Without Instructions on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric operation today.

The easiest way to modify and eSign Irs Form 8844 Without Instructions without stress

- Obtain Irs Form 8844 Without Instructions and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether it's via email, text message (SMS), an invitation link, or downloading it to your computer.

Eliminate worries about missing or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 8844 Without Instructions to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 irs form 8844 without instructions 2013

Create this form in 5 minutes!

How to create an eSignature for the 2012 irs form 8844 without instructions 2013

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is IRS Form 8844 and why would I need it?

IRS Form 8844 is used to claim the Empowerment Zone Employment Credit. If you are eligible for this credit, it's important to understand how to complete the form correctly, even if you have IRS Form 8844 Without Instructions. Using tools like airSlate SignNow can help streamline the process.

-

Can I complete IRS Form 8844 without the official instructions?

Yes, you can complete IRS Form 8844 without the official instructions, but it may require some additional research on your part. airSlate SignNow provides resources that can assist you in understanding the form's requirements, enhancing your experience even with IRS Form 8844 Without Instructions.

-

What features does airSlate SignNow offer for signing IRS Form 8844?

airSlate SignNow offers numerous features such as e-signatures, document templates, and cloud storage that make completing IRS Form 8844 straightforward. Even without instructions, you can use our platform to easily manage your documents while ensuring compliance with IRS regulations related to IRS Form 8844 Without Instructions.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8844?

Yes, there is an affordable subscription cost associated with using airSlate SignNow, which provides a cost-effective solution for managing your documents. The pricing includes the ability to efficiently handle forms like IRS Form 8844 Without Instructions, helping you save time and reduce errors.

-

What benefits does airSlate SignNow provide for managing IRS Form 8844?

Using airSlate SignNow for managing IRS Form 8844 offers signNow benefits including enhanced security, quick access, and ease of collaboration. Our platform ensures that you can handle IRS Form 8844 Without Instructions efficiently, minimizing confusion during the filing process.

-

Can I integrate airSlate SignNow with other software to assist with IRS Form 8844?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software tools, allowing you to create a streamlined workflow for completing IRS Form 8844. This means you can manage and sign documents even if you're working with IRS Form 8844 Without Instructions using your preferred applications.

-

How does airSlate SignNow ensure compliance when using IRS Form 8844?

airSlate SignNow includes features designed to help maintain compliance with federal regulations, such as secure eSignature options and audit trails. This is essential when completing forms like IRS Form 8844 Without Instructions, as it provides peace of mind that your submissions adhere to required standards.

Get more for Irs Form 8844 Without Instructions

- Warranty deed one individual to two individuals as joint tenants with the right of survivorship florida form

- Florida deed husband wife 497303482 form

- Husband wife tenants form

- Warranty deed for husband and wife to a trust florida form

- Florida deed survivorship form

- Quitclaim deed for four individuals to living trust florida form

- Quitclaim deed for two individuals or husband and wife to three individuals as joint tenants with the right of survivorship form

- Fl warranty deed 497303488 form

Find out other Irs Form 8844 Without Instructions

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement