Notice 1036 2018

What is the Notice 1036

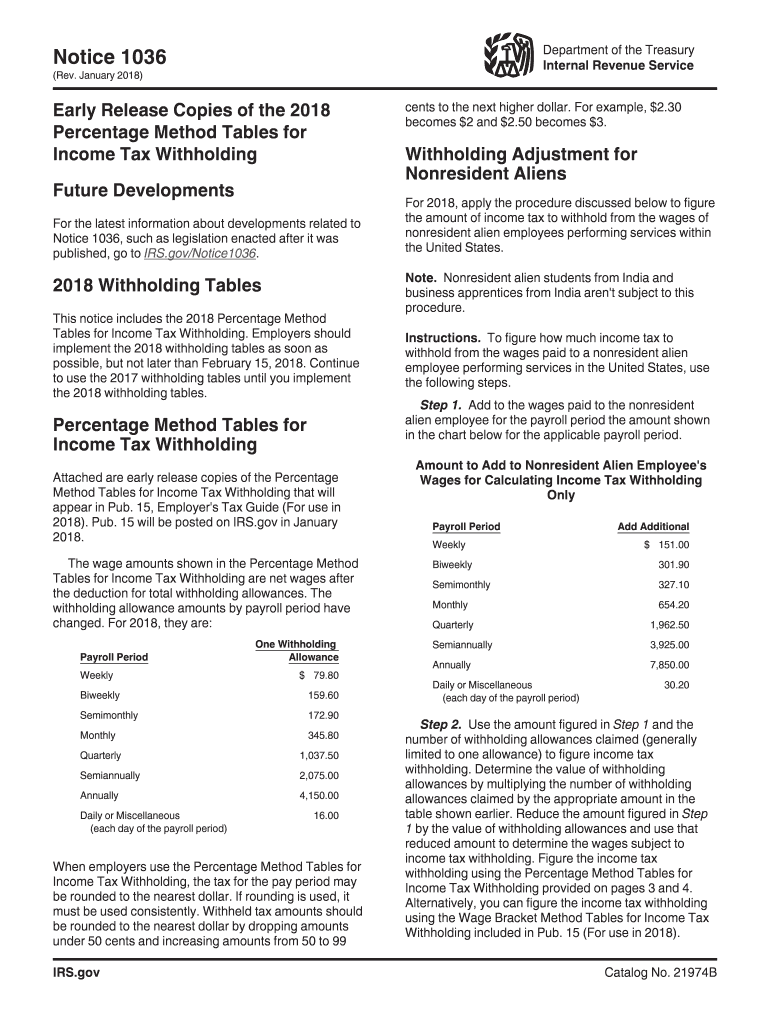

The Notice 1036 is an important document issued by the IRS that provides taxpayers with updated information about withholding allowances. It is particularly relevant for employees who need to adjust their tax withholding based on their individual financial situations. The notice outlines the necessary steps to determine the correct amount of tax to withhold from wages, ensuring compliance with federal tax regulations.

How to use the Notice 1036

To effectively use the Notice 1036, taxpayers should first review the information contained within the document. This includes understanding the withholding tables and how they apply to their specific financial circumstances. Taxpayers can use the notice to fill out Form W-4, which allows them to claim the appropriate number of allowances. By accurately completing this form, individuals can ensure that the correct amount of federal income tax is withheld from their paychecks.

Steps to complete the Notice 1036

Completing the Notice 1036 involves several key steps:

- Read the notice thoroughly to understand the withholding guidelines.

- Gather necessary financial information, including income and deductions.

- Use the withholding tables provided in the notice to determine the correct withholding amount.

- Fill out Form W-4 based on the information gathered and the withholding amount calculated.

- Submit the completed Form W-4 to your employer for processing.

Key elements of the Notice 1036

Several key elements are included in the Notice 1036 that are crucial for taxpayers:

- Withholding Tables: These tables provide the necessary calculations for determining the correct withholding amount based on income levels.

- Instructions: The notice includes detailed instructions on how to complete the associated forms and adjust withholding allowances.

- Examples: Practical examples are often provided to illustrate how to apply the information in real-life scenarios.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the use of the Notice 1036. These guidelines emphasize the importance of keeping withholding accurate to avoid underpayment or overpayment of taxes. Taxpayers are encouraged to review their withholding status annually or when significant life changes occur, such as marriage or a new job. Adhering to these guidelines can help prevent unexpected tax liabilities at the end of the year.

Filing Deadlines / Important Dates

While the Notice 1036 itself does not have a specific filing deadline, it is essential for taxpayers to be aware of key tax deadlines. Typically, employers must submit the withheld taxes to the IRS on a regular schedule, often monthly or quarterly. Additionally, taxpayers should be mindful of the annual tax filing deadline, which is usually April 15. Keeping track of these dates ensures compliance and helps avoid penalties.

Quick guide on how to complete notice 1036

Effortlessly Prepare Notice 1036 on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Notice 1036 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Notice 1036 effortlessly

- Find Notice 1036 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes only seconds and carries the same legal significance as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes requiring new printed document copies. airSlate SignNow manages all your document handling needs in just a few clicks from your chosen device. Modify and eSign Notice 1036 and ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct notice 1036

Create this form in 5 minutes!

How to create an eSignature for the notice 1036

How to generate an eSignature for the Notice 1036 online

How to create an electronic signature for the Notice 1036 in Chrome

How to generate an electronic signature for putting it on the Notice 1036 in Gmail

How to create an electronic signature for the Notice 1036 straight from your mobile device

How to make an electronic signature for the Notice 1036 on iOS devices

How to generate an electronic signature for the Notice 1036 on Android devices

People also ask

-

What are tables withholding in the context of airSlate SignNow?

Tables withholding refers to the structured data provided to help users understand the tax implications of certain transactions. With airSlate SignNow, we ensure that our users can easily access and manage tables withholding for eSigning and document management, simplifying the tax process.

-

How does airSlate SignNow handle tables withholding in documents?

airSlate SignNow allows users to incorporate tables withholding directly into their documents, enhancing transparency and ensuring compliance. This feature simplifies the eSigning process while providing all parties with clear tax information related to the signatures.

-

Is there an additional fee for features related to tables withholding?

No, the features for managing tables withholding are included in the standard pricing plans of airSlate SignNow. We strive to offer a cost-effective solution that encompasses all critical functions, including tables withholding management, without hidden fees.

-

Can I integrate tables withholding data from other systems into airSlate SignNow?

Yes, airSlate SignNow supports integrations with various accounting and tax software that manage tables withholding. This ensures a seamless experience for users who want to import or export data, streamlining the document workflow.

-

What benefits does airSlate SignNow provide for managing tables withholding?

By using airSlate SignNow to manage tables withholding, users experience enhanced efficiency, improved compliance, and reduced errors. Our platform automates many aspects of document handling, ensuring that tax obligations are clearly identified and addressed during the signing process.

-

Are there templates available for documents with tables withholding?

Yes, airSlate SignNow offers customizable templates that include tables withholding. These templates are designed to meet various business needs, making it easier to create documents that comply with tax regulations.

-

How does airSlate SignNow ensure compliance with tables withholding requirements?

airSlate SignNow is committed to providing compliant solutions for businesses. Our platform continuously updates its features and templates to align with current tables withholding regulations, giving users peace of mind.

Get more for Notice 1036

- Soc426a 2016 2019 form

- Inabilty to appear forms 2017 2019

- Ahca affidavit 2015 2019 form

- Obtaining medical records baptist health south florida form

- Iowa pre participation physical form 2015 2019

- Iowa medicaid enterprise iowa department of human services dhs iowa form

- Incident id form

- Idaho practitioner application 2014 2019 form

Find out other Notice 1036

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form