Notice 1036 Rev December Early Release Copies of the Percentage Method Tables for Income Tax Withholding 2019-2026

Understanding the Early Release Method for Income Tax Withholding

The early release method refers to the IRS guidelines allowing taxpayers to access updated income tax withholding tables prior to the official release date. This method is particularly useful for employers and payroll departments to ensure accurate withholding calculations. By utilizing the early release method, businesses can align their payroll processes with the latest tax regulations, minimizing errors and ensuring compliance.

How to Utilize the Early Release Method

To effectively use the early release method, employers should follow these steps:

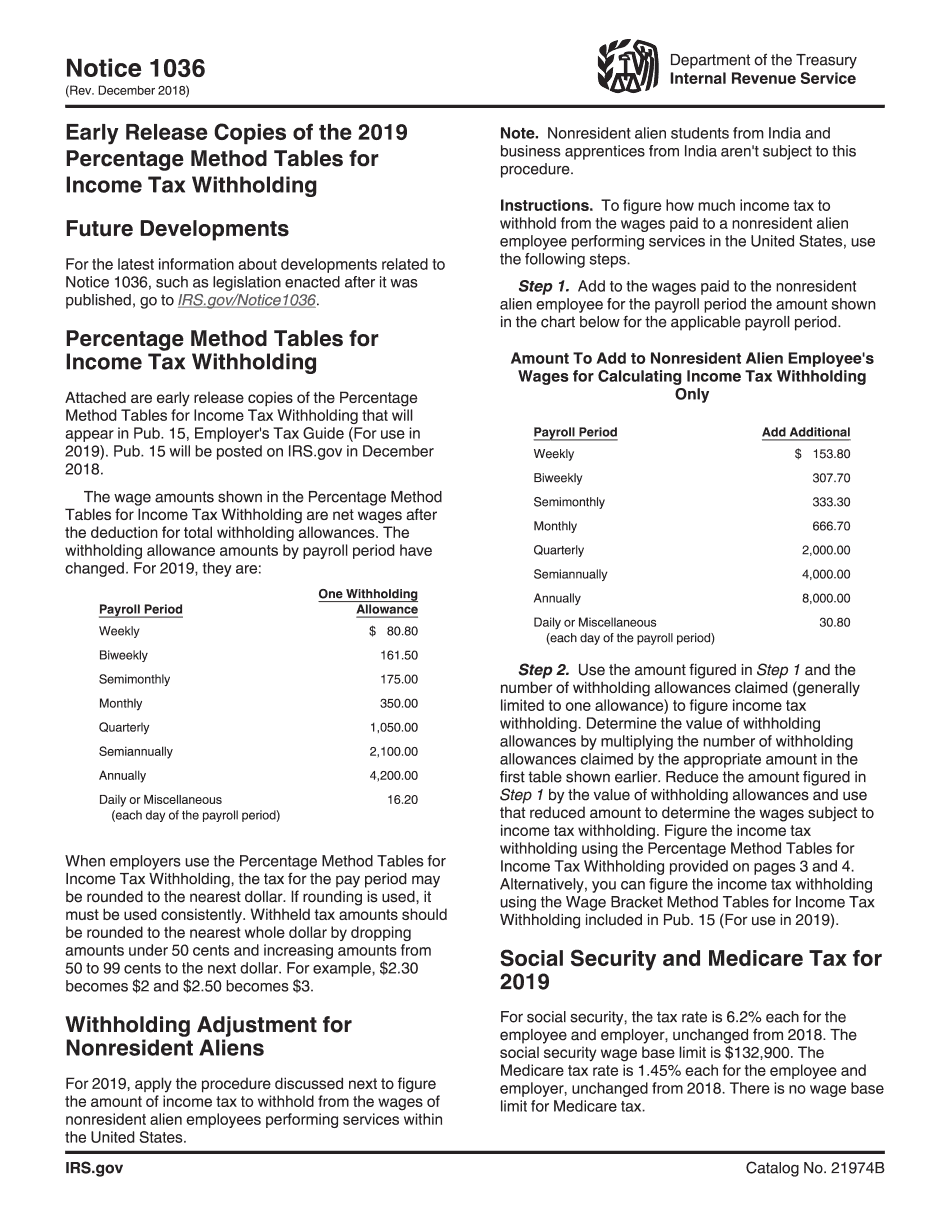

- Access the latest IRS Notice 1036, which provides the updated percentage method tables for income tax withholding.

- Review the tables to understand the new withholding rates applicable to various income levels.

- Adjust payroll systems to incorporate the new rates, ensuring that employee withholdings reflect the most current information.

- Communicate any changes to employees, providing clarity on how their take-home pay may be affected.

Key Components of the Early Release Method

Several important elements define the early release method:

- IRS Notice 1036: This document outlines the updated percentage method tables for income tax withholding, serving as the primary resource for employers.

- Compliance: Using the early release method helps ensure that employers remain compliant with IRS regulations, avoiding potential penalties.

- Accuracy: Implementing updated withholding rates can lead to more accurate tax withholdings, reducing the likelihood of underpayment or overpayment for employees.

Legal Considerations for the Early Release Method

Employers must be aware of the legal implications of using the early release method. Adhering to IRS guidelines is crucial to avoid penalties associated with incorrect tax withholding. The early release method is legally permissible as long as the employer follows the instructions provided in the IRS Notice 1036. This ensures that all withholdings are calculated based on the most current and accurate information.

Examples of the Early Release Method in Action

Consider the following scenarios where the early release method is applied:

- A company updates its payroll system in January to reflect the new withholding rates from the early release method, ensuring employees receive accurate paychecks based on the latest IRS tables.

- During a mid-year review, an employer discovers that their current withholding rates do not align with the updated tables. By utilizing the early release method, they can make necessary adjustments promptly.

Filing Deadlines and Important Dates

Employers should keep track of key deadlines related to the early release method:

- IRS releases the early version of the percentage method tables, typically in December for the upcoming tax year.

- Employers must implement the new withholding rates by the first payroll of the new year to ensure compliance.

Quick guide on how to complete notice 1036 rev december 2018 early release copies of the 2019 percentage method tables for income tax withholding

Complete Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without delays. Manage Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding with ease

- Obtain Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding and ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct notice 1036 rev december 2018 early release copies of the 2019 percentage method tables for income tax withholding

Create this form in 5 minutes!

How to create an eSignature for the notice 1036 rev december 2018 early release copies of the 2019 percentage method tables for income tax withholding

How to create an eSignature for your Notice 1036 Rev December 2018 Early Release Copies Of The 2019 Percentage Method Tables For Income Tax Withholding in the online mode

How to create an electronic signature for your Notice 1036 Rev December 2018 Early Release Copies Of The 2019 Percentage Method Tables For Income Tax Withholding in Google Chrome

How to make an electronic signature for signing the Notice 1036 Rev December 2018 Early Release Copies Of The 2019 Percentage Method Tables For Income Tax Withholding in Gmail

How to create an eSignature for the Notice 1036 Rev December 2018 Early Release Copies Of The 2019 Percentage Method Tables For Income Tax Withholding straight from your smartphone

How to generate an electronic signature for the Notice 1036 Rev December 2018 Early Release Copies Of The 2019 Percentage Method Tables For Income Tax Withholding on iOS

How to create an electronic signature for the Notice 1036 Rev December 2018 Early Release Copies Of The 2019 Percentage Method Tables For Income Tax Withholding on Android devices

People also ask

-

What are IRS tables for withholding?

IRS tables for withholding are guidelines issued by the Internal Revenue Service to help employers determine the amount of federal income tax to withhold from employees' paychecks. These tables vary based on factors such as filing status, income level, and the number of dependents claimed. Understanding how these tables work is essential for both employers and employees to ensure accurate tax withholding.

-

How can airSlate SignNow help with IRS tables withholding?

airSlate SignNow simplifies the process of managing IRS tables withholding by allowing businesses to easily send and eSign documents related to employee pay and tax information. With our platform, you can efficiently collect W-4 forms and other relevant documents while staying compliant with IRS regulations. This ensures that your employees have the correct withholding amounts applied to their paychecks.

-

What features does airSlate SignNow offer for handling IRS tables withholding?

AirSlate SignNow provides features such as customizable templates for tax forms, secure electronic signatures, and automated workflows to streamline document management. These functionalities make it easy to maintain accurate records and ensure that your IRS tables withholding is applied correctly. Additionally, our API integration allows for seamless connections with payroll systems.

-

Are there any costs associated with using airSlate SignNow for IRS tables withholding?

Yes, there are costs associated with using airSlate SignNow, which offers various pricing plans to fit different business needs. Each plan provides access to features that enable efficient handling of documents related to IRS tables withholding. It's important to evaluate the pricing structure to find the plan that best suits your organization's requirements.

-

Can airSlate SignNow integrate with payroll software for IRS tables withholding?

Absolutely! airSlate SignNow integrates seamlessly with a variety of payroll software solutions. This allows businesses to efficiently manage IRS tables withholding by automatically syncing employee data, ensuring that the correct withholding amounts are applied without manual errors.

-

How does airSlate SignNow ensure compliance with IRS guidelines for withholding?

AirSlate SignNow prioritizes compliance by providing tools that help you stay up-to-date with the latest IRS regulations and requirements relating to withholding. Our platform allows for easy updates to forms and documents according to IRS tables withholding, thus safeguarding your business against potential compliance issues.

-

Is there customer support available for questions about IRS tables withholding?

Yes, airSlate SignNow offers robust customer support to assist users with any queries related to IRS tables withholding. Our support team can help troubleshoot issues, provide guidance on using the platform effectively, and ensure you're making the most of our features for tax compliance.

Get more for Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding

- Rhode island fire safety welcome form

- Solved are packaging costs considered part of inventory costs form

- Daily accounting cycle form

- Seligers quick guide to developing federal grant budgets form

- Fbf project allowance form

- Procurement faqscounty of lexington form

- Accessible formnet visualfill gsa

- Labourer application form

Find out other Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors