Request to Reduce Tax Deductions at Source Government of 2019

Understanding the Request to Reduce Tax Deductions at Source

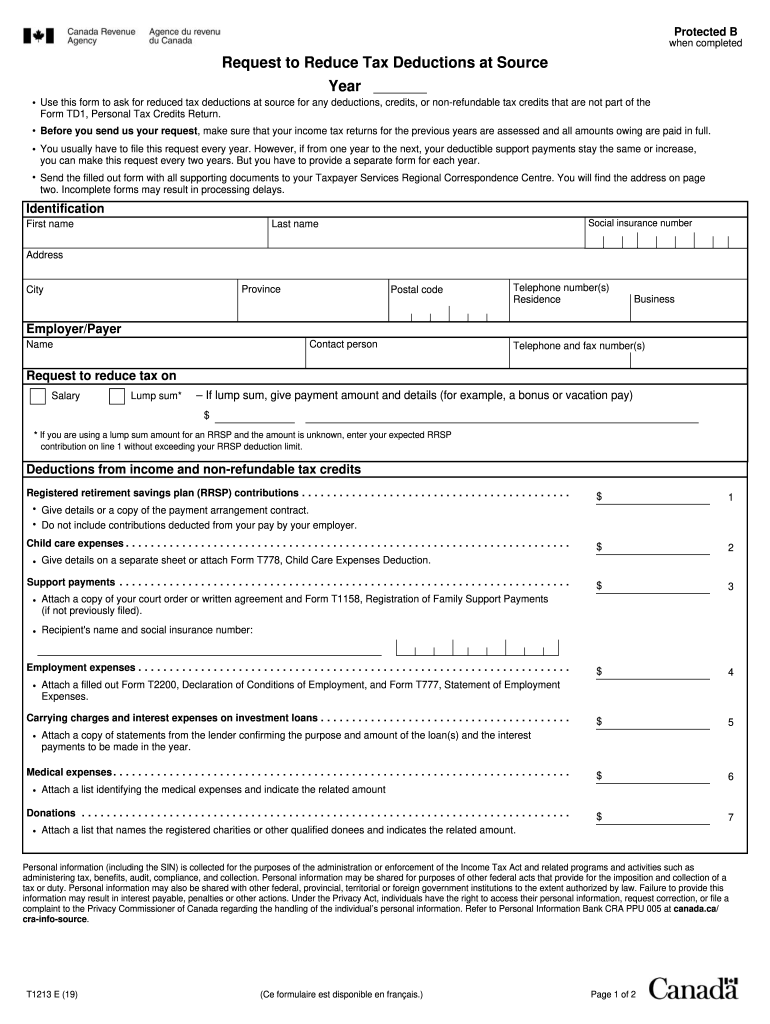

The Request to Reduce Tax Deductions at Source is a form issued by the Canada Revenue Agency (CRA) that allows individuals to request a reduction in the amount of tax withheld from their income. This form is particularly relevant for those who anticipate having lower taxable income or who have deductions that may not be fully taken into account through standard withholding. By submitting this request, taxpayers can manage their cash flow more effectively, ensuring that they do not overpay taxes throughout the year.

Steps to Complete the Request to Reduce Tax Deductions at Source

Completing the Request to Reduce Tax Deductions at Source involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and income details.

- Identify your expected deductions for the year, such as contributions to retirement accounts or other eligible expenses.

- Fill out the form accurately, ensuring that all sections are completed to avoid delays.

- Submit the form to your employer or the appropriate tax authority as specified in the instructions.

It is essential to keep a copy of the submitted form for your records and to monitor your pay stubs to ensure the correct withholding adjustments are made.

Eligibility Criteria for the Request to Reduce Tax Deductions at Source

To qualify for the Request to Reduce Tax Deductions at Source, individuals must meet certain criteria. Generally, you should:

- Be a resident of Canada for tax purposes.

- Have a reasonable expectation of lower income for the current tax year than in previous years.

- Be able to provide documentation supporting your claim for reduced deductions, such as proof of allowable deductions or credits.

Meeting these criteria ensures that your request is valid and increases the likelihood of approval.

Legal Use of the Request to Reduce Tax Deductions at Source

The Request to Reduce Tax Deductions at Source is legally recognized as a valid method for individuals to manage their tax withholdings. It complies with the regulations set forth by the CRA, provided that all information submitted is accurate and truthful. Misrepresentation or failure to meet eligibility requirements can lead to penalties or additional tax liabilities, so it is crucial to ensure that all claims are substantiated by appropriate documentation.

Required Documents for Submission

When submitting the Request to Reduce Tax Deductions at Source, certain documents may be required to support your application. These can include:

- Proof of income, such as pay stubs or tax returns from previous years.

- Documentation of eligible deductions, including receipts or statements for contributions to retirement accounts.

- Any other relevant financial documents that demonstrate your current tax situation.

Having these documents ready can streamline the process and help ensure that your request is processed efficiently.

Form Submission Methods

The Request to Reduce Tax Deductions at Source can typically be submitted through various methods, including:

- Online submission through the CRA's secure portal, if available.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, where applicable.

Choosing the right submission method can depend on your preferences and the urgency of your request.

Quick guide on how to complete request to reduce tax deductions at source government of

Complete Request To Reduce Tax Deductions At Source Government Of effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Request To Reduce Tax Deductions At Source Government Of on any device with airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to alter and eSign Request To Reduce Tax Deductions At Source Government Of with ease

- Obtain Request To Reduce Tax Deductions At Source Government Of and click on Acquire Form to get started.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Request To Reduce Tax Deductions At Source Government Of and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct request to reduce tax deductions at source government of

Create this form in 5 minutes!

How to create an eSignature for the request to reduce tax deductions at source government of

How to generate an eSignature for your Request To Reduce Tax Deductions At Source Government Of in the online mode

How to generate an electronic signature for your Request To Reduce Tax Deductions At Source Government Of in Chrome

How to make an eSignature for putting it on the Request To Reduce Tax Deductions At Source Government Of in Gmail

How to create an electronic signature for the Request To Reduce Tax Deductions At Source Government Of straight from your smart phone

How to make an eSignature for the Request To Reduce Tax Deductions At Source Government Of on iOS devices

How to generate an electronic signature for the Request To Reduce Tax Deductions At Source Government Of on Android

People also ask

-

How can airSlate SignNow help my business reduce tax source?

By utilizing airSlate SignNow, businesses can streamline their document management processes, which can lead to better organization and more efficient tax deductions. This efficiency allows you to reduce tax source by potentially lowering operational costs, as eSigning documents saves time and resources compared to traditional methods.

-

What are the pricing plans available with airSlate SignNow?

airSlate SignNow offers a variety of pricing plans designed to accommodate businesses of all sizes. These plans ensure that you find a cost-effective solution that helps to reduce tax source and optimize your document workflow. Explore monthly or annual subscription options to see what fits your budget.

-

What features does airSlate SignNow provide that can help reduce tax source?

airSlate SignNow includes features like customizable templates, audit trails, and secure cloud storage, all of which enhance your ability to manage documents efficiently. By reducing the time spent on paperwork, businesses can better focus on financial strategies that effectively reduce tax source.

-

How do integrations with other software impact my ability to reduce tax source?

Integrating airSlate SignNow with your existing software tools helps create a seamless workflow, reducing redundancies that can even unintentionally slip into tax calculations. This interconnectedness not only saves time but also supports your overall strategy to reduce tax source by keeping your documentation accurate and organized.

-

Is airSlate SignNow easy to use for teams looking to reduce tax source?

Yes, airSlate SignNow is designed with user-friendliness in mind, allowing teams to quickly adapt and start using the platform. This simplicity means that teams can efficiently handle document signatures and approvals, which in turn contributes to reducing tax source by minimizing errors in paperwork.

-

Can electronic signatures from airSlate SignNow help me avoid tax-related issues?

Utilizing electronic signatures from airSlate SignNow ensures that your documents are secure and legally compliant, helping to prevent tax-related issues caused by lost or improperly signed paperwork. By reducing tax source risks due to documentation errors, you can focus more on your business growth.

-

What benefits can I expect when I use airSlate SignNow for document management?

By switching to airSlate SignNow for document management, your business can expect faster turnaround times and improved tracking of documents, leading to substantial time savings. This efficiency ultimately supports your goal to reduce tax source by simplifying financial processes and minimizing delays.

Get more for Request To Reduce Tax Deductions At Source Government Of

- Personnel security specialist in bethesda md hjf careers form

- Gsa 6102 passing visit authorization letterrequest form

- Gsa internal directives m gsagov form

- Gsa 7437 art in architecture program national artist registry form

- Internal control audit tracking system icats access request form

- Government purchase card gpc program dau form

- Gsa form 7662 us bank travel card approval application

- Chapter 14 title 66 public utilities pa general assembly form

Find out other Request To Reduce Tax Deductions At Source Government Of

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself