T1213 Form 2020-2026

What is the T1213 Form

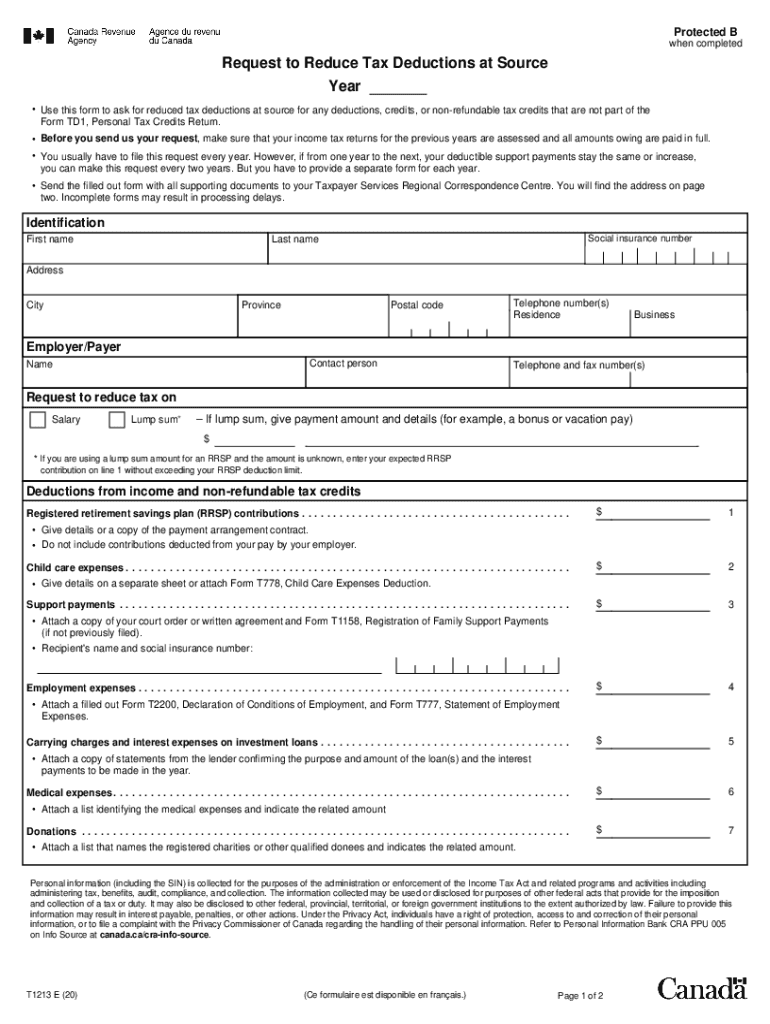

The T1213 form, also known as the CRA Form T1213, is a document used in Canada to request a reduction in tax deductions at source. This form is particularly relevant for individuals who expect to have significant deductions or credits that will reduce their overall tax liability. By submitting the T1213, taxpayers can ensure that they do not overpay taxes throughout the year, allowing them to manage their cash flow more effectively.

How to use the T1213 Form

Using the T1213 form involves several steps. First, individuals must gather the necessary information regarding their tax situation, including details about deductions and credits they plan to claim. Next, they should complete the form accurately, ensuring that all required fields are filled out. Once completed, the form can be submitted to the Canada Revenue Agency (CRA) for review. It is important to keep a copy of the submitted form for personal records.

Steps to complete the T1213 Form

Completing the T1213 form requires careful attention to detail. Here are the essential steps:

- Gather all necessary documentation related to your deductions and credits.

- Fill out your personal information, including your name, address, and social insurance number.

- Indicate the specific deductions you are claiming and provide any relevant details.

- Review the form for accuracy and completeness.

- Submit the form to the CRA through the designated method, either online or by mail.

Legal use of the T1213 Form

The T1213 form is legally recognized for reducing tax deductions at source in Canada. When properly completed and submitted, it serves as an official request to the CRA, allowing taxpayers to adjust their withholding tax based on their anticipated tax situation. Compliance with the CRA's guidelines ensures that the form is valid and can be used to support claims for reduced deductions.

Eligibility Criteria

To be eligible to use the T1213 form, individuals must meet specific criteria set by the CRA. This includes having a valid social insurance number and being able to demonstrate that they will have deductions or credits that justify a reduction in tax withholdings. Common scenarios include self-employed individuals, those with significant medical expenses, or individuals claiming various tax credits.

Form Submission Methods

The T1213 form can be submitted to the CRA through multiple methods. Taxpayers may choose to file the form online using the CRA’s secure portal, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed directly to the CRA's designated address. It is advisable to check the CRA's official guidelines for the most current submission methods and any specific requirements.

Quick guide on how to complete t1213 form 535276248

Easily Prepare T1213 Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle T1213 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign T1213 Form Effortlessly

- Obtain T1213 Form and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Select your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing fresh copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign T1213 Form to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1213 form 535276248

Create this form in 5 minutes!

How to create an eSignature for the t1213 form 535276248

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the t1213 Canada form and why is it important?

The t1213 Canada form is a tax-related document that allows you to request the Canada Revenue Agency to reduce the amount of tax withheld from your income. This form is essential for individuals who wish to manage their taxes more effectively and keep more of their earnings in hand throughout the year.

-

How can airSlate SignNow help me with the t1213 Canada form?

airSlate SignNow offers a user-friendly platform that streamlines the process of completing and eSigning the t1213 Canada form. With our solution, you can easily fill out, send, and store your document securely, ensuring you meet all deadlines without any hassle.

-

Is there a cost associated with using airSlate SignNow for the t1213 Canada form?

Yes, while airSlate SignNow provides a cost-effective solution, there are various pricing plans available based on your needs. All plans include features that can help you manage the t1213 Canada form efficiently while ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for managing the t1213 Canada form?

airSlate SignNow includes features such as an intuitive document editor, customizable templates, and secure eSigning capabilities. These tools make it easy to manage the t1213 Canada form and other important documents quickly and efficiently.

-

Can I integrate airSlate SignNow with other tools for the t1213 Canada form?

Absolutely! airSlate SignNow offers seamless integrations with several popular applications, allowing you to streamline your workflow. This means you can easily access your t1213 Canada form and other essential documents directly from your favorite tools.

-

How secure is my data when using airSlate SignNow for the t1213 Canada form?

Data security is a top priority at airSlate SignNow. We utilize advanced encryption methods and secure data storage solutions to ensure that your t1213 Canada form and any other sensitive information remain protected at all times.

-

Can multiple users collaborate on the t1213 Canada form using airSlate SignNow?

Yes, airSlate SignNow enables multiple users to collaborate on the t1213 Canada form efficiently. You can invite stakeholders to review and eSign the document, helping to ensure a smooth and effective completion process.

Get more for T1213 Form

Find out other T1213 Form

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament