Irs Form 3911 Printable 2018

What is the IRS Form 3911 Printable

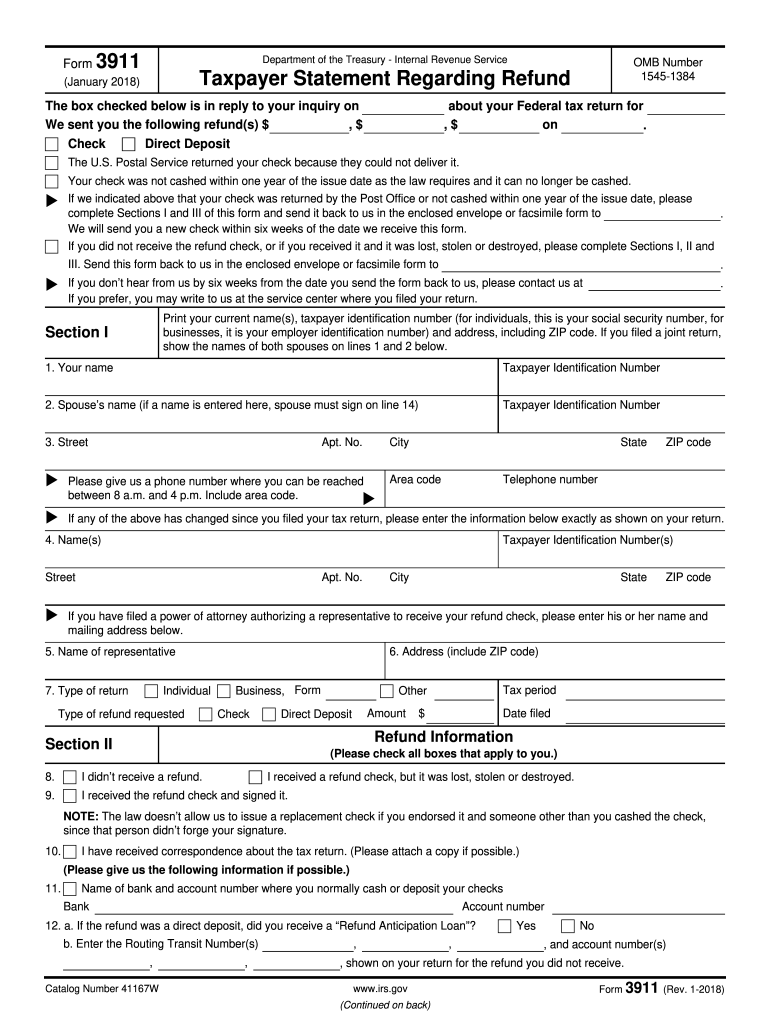

The IRS Form 3911, also known as the Taxpayer Statement Regarding Refund, is a document used by taxpayers in the United States to inquire about the status of a lost or missing tax refund check. This form serves as an official request to the IRS for assistance in locating the refund and is essential for taxpayers who have not received their expected refunds. The form is designed to capture important information, such as the taxpayer's identification details, the tax year in question, and the amount of the refund that is missing.

How to use the IRS Form 3911 Printable

Using the IRS Form 3911 is straightforward. Taxpayers need to fill out the form with accurate information regarding their identity and the details of the refund they are inquiring about. After completing the form, it should be submitted to the IRS for processing. It is important to ensure that all information is correct to avoid delays in the investigation of the missing refund. The form can be filled out electronically or printed for manual completion, allowing for flexibility in how it is submitted.

Steps to complete the IRS Form 3911 Printable

Completing the IRS Form 3911 involves several key steps:

- Download the form from the IRS website or access it through a digital platform.

- Enter your personal information, including your name, address, and Social Security number.

- Provide details about the tax year for which you are inquiring about the refund.

- Indicate the amount of the refund you are expecting.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the IRS, either online or by mailing it to the appropriate address.

Legal use of the IRS Form 3911 Printable

The IRS Form 3911 is legally recognized as a valid means for taxpayers to formally request information regarding their missing tax refunds. When completed correctly, it serves as a legal document that initiates the IRS's investigation into the status of the refund. It is crucial for taxpayers to understand that submitting this form does not guarantee immediate results; however, it is an essential step in resolving issues related to lost refund checks.

Key elements of the IRS Form 3911 Printable

Several key elements must be included in the IRS Form 3911 for it to be processed effectively:

- Taxpayer Information: Name, address, and Social Security number.

- Tax Year: The year for which the refund is being requested.

- Refund Amount: The expected amount of the refund that is missing.

- Signature: A signed declaration affirming the accuracy of the provided information.

Form Submission Methods

The IRS Form 3911 can be submitted through various methods, depending on the taxpayer's preference. It can be mailed directly to the IRS at the address specified in the form instructions. Alternatively, taxpayers may have the option to submit the form electronically through the IRS website, depending on the current IRS policies and available services. It is important to check the latest guidelines to ensure compliance with submission requirements.

Quick guide on how to complete irs form 3911 printable

Complete Irs Form 3911 Printable seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Irs Form 3911 Printable on any device with airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign Irs Form 3911 Printable effortlessly

- Locate Irs Form 3911 Printable and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you choose. Modify and electronically sign Irs Form 3911 Printable and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 3911 printable

Create this form in 5 minutes!

How to create an eSignature for the irs form 3911 printable

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the Irs Form 3911 Printable used for?

The Irs Form 3911 Printable is used to request a refund trace for your tax refund. If you haven't received your refund and need to track it, this form is essential. With airSlate SignNow, you can easily fill out and eSign the Irs Form 3911 Printable to expedite your request.

-

How can I obtain the Irs Form 3911 Printable through airSlate SignNow?

You can easily access the Irs Form 3911 Printable on the airSlate SignNow platform. Simply log in, search for the form, and start filling it out online. Our platform allows for seamless eSigning, making it quick and hassle-free to submit your requests.

-

Is there a cost associated with using airSlate SignNow for the Irs Form 3911 Printable?

airSlate SignNow offers a cost-effective solution for managing documents, including the Irs Form 3911 Printable. Pricing plans vary based on features and usage, but we ensure that our services remain budget-friendly for businesses of all sizes. Check our pricing page for more details.

-

Can I integrate airSlate SignNow with other applications for handling the Irs Form 3911 Printable?

Yes, airSlate SignNow provides integrations with various applications, making it easy to manage the Irs Form 3911 Printable alongside your existing workflows. Whether you use CRM systems or document management tools, our platform can seamlessly integrate to enhance your productivity.

-

What are the benefits of using airSlate SignNow for the Irs Form 3911 Printable?

Using airSlate SignNow for the Irs Form 3911 Printable streamlines the process of filling out and submitting your form. Our intuitive interface ensures that you can eSign and send documents quickly, reducing turnaround times and improving efficiency for your business.

-

Is it secure to eSign the Irs Form 3911 Printable with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and compliance, offering a secure environment for eSigning the Irs Form 3911 Printable. All documents are encrypted, ensuring that your sensitive information remains protected throughout the process.

-

Can I save my completed Irs Form 3911 Printable for future reference?

Yes, airSlate SignNow allows you to save your completed Irs Form 3911 Printable for future reference. You can easily access and download your signed documents anytime you need them, providing you with peace of mind and easy access to your important paperwork.

Get more for Irs Form 3911 Printable

Find out other Irs Form 3911 Printable

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later