About Form 3911, Taxpayer Statement Regarding Refund 2022-2026

What is IRS Form 3911?

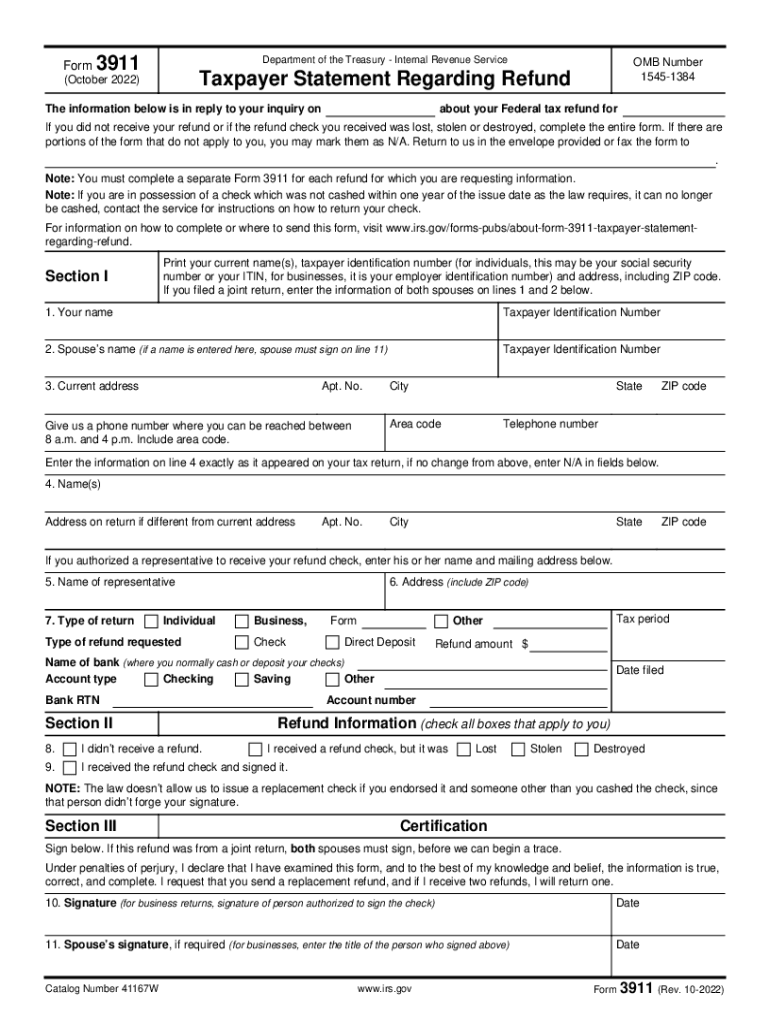

IRS Form 3911, officially titled the Taxpayer Statement Regarding Refund, is a form used by individuals to inquire about the status of their tax refund or to report a lost stimulus check. This form is particularly important for those who have not received their expected refund or stimulus payment and need to initiate a trace with the IRS. The form provides the IRS with necessary information to locate the missing funds and ensure that taxpayers receive what they are owed.

Steps to Complete IRS Form 3911

Completing IRS Form 3911 involves several key steps:

- Gather your information: Collect necessary details such as your Social Security number, filing status, and the exact amount of the refund or stimulus payment you are inquiring about.

- Fill out the form: Provide accurate information in the designated fields, ensuring that all entries are correct to avoid delays.

- Sign and date the form: Your signature is required to validate the request, confirming that the information provided is accurate.

- Submit the form: Choose your submission method, whether online, by mail, or in person, depending on your preference and circumstances.

How to Obtain IRS Form 3911

IRS Form 3911 can be easily obtained through various channels. You can download the form directly from the official IRS website or request a physical copy by contacting the IRS. Additionally, many tax preparation software programs include the form as part of their offerings, allowing for easy access and completion.

Legal Use of IRS Form 3911

IRS Form 3911 is legally recognized as a formal request to trace a missing refund or stimulus payment. When completed and submitted correctly, it serves as a binding document that allows the IRS to investigate the status of your funds. It is important to ensure that the form is filled out accurately to maintain its legal validity and to comply with IRS regulations.

Filing Deadlines for IRS Form 3911

While there is no specific deadline for submitting Form 3911, it is advisable to file it as soon as you realize that your refund or stimulus payment is missing. The sooner you submit the form, the quicker the IRS can begin processing your request and work towards resolving the issue. Keep in mind that delays in submission may prolong the time it takes to receive your funds.

Form Submission Methods

IRS Form 3911 can be submitted through several methods:

- Online: If you are using tax software, you may have the option to submit the form electronically.

- By Mail: Print the completed form and send it to the appropriate IRS address, which can be found on the form's instructions.

- In Person: You can also visit a local IRS office to submit the form directly, though it is recommended to make an appointment beforehand.

Quick guide on how to complete about form 3911 taxpayer statement regarding refund

Complete About Form 3911, Taxpayer Statement Regarding Refund effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage About Form 3911, Taxpayer Statement Regarding Refund on any device utilizing airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign About Form 3911, Taxpayer Statement Regarding Refund seamlessly

- Obtain About Form 3911, Taxpayer Statement Regarding Refund and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow attends to your document management requirements in just a few clicks from any device you prefer. Modify and eSign About Form 3911, Taxpayer Statement Regarding Refund to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 3911 taxpayer statement regarding refund

Create this form in 5 minutes!

People also ask

-

How can I file for missing stimulus payments using airSlate SignNow?

To file for missing stimulus payments with airSlate SignNow, simply prepare your required documents and send them for eSignature through our platform. With intuitive tools and templates, you can streamline the process effectively. Our solution allows you to collect signatures quickly, ensuring your application signNowes the right authorities without delay.

-

What are the costs associated with filing for missing stimulus through airSlate SignNow?

airSlate SignNow offers a cost-effective solution for businesses looking to file for missing stimulus payments. Our pricing plans are designed to provide value while ensuring you have access to essential features without unnecessary expenses. We offer a range of options, making it easy to choose a plan that fits your budget and document volume.

-

Does airSlate SignNow provide templates for filing for missing stimulus?

Yes, airSlate SignNow provides customizable templates specifically designed for filing for missing stimulus payments. These templates help expedite the preparation process and ensure that all necessary information is included. You can easily modify them to reflect your specific circumstances, making it simple to meet your requirements.

-

What features does airSlate SignNow offer that help in filing for missing stimulus?

airSlate SignNow includes features that are particularly useful when you need to file for missing stimulus payments. These features include eSignature collection, document tracking, and secure cloud storage. By using these tools, you can manage your documents efficiently and ensure a smooth filing process.

-

Can I integrate airSlate SignNow with other applications while filing for missing stimulus?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow when filing for missing stimulus payments. This means you can connect with your existing tools, like CRM systems or cloud storage solutions, ensuring a smoother document management process.

-

Is airSlate SignNow secure for filing sensitive documents like missing stimulus applications?

Yes, security is a top priority at airSlate SignNow. When you file for missing stimulus applications, your documents are protected with industry-standard encryption and secure access protocols. This guarantees that your sensitive information remains confidential and safe from unauthorized access during the eSigning process.

-

What are the benefits of using airSlate SignNow for filing for missing stimulus?

Using airSlate SignNow to file for missing stimulus payments offers several key benefits. You gain quick eSignature capabilities, easy document sharing, and efficient tracking of your application status. Our user-friendly platform saves time and reduces frustration, making the filing process much more manageable.

Get more for About Form 3911, Taxpayer Statement Regarding Refund

- Oh tenant form

- Letter landlord rent template 497322285 form

- Oh landlord notice 497322286 form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase ohio form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant ohio form

- Letter tenant notice rent 497322289 form

- Oh tenant landlord notice form

- Temporary lease agreement to prospective buyer of residence prior to closing ohio form

Find out other About Form 3911, Taxpayer Statement Regarding Refund

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself