Form W 9 2014

What is the Form W-9

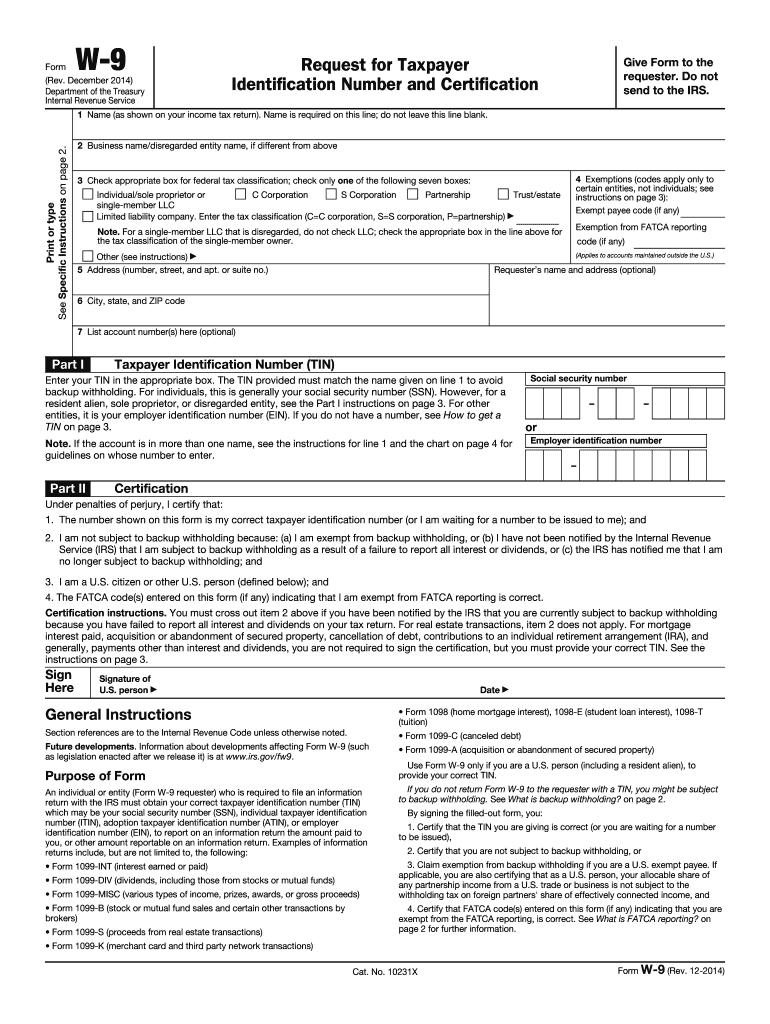

The Form W-9 is a document used in the United States by individuals and entities to provide their taxpayer identification information to others. This form is primarily utilized by businesses to request the correct name and Taxpayer Identification Number (TIN) of individuals or entities they pay. Completing the W-9 accurately is essential for tax reporting purposes, as it helps ensure that the IRS receives the correct information regarding payments made to independent contractors, freelancers, and other non-employees.

How to Use the Form W-9

The Form W-9 is typically used by businesses when they need to gather information from contractors or freelancers for tax reporting. When a business hires an independent contractor, it requires them to fill out the W-9 to obtain their TIN. Once completed, the form is returned to the business, which will use the information to report payments made to the contractor on Form 1099 at the end of the tax year. It is important to keep the W-9 on file for record-keeping and compliance with IRS regulations.

Steps to Complete the Form W-9

Completing the Form W-9 involves several straightforward steps:

- Provide Your Name: Enter your full name as it appears on your tax return.

- Business Name (if applicable): If you operate under a business name, include it here.

- Check the Appropriate Box: Indicate your tax classification, such as individual, corporation, or partnership.

- Enter Your Address: Provide your complete mailing address.

- Taxpayer Identification Number: Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

- Signature and Date: Sign and date the form to certify that the information provided is accurate.

Legal Use of the Form W-9

The Form W-9 is legally binding when filled out correctly and signed. It serves as a declaration of the taxpayer's identification number and ensures that the information is accurate for tax purposes. Businesses must keep the W-9 on file for at least four years after the tax year in which the payments were made. Failure to provide accurate information can lead to penalties and complications with the IRS.

IRS Guidelines

The IRS provides specific guidelines for the use of the Form W-9. It is crucial to ensure that the information is current and accurate. The IRS may request a copy of the W-9 during audits or reviews, and any discrepancies could lead to issues with tax reporting. Additionally, the IRS recommends that businesses verify the TIN provided on the W-9 against their records to prevent errors in tax filings.

Form Submission Methods

The Form W-9 can be submitted in various ways, depending on the preferences of the requesting party. Common submission methods include:

- Electronic Submission: Many businesses accept W-9 forms submitted electronically, allowing for quicker processing.

- Mail: The completed form can be printed and mailed directly to the requesting business.

- In-Person: In some cases, individuals may need to submit the form in person, especially for local businesses.

Quick guide on how to complete form w 9 2014

Easily Prepare Form W 9 on Any Device

Digital document management has become a favored option for businesses and individuals alike. It offers a sustainable alternative to conventional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow provides all the resources required to generate, modify, and electronically sign your documents efficiently without delays. Manage Form W 9 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Form W 9 with Ease

- Obtain Form W 9 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all details and select the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Form W 9 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 9 2014

Create this form in 5 minutes!

How to create an eSignature for the form w 9 2014

How to generate an electronic signature for your Form W 9 2014 in the online mode

How to generate an eSignature for the Form W 9 2014 in Google Chrome

How to create an eSignature for putting it on the Form W 9 2014 in Gmail

How to generate an electronic signature for the Form W 9 2014 from your smartphone

How to generate an electronic signature for the Form W 9 2014 on iOS devices

How to create an eSignature for the Form W 9 2014 on Android

People also ask

-

What is a Form W 9 and why do I need it?

A Form W 9 is a tax form used in the United States to provide your taxpayer identification number (TIN) to entities that need to report income paid to you. It's essential for freelancers, contractors, and vendors to submit a completed Form W 9 to ensure accurate tax reporting. Using airSlate SignNow makes it easy to fill out and eSign your Form W 9 securely.

-

How can I complete a Form W 9 using airSlate SignNow?

To complete a Form W 9 using airSlate SignNow, simply upload your form to our platform, fill in the required fields, and add your electronic signature. Our user-friendly interface allows you to complete the Form W 9 quickly and efficiently. Plus, you can send it directly to the requester without the hassle of printing or mailing.

-

Is there a cost to use airSlate SignNow for filling out a Form W 9?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs. However, the cost is often outweighed by the time saved and the convenience of electronically signing and managing your Form W 9. Check our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow offer for managing Form W 9 submissions?

airSlate SignNow provides several features for managing Form W 9 submissions, including secure electronic signatures, document tracking, and the ability to store completed forms in the cloud. You can also set reminders for follow-ups and send forms to multiple recipients at once, streamlining your document management process.

-

Can I integrate airSlate SignNow with other applications to manage my Form W 9?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Dropbox. This allows you to manage your Form W 9 alongside your other documents and workflows, enhancing productivity and ensuring all business processes are interconnected.

-

How secure is the electronic signing of a Form W 9 with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform uses industry-leading encryption to protect your data and ensure that your electronic signature on a Form W 9 is legally binding. You can trust that your sensitive information is safe when you use our services.

-

What are the benefits of using airSlate SignNow for my business's Form W 9 needs?

Using airSlate SignNow for your Form W 9 needs offers several benefits, including speed, convenience, and enhanced security. You can quickly fill out and eSign forms without the delays of traditional methods, and our platform keeps all documents organized and accessible at any time.

Get more for Form W 9

Find out other Form W 9

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors