CASH and NON CASH DONATIONS IRS REQUIREMENTS for 2020-2026

Understanding IRS Requirements for Cash and Non-Cash Donations

The IRS outlines specific requirements for cash and non-cash donations to ensure that taxpayers can claim these contributions on their tax returns. Cash donations include monetary gifts made to qualified organizations, while non-cash donations involve tangible items such as clothing, furniture, or vehicles. To qualify for a tax deduction, these donations must be made to a registered 501(c)(3) organization. It is essential to keep records of all donations, including receipts and acknowledgment letters from the charities, to substantiate claims during tax filing.

Steps to Complete IRS Requirements for Cash and Non-Cash Donations

Completing the IRS requirements for cash and non-cash donations involves several steps:

- Determine Eligibility: Ensure the organization you are donating to is a qualified charity recognized by the IRS.

- Document Donations: For cash donations, keep bank records or receipts. For non-cash donations, obtain a written acknowledgment from the charity, especially for items valued over $250.

- Value Your Donations: For non-cash items, use a reliable valuation guide to determine fair market value. The IRS provides guidelines on how to assess the value of donated goods.

- Complete Form 8283: If your non-cash donations exceed $500, complete Form 8283, which details the items donated and their values.

- File Your Tax Return: Include your cash and non-cash donations on your tax return, ensuring all documentation is attached or available for review.

Key Elements of IRS Guidelines for Donations

Understanding the key elements of IRS guidelines for donations is crucial for compliance:

- Qualified Organizations: Donations must be made to organizations that are classified as tax-exempt under section 501(c)(3).

- Documentation: Keep detailed records of all donations, including dates, amounts, and descriptions of non-cash items.

- Valuation: Non-cash donations must be valued at fair market value, and appraisals may be required for high-value items.

- Limitations: Be aware of the percentage limits on deductions based on your adjusted gross income (AGI) and the type of donation.

Required Documents for Claiming Donations

When claiming cash and non-cash donations, certain documents are required:

- Receipts: For cash donations, a receipt from the charity is necessary, especially for contributions over $250.

- Acknowledgment Letters: Non-cash donations should be supported by acknowledgment letters from the charity, detailing the items donated.

- Form 8283: Required for non-cash donations exceeding $500, this form provides a detailed account of the donated items.

- Valuation Documentation: For non-cash donations valued over $5,000, an independent appraisal may be needed.

Filing Deadlines for Donation Claims

Understanding the filing deadlines is essential to ensure your donation claims are processed correctly:

- Tax Return Deadline: Typically, individual tax returns are due on April 15 each year, unless extended.

- Form 8283 Submission: This form should be submitted along with your tax return if applicable, adhering to the same deadline.

- Extension Requests: If you need more time to gather documentation, consider filing for an extension, which allows additional time to submit your return.

Examples of Cash and Non-Cash Donations

Examples of donations that qualify under IRS guidelines include:

- Cash Donations: Monetary contributions to local charities, religious organizations, or educational institutions.

- Non-Cash Donations: Donating clothing to a thrift store, furniture to a shelter, or vehicles to a nonprofit organization.

- Special Cases: Donating stock or other securities, which may have specific tax implications and require additional documentation.

Quick guide on how to complete cash and non cash donations irs requirements for

Effortlessly Prepare CASH AND NON CASH DONATIONS IRS REQUIREMENTS FOR on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can access the necessary template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Manage CASH AND NON CASH DONATIONS IRS REQUIREMENTS FOR on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign CASH AND NON CASH DONATIONS IRS REQUIREMENTS FOR with Ease

- Locate CASH AND NON CASH DONATIONS IRS REQUIREMENTS FOR and click Get Form to begin.

- Use the features we provide to complete your form.

- Mark important parts of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to preserve your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Alter and electronically sign CASH AND NON CASH DONATIONS IRS REQUIREMENTS FOR to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cash and non cash donations irs requirements for

Create this form in 5 minutes!

How to create an eSignature for the cash and non cash donations irs requirements for

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

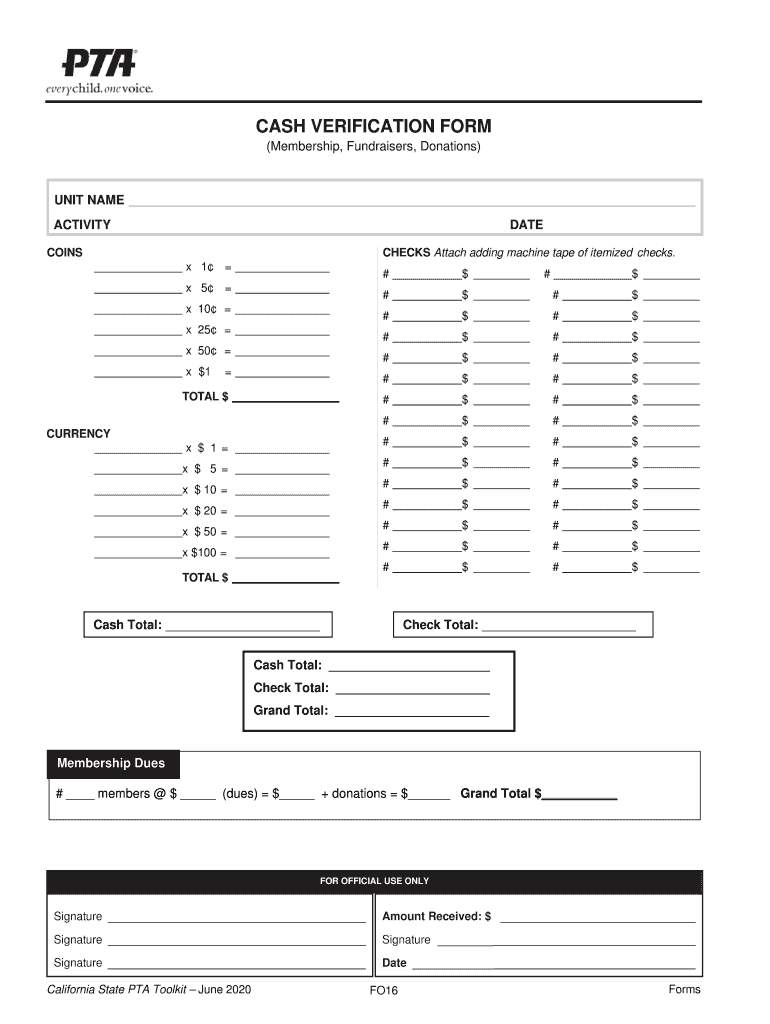

What is a PTA cash form?

A PTA cash form is a document used by Parent-Teacher Associations to manage cash handling, including receipts and expenditures. It simplifies financial tracking and accountability, making it easier for PTA members to maintain transparency in their finances. Using airSlate SignNow, you can easily create and manage PTA cash forms electronically.

-

How can airSlate SignNow help with PTA cash forms?

airSlate SignNow offers an intuitive platform for creating and eSigning PTA cash forms quickly and efficiently. With customizable templates, you can ensure that your forms meet your PTA's specific needs. This automation saves time and enhances accuracy in your cash management processes.

-

Is airSlate SignNow cost-effective for managing PTA cash forms?

Yes, airSlate SignNow is a cost-effective solution for managing PTA cash forms. Its pricing plans cater to various budgets, allowing PTAs to choose a plan that fits their needs. With features that streamline document management, the platform offers signNow savings in both time and resources.

-

What features does airSlate SignNow provide for PTA cash forms?

airSlate SignNow includes features such as eSignatures, customizable templates, and document tracking that make managing PTA cash forms straightforward. The user-friendly interface facilitates quick access and collaboration among PTA members. Additionally, you can store all transactions securely and access them from anywhere.

-

Can I integrate airSlate SignNow with other tools for PTA cash forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications and tools, allowing you to optimize your PTA cash form workflows. You can connect with platforms such as Google Drive, Dropbox, and more, ensuring that you have a cohesive ecosystem for managing your documents and cash tracking.

-

How secure is the information on PTA cash forms in airSlate SignNow?

Security is a top priority for airSlate SignNow. All PTA cash forms are protected with bank-level encryption, ensuring that sensitive information remains confidential. With audit trails and secure storage, you can rest assured that your PTA's financial data is protected.

-

Can I access PTA cash forms on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage your PTA cash forms from any device. Whether you're at a meeting or on the go, you can easily send, sign, and receive documents. This flexibility ensures that PTA members can stay engaged and informed wherever they are.

Get more for CASH AND NON CASH DONATIONS IRS REQUIREMENTS FOR

Find out other CASH AND NON CASH DONATIONS IRS REQUIREMENTS FOR

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer