Tax Court Petition Form 2003

What is the Tax Court Petition Form

The Tax Court Petition Form is a legal document that taxpayers use to formally challenge decisions made by the Internal Revenue Service (IRS) regarding their tax liabilities. This form initiates proceedings in the United States Tax Court, allowing individuals or businesses to dispute tax deficiencies, penalties, or other IRS determinations. It is essential for taxpayers seeking to resolve disputes without resorting to paying the disputed tax amount upfront. Understanding the purpose and function of this form is crucial for anyone considering a legal challenge against the IRS.

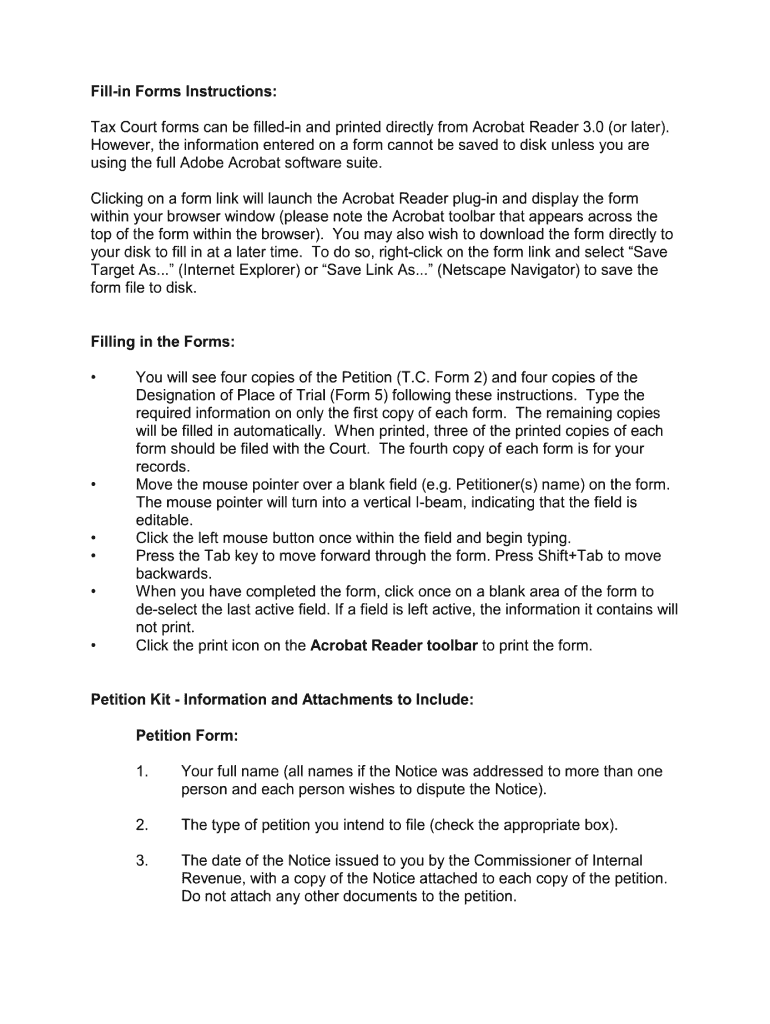

How to use the Tax Court Petition Form

Using the Tax Court Petition Form involves several steps to ensure that the petition is filed correctly and in compliance with legal requirements. First, taxpayers must gather all relevant documentation related to their case, including IRS notices and correspondence. Next, the form must be filled out accurately, providing detailed information about the taxpayer, the tax year in question, and the specific issues being contested. Once completed, the form should be signed and dated. Finally, it must be submitted to the Tax Court, either by mail or electronically, depending on the court's guidelines.

Steps to complete the Tax Court Petition Form

Completing the Tax Court Petition Form requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including IRS notices and any supporting evidence.

- Download the Tax Court Petition Form from the official Tax Court website or obtain a physical copy.

- Fill out the form, ensuring all sections are completed accurately, including taxpayer information and details of the dispute.

- Review the form for any errors or omissions before signing.

- Submit the form to the Tax Court within the required timeframe, ensuring it is sent to the correct address.

Key elements of the Tax Court Petition Form

The Tax Court Petition Form includes several key elements that must be addressed for the petition to be valid. These elements typically include:

- Petitioner's Information: Name, address, and taxpayer identification number.

- IRS Information: Details about the IRS notice being contested, including the date and type of notice.

- Statement of Facts: A clear and concise explanation of the dispute and the taxpayer's position.

- Relief Sought: A description of what the taxpayer is requesting from the court.

Legal use of the Tax Court Petition Form

The legal use of the Tax Court Petition Form is governed by specific rules and regulations. It serves as a formal request for the Tax Court to review and adjudicate disputes between taxpayers and the IRS. To be legally binding, the form must be filed within a prescribed timeframe, typically within ninety days of receiving a notice of deficiency from the IRS. Proper filing ensures that taxpayers retain their rights to challenge IRS decisions and seek judicial relief.

Filing Deadlines / Important Dates

Timeliness is crucial when filing the Tax Court Petition Form. The general deadline for filing a petition is ninety days from the date of the IRS notice of deficiency. Missing this deadline can result in the loss of the right to contest the IRS's determination. It is advisable for taxpayers to mark their calendars and ensure that all forms are submitted well before the deadline to avoid complications.

Quick guide on how to complete tax court petition form 2003

Effortlessly Prepare Tax Court Petition Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without any delays. Handle Tax Court Petition Form on any platform with the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The easiest method to modify and electronically sign Tax Court Petition Form with ease

- Find Tax Court Petition Form and click on Get Form to begin.

- Utilize the resources we provide to fill out your form.

- Mark important sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or wrongly placed documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tax Court Petition Form to ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax court petition form 2003

Create this form in 5 minutes!

How to create an eSignature for the tax court petition form 2003

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is a Tax Court Petition Form?

A Tax Court Petition Form is a legal document that taxpayers file with the U.S. Tax Court to dispute a decision made by the Internal Revenue Service (IRS). This form outlines the taxpayer's case and serves as the basis for the litigation process. Using airSlate SignNow, you can easily create, sign, and submit your Tax Court Petition Form digitally.

-

How can I create a Tax Court Petition Form using airSlate SignNow?

To create a Tax Court Petition Form with airSlate SignNow, simply select a template or start from scratch using our user-friendly document editor. You can customize the form as needed and add fields for signatures and dates. Once completed, you can eSign directly within the platform, saving time and ensuring compliance.

-

What features does airSlate SignNow offer for managing Tax Court Petition Forms?

airSlate SignNow provides a range of features tailored for managing Tax Court Petition Forms, including eSignature capabilities, document templates, and workflow automation. You can track the progress of your petition, set reminders for important deadlines, and securely store all documents in one place. This streamlines the entire process and enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for Tax Court Petition Forms?

Yes, airSlate SignNow offers flexible pricing plans based on your needs. We have a free trial available, which allows you to explore our features before committing. For ongoing use, choose a plan that fits your budget, ensuring you can create and manage your Tax Court Petition Forms cost-effectively.

-

Can I integrate airSlate SignNow with other software for my Tax Court Petition Forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including Google Drive, Dropbox, and Microsoft Office. This allows you to pull in documents directly from your preferred services and easily manage your Tax Court Petition Forms. Integrations help maintain workflow efficiency and enhance collaboration.

-

What are the benefits of using airSlate SignNow for Tax Court Petition Forms?

Using airSlate SignNow for Tax Court Petition Forms streamlines the signing and filing process, making it quick and efficient. You eliminate the hassle of printing and mailing documents, reducing turnaround time. Additionally, our platform provides secure storage and easy access to all your legal documents whenever you need them.

-

Is airSlate SignNow compliant with legal standards for Tax Court Petition Forms?

Yes, airSlate SignNow complies with all necessary legal standards for eSignatures and document management. Our platform adheres to the ESIGN Act and UETA guidelines, ensuring that your Tax Court Petition Forms are legally binding and secure. This compliance provides peace of mind, knowing your documents are handled with integrity.

Get more for Tax Court Petition Form

- Epsdt pcs form 90 revised 11 1 10

- Non contagious c form

- Instructions for fax cover sheet when you complete this form please

- Individual insurance coverage termination form individual insurance coverage termination form

- Save a copy of a workbook to your computer excel form

- Sugar testing log form

- 4560 g form

- Samples form

Find out other Tax Court Petition Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document