Nys 1 Instructions Form

What is the Nys 1 Instructions

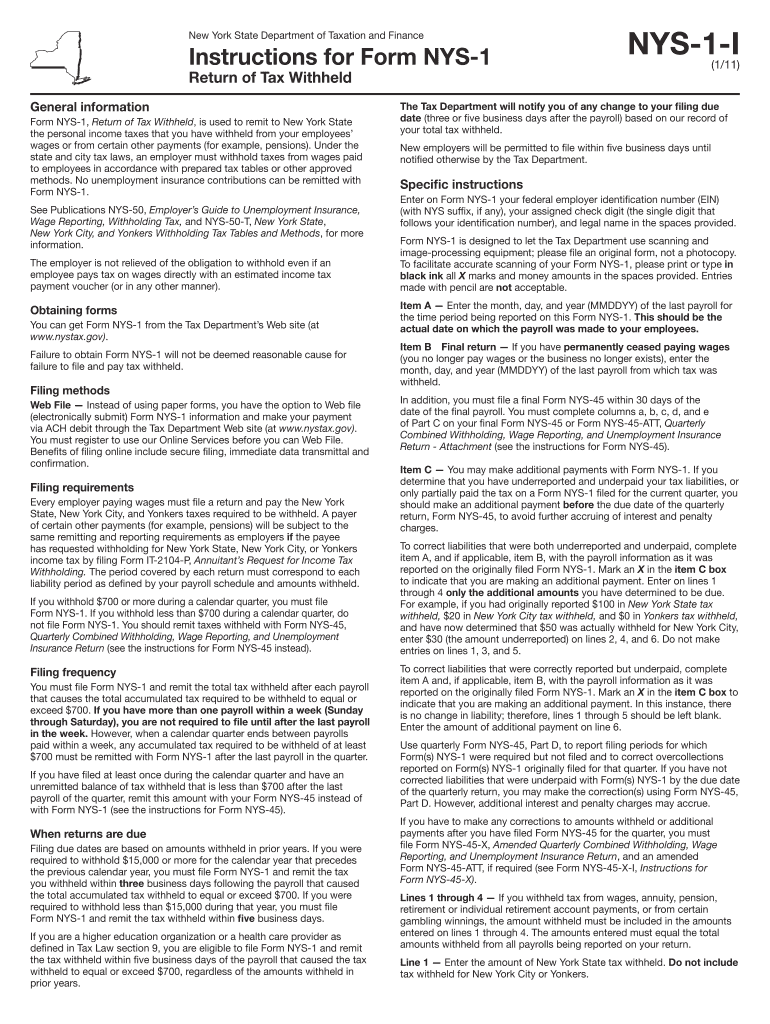

The Nys 1 form is a critical document for businesses operating in New York State, specifically designed for reporting and remitting state income tax withheld from employees. The Nys 1 instructions provide detailed guidance on how to accurately complete this form, ensuring compliance with state tax regulations. Understanding these instructions is essential for businesses to avoid penalties and ensure timely submissions.

Steps to Complete the Nys 1 Instructions

Completing the Nys 1 form involves several key steps:

- Gather necessary information, including your business's Employer Identification Number (EIN) and details of employees.

- Access the Nys 1 form PDF from a reliable source, ensuring you have the most current version.

- Follow the instructions carefully, filling in all required fields accurately.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Legal Use of the Nys 1 Instructions

The Nys 1 instructions are legally binding and must be adhered to for the form to be considered valid. Compliance with these instructions ensures that businesses meet their tax obligations under New York State law. Failure to follow the guidelines can result in penalties, interest on unpaid taxes, and potential legal issues.

Key Elements of the Nys 1 Instructions

Several key elements are essential for completing the Nys 1 form accurately:

- Employer Identification Number (EIN): This unique number identifies your business for tax purposes.

- Employee Information: Accurate details about employees, including names and Social Security numbers, are necessary.

- Tax Withholding Amounts: Report the correct amounts withheld from employee wages to ensure proper tax remittance.

- Submission Method: Choose the appropriate method for submitting the form based on your business needs.

Form Submission Methods

Businesses have several options for submitting the Nys 1 form:

- Online Submission: Many businesses prefer to file electronically for convenience and speed.

- Mail: The form can be printed and mailed to the appropriate tax authority.

- In-Person Submission: Some businesses may choose to deliver the form directly to a local tax office.

Filing Deadlines / Important Dates

Timely filing of the Nys 1 form is crucial. Businesses should be aware of the following important dates:

- Quarterly Filing Deadlines: The Nys 1 form is typically due quarterly, with specific deadlines for each quarter.

- Annual Reconciliation: An annual reconciliation may also be required, depending on the business structure and employee count.

Quick guide on how to complete nys 1 instructions form

Complete Nys 1 Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Handle Nys 1 Instructions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Nys 1 Instructions without effort

- Obtain Nys 1 Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Nys 1 Instructions and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

Create this form in 5 minutes!

How to create an eSignature for the nys 1 instructions form

How to make an eSignature for your Nys 1 Instructions Form online

How to make an electronic signature for the Nys 1 Instructions Form in Chrome

How to create an eSignature for signing the Nys 1 Instructions Form in Gmail

How to generate an electronic signature for the Nys 1 Instructions Form right from your mobile device

How to create an electronic signature for the Nys 1 Instructions Form on iOS devices

How to make an eSignature for the Nys 1 Instructions Form on Android OS

People also ask

-

What are the Nys 1 Instructions for using airSlate SignNow?

The Nys 1 Instructions provide detailed guidance on how to properly complete and submit the Nys 1 form using airSlate SignNow. This includes step-by-step directions on filling out the document, signing it electronically, and submitting it securely. With airSlate SignNow, you can easily follow these instructions to ensure compliance and accuracy.

-

How can airSlate SignNow help with Nys 1 Instructions?

airSlate SignNow simplifies the process of adhering to Nys 1 Instructions by offering an intuitive interface for document management. Users can easily upload their Nys 1 forms, fill them out, and eSign them all in one platform. This streamlines the compliance process and reduces the risk of errors.

-

Is there a cost associated with following Nys 1 Instructions on airSlate SignNow?

While airSlate SignNow offers various pricing plans, following the Nys 1 Instructions itself does not incur additional costs. Users can choose a plan that fits their business needs and utilize the platform’s features to manage their Nys 1 forms effectively. Explore our pricing options to find the best fit for you.

-

What features support Nys 1 Instructions on airSlate SignNow?

airSlate SignNow includes several features that facilitate adherence to Nys 1 Instructions, such as template creation, electronic signatures, and real-time tracking. These tools allow users to easily customize their forms and ensure they meet all requirements outlined in the Nys 1 Instructions. Additionally, the platform supports document storage for future reference.

-

Are there integrations available for managing Nys 1 Instructions?

Yes, airSlate SignNow offers integrations with various applications to enhance the management of Nys 1 Instructions. You can connect with popular tools like Google Drive, Salesforce, and Microsoft Office to streamline your workflow. This integration capability ensures that you can access your documents and maintain compliance with Nys 1 Instructions effortlessly.

-

Can I use airSlate SignNow on mobile devices for Nys 1 Instructions?

Absolutely! airSlate SignNow is fully optimized for mobile use, allowing you to follow Nys 1 Instructions on-the-go. Whether you’re using a smartphone or tablet, you can upload documents, fill them out, and eSign directly from your device, ensuring that you never miss a deadline.

-

What are the benefits of using airSlate SignNow for Nys 1 Instructions?

Using airSlate SignNow for Nys 1 Instructions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround and ensures that your submissions are compliant with state regulations. Embracing digital solutions like airSlate SignNow will help your business save time and resources.

Get more for Nys 1 Instructions

- Computer employee professional exemption checklist form

- Creative professional exemption checklist form

- Executive exemption checklist form

- Factor evaluation system position evaluation summary form

- Administrative exemption checklist form

- Coates canons blog salaried employees and the flsa form

- Application to qualify for the foreign exemption employees must spend all form

- Administrative analysis grade evaluation guide opm form

Find out other Nys 1 Instructions

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter