Va Form R 1 2015

What is the Va Form R 1

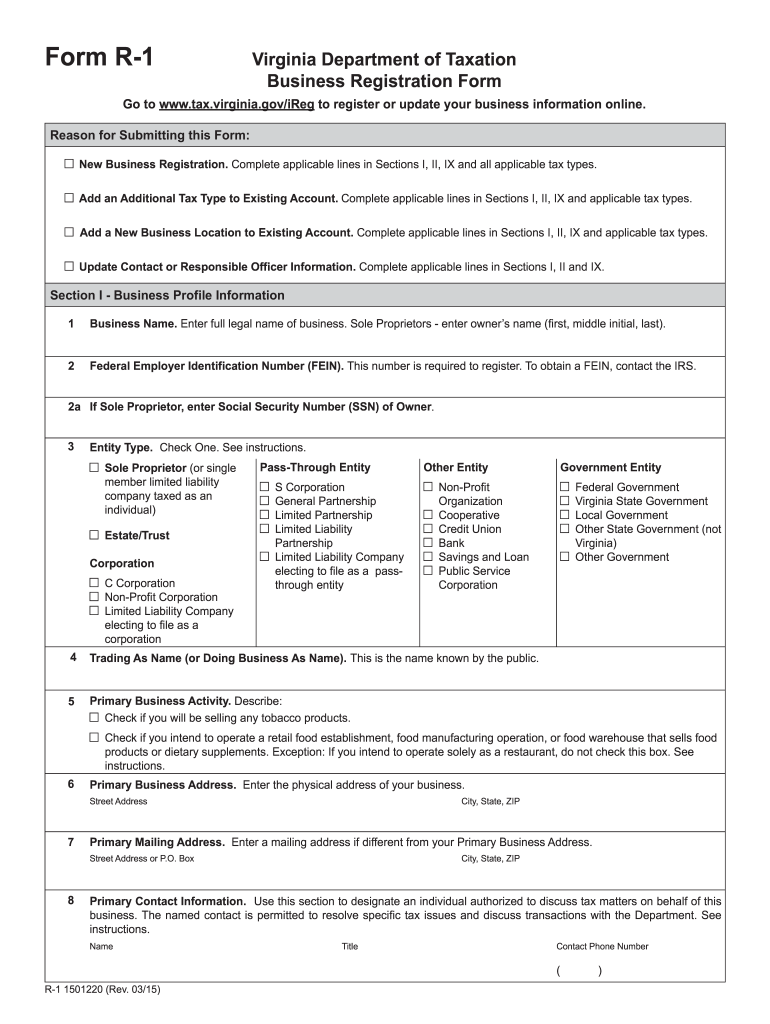

The Va Form R 1 is a specific document used by veterans to apply for various benefits and services offered by the Department of Veterans Affairs (VA). This form is essential for veterans seeking to access healthcare, disability compensation, or other VA services. It serves as a formal request that provides the VA with necessary information about the applicant's military service, personal details, and the benefits being requested. Understanding the purpose and requirements of this form is crucial for veterans to ensure their applications are processed efficiently.

How to use the Va Form R 1

Using the Va Form R 1 involves several steps to ensure that all required information is accurately provided. First, gather all necessary documentation, including military service records and personal identification. Next, fill out the form carefully, ensuring that each section is completed with accurate and up-to-date information. Once the form is completed, it can be submitted either online through the VA's website or by mailing it to the appropriate VA office. It is important to keep a copy of the completed form for your records and to track the submission status if filed online.

Steps to complete the Va Form R 1

Completing the Va Form R 1 requires careful attention to detail. Follow these steps for a successful submission:

- Review the form instructions to understand the requirements.

- Gather necessary documents, such as your DD-214 and any relevant medical records.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about your military service, including dates of service and branch.

- Clearly indicate the benefits you are applying for and any supporting information.

- Review the completed form for accuracy and completeness.

- Submit the form online or by mail, depending on your preference.

Legal use of the Va Form R 1

The Va Form R 1 is legally recognized as a valid document for veterans seeking benefits from the VA. It must be filled out accurately to comply with federal regulations. Misrepresentation or incomplete information can lead to delays or denials of benefits. Therefore, it is essential to ensure that all information provided is truthful and supported by documentation where required. The form is designed to protect the rights of veterans while facilitating access to necessary services.

Key elements of the Va Form R 1

Several key elements are essential to the Va Form R 1. These include:

- Personal Information: Name, address, and Social Security number.

- Military Service Details: Branch of service, dates of service, and discharge status.

- Benefit Request: Specific benefits being applied for, such as healthcare or disability compensation.

- Supporting Documentation: Required documents that substantiate the claims made in the application.

Form Submission Methods (Online / Mail / In-Person)

The Va Form R 1 can be submitted through various methods, offering flexibility to applicants. The online submission process is often the fastest option, allowing veterans to fill out and submit the form directly through the VA's secure website. Alternatively, the form can be printed, filled out manually, and mailed to the appropriate VA office. In-person submissions may also be possible at local VA offices, providing another avenue for veterans to ensure their applications are received and processed. Each method has its advantages, and veterans should choose the one that best suits their needs.

Quick guide on how to complete va form r 1 2015

Your assistance manual on how to prepare your Va Form R 1

If you’re interested in learning how to generate and submit your Va Form R 1, here are some brief instructions on how to streamline the tax submission process.

To begin, you simply need to create your airSlate SignNow account to transform your online paperwork management. airSlate SignNow is an extremely intuitive and efficient document solution that allows you to modify, generate, and finalize your tax documents with ease. With its editor, you can toggle between textual input, check boxes, and eSignatures, and return to revise responses as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and easy sharing options.

Complete the following steps to finalize your Va Form R 1 in just a few minutes:

- Create your account and start editing PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through variants and schedules.

- Click Get form to access your Va Form R 1 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any inaccuracies.

- Save your changes, print a copy, submit it to your recipient, and save it to your device.

Make the most of this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper filing can lead to increased errors and delays in refunds. Before electronically filing your taxes, be sure to check the IRS website for the filing regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct va form r 1 2015

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Why do ex-employers refuse to fill out the VA form 21-4192 for a vet?

VA Form 21–4192 is an application for disability benefits and like similar state benefits, it must be filled out by the veteran or by his or her qualified representative. This is a private, sensitive, legal document and every dot or dash in it can be critical, so must be accurate and verifiable.Employers have zero responsibility to fill out this form or furnish information for it, however, Social Security would have all the information required that the Department of Defense did not have. The veteran’s DD-214 is likely required, but does not furnish all the information required on the form.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How can I get my registration ID, which I forgot to note down after filling part 1 of the SSC JEE 2015 form?

If you have successfully registered for cgl then you must be able to download your admit card using your name and date of birth. So I suppose there should not be any problem. Even if you want your registration Id then I suggest you to contact a fb group admin ( group name is ssc naukari, as I recall ) there you can get help from them. Best of luck.

-

How do I fill out the regional centre code in IGNOU OpenMat Form 1?

IGNOU OPENMAT Entrance Application Forms & Procedureplease view this link

Create this form in 5 minutes!

How to create an eSignature for the va form r 1 2015

How to create an electronic signature for the Va Form R 1 2015 online

How to generate an electronic signature for your Va Form R 1 2015 in Google Chrome

How to create an electronic signature for putting it on the Va Form R 1 2015 in Gmail

How to make an eSignature for the Va Form R 1 2015 straight from your mobile device

How to generate an electronic signature for the Va Form R 1 2015 on iOS

How to create an electronic signature for the Va Form R 1 2015 on Android devices

People also ask

-

What is VA Form R 1 and how can it benefit my business?

VA Form R 1 is a crucial document often used in various business and administrative processes. By integrating VA Form R 1 into your workflows, you can streamline document management, enhance efficiency, and ensure compliance with necessary regulations.

-

What features does airSlate SignNow offer for managing VA Form R 1?

airSlate SignNow provides a range of features to manage VA Form R 1 effectively. These include easy eSigning, customizable templates, secure document storage, and automated workflows that simplify the completion and processing of VA Form R 1.

-

How does the pricing structure work for using VA Form R 1 with airSlate SignNow?

The pricing structure for using VA Form R 1 with airSlate SignNow is competitive and tailored to fit various business needs. You can choose from different plans based on the number of users and features required, ensuring that you get the best value for managing VA Form R 1.

-

Can I integrate VA Form R 1 with other applications using airSlate SignNow?

Yes, airSlate SignNow allows you to integrate VA Form R 1 with a variety of applications, enhancing your workflow efficiency. Popular integrations include Google Drive, Salesforce, and Microsoft Office, making it easy to manage documents across platforms.

-

Is it easy to eSign VA Form R 1 using airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSigning process for VA Form R 1, allowing users to sign documents from any device in just a few clicks. This ease of access increases compliance and reduces turnaround time for approvals.

-

What security measures does airSlate SignNow take for VA Form R 1?

Security is a top priority for airSlate SignNow. When handling VA Form R 1, the platform utilizes bank-level encryption, secure servers, and user authentication to protect your sensitive information and ensure compliance with legal standards.

-

How can airSlate SignNow help me stay compliant with VA Form R 1 requirements?

airSlate SignNow assists businesses in maintaining compliance with VA Form R 1 by providing features such as audit trails and secure storage. These tools help ensure that all actions taken on VA Form R 1 are documented, creating a clear compliance record.

Get more for Va Form R 1

- Employment 2016 use the sa1022016 supplementary pages to record your employment details when filing a tax return for the tax form

- Direct payment schemes for inheritance tax iht423 use this form to pay the inheritance tax due by transferring money from the

- Tax information for tsp participants receiving installment payments tax information for participants who are withdrawing their

- Hypoglycemia emergency care plan for low blood glucose students name gradeteacher date of plan emergency contact information

- Fl260 s abogado o parte sin abogado nombre nmero del colegio de abogados del estado y direccin n de telfono optativo direccin form

- Fin 274 additional property transfer tax application for refund complete this form to apply for a refund of the additional

- Tax return for trustees of registered pension schemes 2011 use form sa970 to file your tax return for the tax year ended 5

- The commonwealth of massachusetts department of fire services office of the state fire marshal application and permit fee for form

Find out other Va Form R 1

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors