Nyc Att S Corp 2018

What is the NYC ATT S Corp?

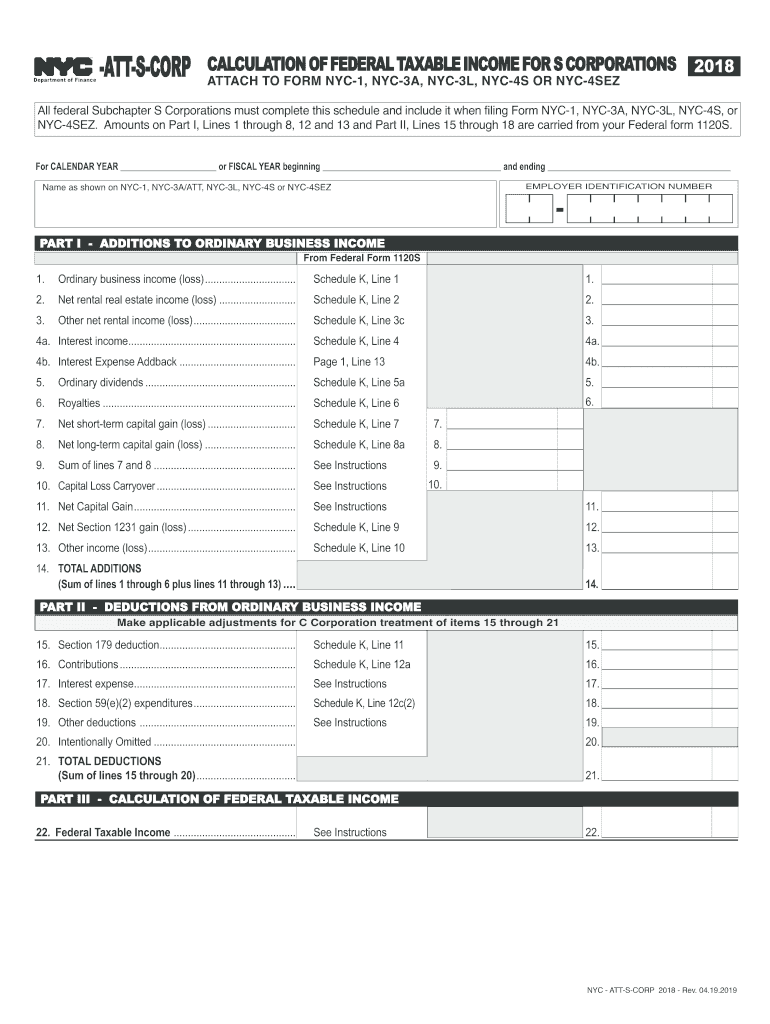

The NYC ATT S Corp is a specific form used by S corporations operating in New York City to report their income and calculate their tax obligations. This form is essential for businesses that have elected to be treated as S corporations for federal tax purposes, allowing them to pass income, losses, deductions, and credits through to shareholders for federal tax purposes. The NYC ATT S Corp ensures compliance with local tax laws and helps businesses accurately report their financial activities to the city.

Steps to Complete the NYC ATT S Corp

Completing the NYC ATT S Corp involves several important steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the form accurately, ensuring all required sections are completed.

- Calculate the total income and any applicable deductions specific to the S corporation.

- Review the form for accuracy and completeness before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the NYC ATT S Corp

The NYC ATT S Corp is legally recognized for tax reporting purposes within New York City. To ensure its validity, businesses must adhere to the guidelines set forth by the New York City Department of Finance. This includes maintaining accurate records and ensuring that the form is submitted on time. Compliance with local tax laws is crucial for avoiding legal issues and potential fines.

Filing Deadlines / Important Dates

It is important for businesses to be aware of the filing deadlines associated with the NYC ATT S Corp. Typically, the form must be submitted by the due date of the corporation's federal tax return. For most S corporations, this is March 15 of each year. However, if an extension is filed, the deadline may be extended to September 15. Marking these dates on your calendar can help ensure timely compliance.

Required Documents

When completing the NYC ATT S Corp, several documents are necessary to provide accurate information:

- Financial statements, including profit and loss statements.

- Balance sheets that reflect the corporation's financial position.

- Records of any deductions or credits claimed.

- Previous year’s tax returns, if applicable.

Who Issues the Form

The NYC ATT S Corp is issued by the New York City Department of Finance. This department is responsible for overseeing tax compliance and ensuring that businesses operating within the city adhere to local tax regulations. Understanding the issuing authority can help businesses navigate any questions or issues that may arise during the filing process.

Quick guide on how to complete calculation of federal taxable income for s corporations 2018

Complete Nyc Att S Corp effortlessly on any device

Digital document management has surged in popularity among companies and individuals. It serves as a superb eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Nyc Att S Corp on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Nyc Att S Corp without hassle

- Obtain Nyc Att S Corp and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and eSign Nyc Att S Corp and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct calculation of federal taxable income for s corporations 2018

Create this form in 5 minutes!

How to create an eSignature for the calculation of federal taxable income for s corporations 2018

How to generate an eSignature for your Calculation Of Federal Taxable Income For S Corporations 2018 in the online mode

How to make an electronic signature for your Calculation Of Federal Taxable Income For S Corporations 2018 in Google Chrome

How to create an electronic signature for putting it on the Calculation Of Federal Taxable Income For S Corporations 2018 in Gmail

How to create an eSignature for the Calculation Of Federal Taxable Income For S Corporations 2018 straight from your smartphone

How to make an eSignature for the Calculation Of Federal Taxable Income For S Corporations 2018 on iOS devices

How to make an electronic signature for the Calculation Of Federal Taxable Income For S Corporations 2018 on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to nyc att s corp.?

airSlate SignNow is a powerful eSignature and document management solution designed to meet the needs of businesses, including those operating as nyc att s corp. It simplifies the process of sending and signing documents, making it suitable for various industries. With its user-friendly interface, airSlate SignNow empowers businesses to streamline their operations efficiently.

-

What are the pricing options for airSlate SignNow for nyc att s corp.?

airSlate SignNow offers flexible pricing plans tailored for different business needs, including those of nyc att s corp. Plans range from basic to advanced options, allowing you to choose the best fit for your budget and document volume. Each plan includes essential features to help your business save time and reduce costs.

-

What are the key features of airSlate SignNow suitable for nyc att s corp.?

Key features of airSlate SignNow include electronic signatures, document templates, and advanced security options, all vital for any nyc att s corp. These features enhance collaboration and ensure the legality of documents. Additionally, users can easily track document status and access a variety of integration options.

-

How can airSlate SignNow benefit my nyc att s corp.?

airSlate SignNow benefits your nyc att s corp. by streamlining document transactions and improving workflow efficiency. The platform reduces turnaround time for signed documents, which is crucial for business operations. Ultimately, this helps to enhance customer satisfaction and drive revenue.

-

Is airSlate SignNow customizable for the needs of nyc att s corp.?

Yes, airSlate SignNow is customizable, allowing users to tailor it to the specific needs of a nyc att s corp. You can create custom templates, workflows, and branding elements to maintain consistency across your documents. This customization enhances user experience and helps meet unique business requirements.

-

What integrations does airSlate SignNow offer for nyc att s corp.?

airSlate SignNow supports numerous integrations with popular tools and applications that a nyc att s corp. may already be using. This includes CRM systems, cloud storage solutions, and project management tools. Such integrations streamline your processes and improve overall efficiency.

-

Are there security features in airSlate SignNow for nyc att s corp.?

Absolutely! airSlate SignNow includes robust security features designed to protect sensitive documents for your nyc att s corp. These security measures encompass encryption, multi-factor authentication, and audit trails for every transaction. This ensures compliance and builds trust with your clients.

Get more for Nyc Att S Corp

- Training ground use request form

- Usd head start enrollment application university of south dakota usd form

- File types com extension ugdopening ugd files what is a file with ugd extension form

- State farm insurance scholarship at bgsu state fire school bgsu form

- The university of arizona college of medicine dep form

- Nursing skills remediation competency form smc

- Fire 7 foundation scholarship application lake stevens school form

- Studentfinance northeastern edutuition and feestuition and feesstudent financial services form

Find out other Nyc Att S Corp

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors