45 Exemptions Form

What are the 45 Exemptions?

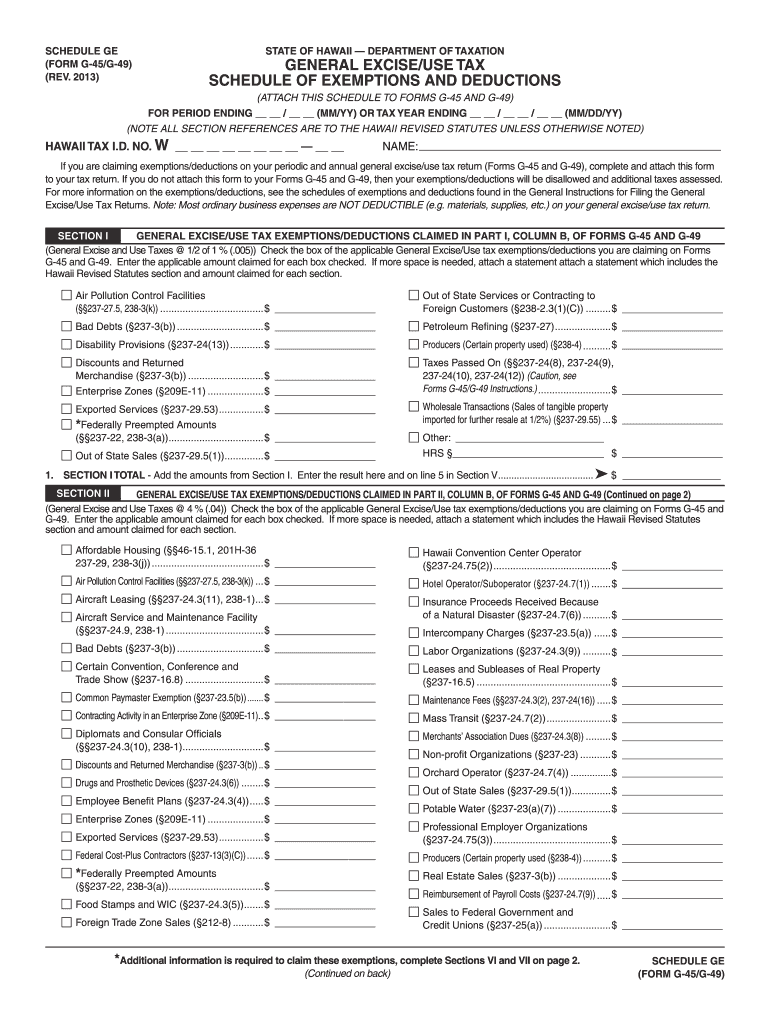

The 45 exemptions refer to specific categories of transactions and entities that may be exempt from the general excise tax in Hawaii. This tax applies to businesses engaged in various activities, and understanding these exemptions is crucial for compliance. Common exemptions include certain types of sales, services, and income that do not fall under the taxable categories outlined by the state. For instance, sales of certain food items, medical services, and educational services may qualify for exemption under the 45 exemptions.

How to Use the 45 Exemptions

Utilizing the 45 exemptions involves identifying the applicable categories that pertain to your business activities. Once you determine which exemptions apply, you must document your transactions accurately to ensure compliance with state regulations. This may include collecting and maintaining records that support your claims for exemption. It is advisable to consult with a tax professional to navigate the complexities of the exemptions and ensure that your business adheres to all legal requirements.

Steps to Complete the 45 Exemptions

Completing the process for the 45 exemptions involves several key steps:

- Identify the specific exemptions that apply to your business activities.

- Gather necessary documentation to support your exemption claims.

- Complete any required forms or applications related to the exemptions.

- Submit the completed forms to the appropriate state agency, ensuring compliance with submission guidelines.

- Maintain records of all transactions and documentation for future reference and audits.

Eligibility Criteria for the 45 Exemptions

Eligibility for the 45 exemptions varies based on the nature of the business and the specific activities conducted. Generally, businesses must demonstrate that their transactions fall within the defined categories of exemption. This may include providing evidence of the type of goods sold or services provided. Additionally, certain entities, such as non-profit organizations and government agencies, may automatically qualify for exemptions. It is important to review the specific criteria outlined by the state to determine your eligibility.

Filing Deadlines and Important Dates

Filing deadlines for claiming the 45 exemptions are critical to avoid penalties and ensure compliance. Typically, businesses must submit their exemption claims alongside their general excise tax returns. It is essential to stay informed about the specific deadlines set by the Hawaii Department of Taxation, as these dates may vary based on the type of business and the fiscal year. Marking these dates on your calendar can help ensure timely submissions.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the 45 exemptions can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential audits by the state tax authority. Understanding the implications of non-compliance is crucial for business owners. It is advisable to maintain accurate records and seek professional guidance to navigate the complexities of tax regulations and avoid penalties.

Quick guide on how to complete 45 exemptions

Manage 45 Exemptions seamlessly on any device

Web-based document handling has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle 45 Exemptions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and electronically sign 45 Exemptions effortlessly

- Locate 45 Exemptions and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional handwritten signature.

- Verify the details and click the Done button to save your adjustments.

- Choose your preferred method to send your form: via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and electronically sign 45 Exemptions and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 45 exemptions

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the form G45 excise tax?

The form G45 excise tax is a tax return filed in Hawaii, reporting tax collected on sales of goods and services. It is essential for businesses to comply with state tax requirements. Understanding how to properly complete the form G45 excise tax is crucial to avoid penalties and ensure smooth operations.

-

How can airSlate SignNow help with the form G45 excise tax?

airSlate SignNow streamlines the process of completing and submitting the form G45 excise tax by allowing users to electronically sign and manage their documents. This efficiency helps businesses save time and reduce the likelihood of errors in tax filings. Our platform ensures secure and compliant handling of sensitive information related to tax returns.

-

What are the pricing options for airSlate SignNow when managing form G45 excise tax?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes. These plans provide features that help users efficiently complete the form G45 excise tax and other essential documents. By choosing a plan that meets your business needs, you can optimize workflow without breaking the bank.

-

Is airSlate SignNow suitable for small businesses filing form G45 excise tax?

Absolutely! airSlate SignNow is designed to be user-friendly for small businesses managing the form G45 excise tax. Our cost-effective solution enables small business owners to eSign their documents quickly, ensuring they stay compliant with tax obligations without overwhelming their resources.

-

Does airSlate SignNow integrate with accounting software for the form G45 excise tax?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easier for businesses to handle the form G45 excise tax. These integrations allow for automatic data transfer, reducing the chances of discrepancies and ensuring all tax-related documents are up to date. This simplified process enhances overall productivity.

-

What features does airSlate SignNow offer for completing the form G45 excise tax?

airSlate SignNow provides several features designed to simplify completing the form G45 excise tax. These include customizable templates, electronic signatures, and document tracking, ensuring businesses can manage their tax-related paperwork efficiently. This comprehensive suite of tools helps maintain accuracy and timeliness in submissions.

-

Can I get support if I encounter issues while using airSlate SignNow for form G45 excise tax?

Yes, airSlate SignNow offers comprehensive customer support to assist users with any issues related to the form G45 excise tax. Our support team is available via multiple channels, ensuring you receive timely assistance whatever your query may be. This commitment to customer satisfaction makes using our platform stress-free.

Get more for 45 Exemptions

Find out other 45 Exemptions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors