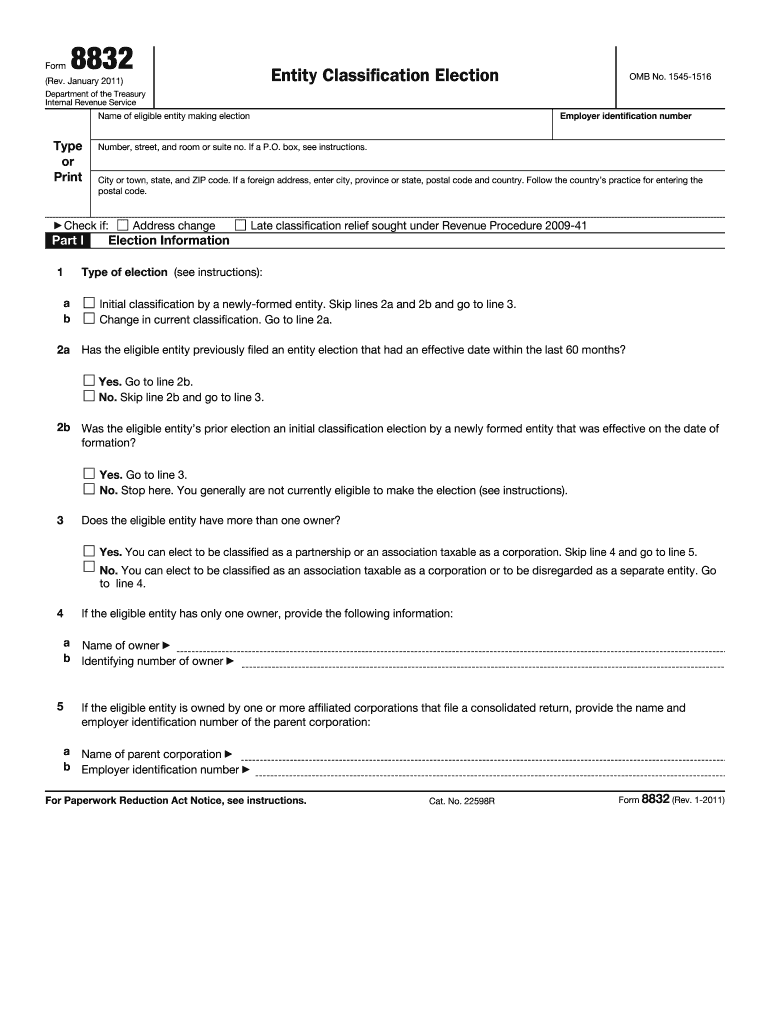

Form 8832 2011

What is the Form 8832

The Form 8832, officially known as the Entity Classification Election, is a tax form used by businesses in the United States to elect how they will be classified for federal tax purposes. This form allows eligible entities to choose between being treated as a corporation, partnership, or disregarded entity. The classification selected can significantly impact the entity's tax obligations and benefits, making it essential for business owners to understand their options before submitting the form.

How to use the Form 8832

To use the Form 8832 effectively, a business must first determine its eligibility and the desired classification. Once the decision is made, the form must be completed accurately, providing all required information, including the entity's name, address, and the specific classification being elected. After filling out the form, it should be submitted to the IRS, ensuring that it is done within the specified time frame to avoid any penalties or complications with tax status.

Steps to complete the Form 8832

Completing the Form 8832 involves several key steps:

- Gather necessary information about the business entity, including its legal name and address.

- Determine the desired tax classification (corporation, partnership, or disregarded entity).

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for accuracy and completeness.

- Submit the form to the IRS, either online or by mail, depending on the preferred submission method.

Legal use of the Form 8832

The legal use of the Form 8832 is governed by IRS regulations. When properly completed and submitted, the form serves as a formal election for tax classification. It is crucial for businesses to adhere to IRS guidelines to ensure that their election is valid and recognized. Any errors or omissions in the form may lead to complications, including the rejection of the election or unintended tax consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8832 are essential for businesses to consider. Generally, the form must be submitted within seventy-five days of the desired effective date of the election. If a business misses this deadline, it may lose the opportunity to change its tax classification for that tax year. It is advisable for businesses to plan ahead and be aware of any important dates related to their specific situation.

Required Documents

When completing the Form 8832, certain documents may be required to support the election. These can include:

- Articles of incorporation or organization.

- Operating agreements or partnership agreements.

- Tax identification numbers for all owners or partners.

Having these documents ready can facilitate a smoother completion process and help ensure compliance with IRS requirements.

Quick guide on how to complete 2011 form 8832

Complete Form 8832 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with everything required to create, modify, and eSign your documents promptly without any delays. Manage Form 8832 across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 8832 without hassle

- Find Form 8832 and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that function.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or errors that require printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 8832 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 8832

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 8832

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 8832 and why is it important?

Form 8832 is a tax form used by businesses to elect how they want to be classified for federal tax purposes. It is crucial for determining if your business will be treated as a corporation, partnership, or sole proprietorship. Filing Form 8832 correctly can signNowly impact your tax obligations and benefits.

-

How can airSlate SignNow help with Form 8832 management?

airSlate SignNow offers a streamlined solution for managing Form 8832 by allowing users to create, send, and eSign the document digitally. Our platform simplifies the paperwork process, ensuring that your Form 8832 is completed accurately and efficiently. Plus, with our secure storage, you can easily access your signed documents anytime.

-

What features does airSlate SignNow provide for signing Form 8832?

AirSlate SignNow provides a variety of features to enhance the signing process for Form 8832, including customizable templates, bulk sending options, and real-time tracking of document status. With our intuitive interface, you can ensure that all parties can eSign the form quickly and securely, making the process hassle-free.

-

Is airSlate SignNow cost-effective for managing Form 8832?

Yes, airSlate SignNow is a cost-effective solution for managing Form 8832 and other business documents. Our pricing plans are designed to fit various budgets, providing excellent value with features that enhance productivity and streamline workflows. You can save time and resources by choosing a digital solution over traditional paper methods.

-

Can I integrate airSlate SignNow with other applications for Form 8832?

Absolutely! AirSlate SignNow offers seamless integrations with various applications, including CRM systems, cloud storage services, and project management tools. This flexibility allows you to easily incorporate Form 8832 into your existing workflows, ensuring that all your business processes are connected.

-

What are the benefits of using airSlate SignNow for Form 8832?

Using airSlate SignNow for Form 8832 offers numerous benefits, such as increased efficiency, reduced processing time, and improved accuracy. Our electronic signature solution eliminates the need for printing and scanning, making it environmentally friendly and convenient. Additionally, you can track the status of your Form 8832 in real-time.

-

Is it safe to use airSlate SignNow for submitting Form 8832?

Yes, airSlate SignNow is committed to ensuring the security and confidentiality of your documents, including Form 8832. We use advanced encryption technologies and comply with industry standards to protect your sensitive information. You can confidently manage your Form 8832 knowing that your data is secure.

Get more for Form 8832

- Texas oil amp gas pac form

- Garage sale permit applicationpdf city of lavon form

- H1535 form

- Welcome new business salt lake county form

- Virginia department of agriculture consumer services office of charitable and requlatory programs storeroom inventory instant form

- Hereinafter known as form

- New and transfer of location form

- Indian post rd full fill form 2007

Find out other Form 8832

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation