Form 8832 2012

What is the Form 8832

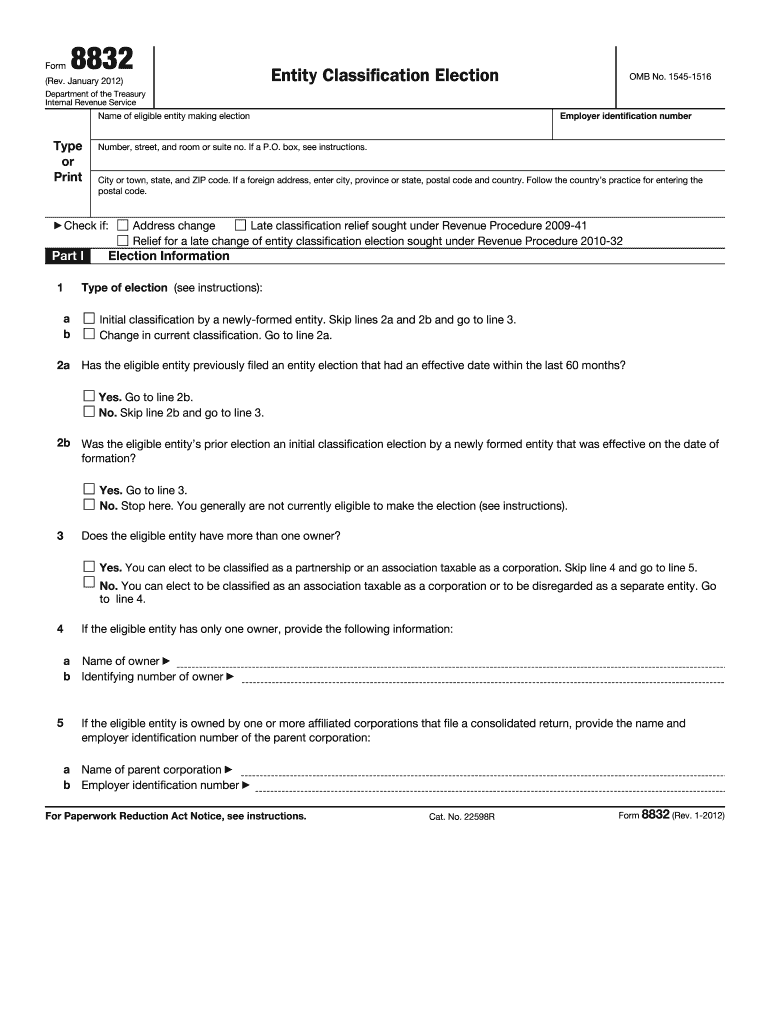

The Form 8832, also known as the Entity Classification Election, is a tax form used by businesses to choose how they want to be classified for federal tax purposes. This form allows eligible entities, such as limited liability companies (LLCs) and partnerships, to elect to be treated as a corporation, partnership, or disregarded entity. The classification affects how income, deductions, and credits are reported on tax returns.

How to use the Form 8832

To use the Form 8832, a business must first determine its eligibility for classification. Once eligibility is confirmed, the entity completes the form by providing necessary information, including the name, address, and tax identification number. After filling out the form, it must be submitted to the IRS, typically within seventy-five days of the desired effective date of the election. This election can significantly impact tax liabilities, so careful consideration is essential.

Steps to complete the Form 8832

Completing the Form 8832 involves several key steps:

- Gather required information, including the entity's legal name, address, and taxpayer identification number.

- Determine the desired classification for tax purposes, whether as a corporation, partnership, or disregarded entity.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by mail or electronically, if applicable.

Legal use of the Form 8832

The legal use of the Form 8832 is governed by IRS regulations. When properly executed, the election made on this form is legally binding. It is crucial for businesses to ensure compliance with the submission guidelines and deadlines to avoid penalties. The form must be filed in accordance with the Internal Revenue Code, and any changes in classification must also be reported using the appropriate procedures.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8832 are critical to ensure the timely processing of the election. The form must generally be filed within seventy-five days of the desired effective date of the election. If the form is submitted late, the election may not be recognized for the intended tax year. It is advisable for businesses to keep track of important dates and to plan accordingly to avoid any complications.

Required Documents

When completing the Form 8832, certain documents may be required to support the election. These can include:

- Proof of the entity's formation, such as articles of incorporation or organization.

- Tax identification number issued by the IRS.

- Any prior tax returns that may be relevant for the classification election.

Having these documents ready can facilitate a smoother filing process.

Quick guide on how to complete 2012 form 8832

Complete Form 8832 easily on any device

Online document management has become widespread among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Form 8832 on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form 8832 effortlessly

- Locate Form 8832 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and eSign Form 8832 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 8832

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 8832

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is Form 8832 and why do I need it?

Form 8832 is used by eligible entities to elect to be classified as a corporation or partnership for federal tax purposes. Understanding Form 8832 is crucial for businesses looking to optimize their tax treatment and comply with IRS regulations. airSlate SignNow simplifies the process of completing and submitting Form 8832, ensuring you meet all deadlines and requirements.

-

How does airSlate SignNow help with Form 8832?

airSlate SignNow provides tools that streamline the process of preparing and signing Form 8832. With our intuitive interface, you can easily fill out the required fields and send the document for electronic signatures, ensuring a quick and efficient workflow. Our platform is designed to help you focus on your business while we take care of the paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 8832?

Yes, airSlate SignNow offers several pricing plans that cater to different business sizes and needs. Our plans are competitively priced for the features provided, including the ability to eSign Form 8832. By investing in our solution, you can save time and increase efficiency, making it a smart choice for your document management needs.

-

Can I integrate airSlate SignNow with my existing software for Form 8832 management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it simple to incorporate our solution into your existing workflow. Whether you're using accounting software or project management tools, our integrations allow for easy access to Form 8832 and other essential documents. This flexibility enhances productivity by keeping everything connected.

-

What security measures does airSlate SignNow have for handling Form 8832?

Security is a top priority at airSlate SignNow. We implement robust encryption and secure cloud storage to protect your sensitive information associated with Form 8832. Additionally, our platform complies with industry standards to ensure that your data remains safe while you eSign and share documents.

-

How can I track the status of my Form 8832 with airSlate SignNow?

airSlate SignNow provides tracking features that allow you to monitor the status of your Form 8832 in real-time. You will receive notifications when the document is sent, viewed, or signed, ensuring you stay informed throughout the process. This transparency helps you manage your documents efficiently and reduces any uncertainty.

-

Can I access my completed Form 8832 later on airSlate SignNow?

Yes, once you’ve completed and signed Form 8832 using airSlate SignNow, you can easily access it at any time through your account. Our platform stores all your documents securely in the cloud, allowing you to retrieve your Form 8832 whenever necessary. This feature enables easy record-keeping and future reference.

Get more for Form 8832

- Ga odometer form

- Promissory note in connection with sale of vehicle or automobile georgia form

- Ga bill sale boat form

- Bill of sale of automobile and odometer statement for as is sale georgia form

- Contract cost fixed form

- Painting contract for contractor georgia form

- Trim carpenter contract for contractor georgia form

- Fencing contract for contractor georgia form

Find out other Form 8832

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer