Form 8832 2010

What is the Form 8832

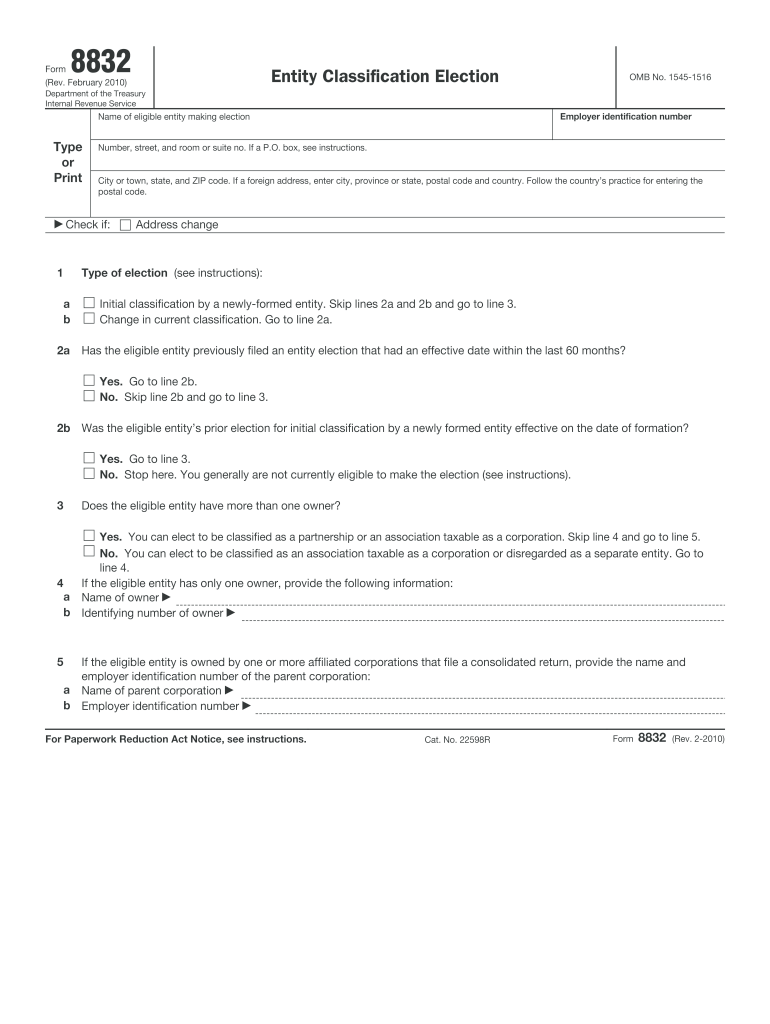

The Form 8832, also known as the Entity Classification Election, is a tax form used by businesses to elect how they want to be classified for federal tax purposes. This form allows eligible entities, such as limited liability companies (LLCs) and partnerships, to choose whether they will be treated as a corporation, partnership, or disregarded entity. The classification affects how the entity is taxed and can have significant implications for tax liability and compliance. Understanding the purpose and implications of Form 8832 is crucial for business owners looking to optimize their tax strategies.

How to use the Form 8832

Using the Form 8832 involves several steps to ensure proper completion and submission. First, determine the eligibility of your business entity to make the election. Next, gather necessary information, such as the entity's name, address, and taxpayer identification number. Complete the form by providing details about the entity's classification choice and any other required information. After completing the form, it must be signed by an authorized individual. Finally, submit the form to the IRS according to the guidelines provided, ensuring that it is done within the specified time frame to avoid penalties.

Steps to complete the Form 8832

Completing the Form 8832 requires careful attention to detail. Follow these steps for a successful submission:

- Identify your entity type and ensure it is eligible to make the election.

- Gather required information, including the entity's legal name, address, and taxpayer identification number.

- Fill out the form, indicating the desired classification and providing any additional information as required.

- Review the completed form for accuracy and completeness.

- Sign the form in the designated area by an authorized person.

- Submit the form to the IRS, ensuring you meet any applicable deadlines.

Legal use of the Form 8832

The legal use of Form 8832 is governed by IRS regulations, which stipulate that the form must be filed in accordance with specific guidelines. The election made using this form is legally binding and affects the entity's tax classification. It is essential for businesses to understand the implications of their classification choice, as it can impact tax obligations and compliance requirements. Consulting with a tax professional can provide clarity on the legal ramifications of filing Form 8832 and help ensure adherence to all relevant laws.

Filing Deadlines / Important Dates

Filing deadlines for Form 8832 are crucial for maintaining compliance with IRS regulations. Generally, the form must be filed within seventy-five days of the desired effective date of the election. If the form is submitted late, the election may not be recognized for the intended tax year. It is important to keep track of these deadlines to avoid complications. Additionally, businesses should be aware of any changes in IRS guidelines that may affect filing dates.

Eligibility Criteria

To file Form 8832, certain eligibility criteria must be met. The entity must be a domestic eligible entity, which includes LLCs, partnerships, and certain corporations. Additionally, the entity must not be classified as a foreign entity or a corporation that has elected to be treated as an S corporation. Understanding these criteria is essential for businesses to determine if they can make the election and how it will impact their tax situation.

Quick guide on how to complete 2010 form 8832

Complete Form 8832 effortlessly on any device

Managing documents online has become common among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents promptly without delays. Manage Form 8832 on any device with the airSlate SignNow Android or iOS applications and enhance any document-related activity today.

How to modify and electronically sign Form 8832 effortlessly

- Obtain Form 8832 and then click Get Form to get started.

- Utilize the tools we provide to fill in your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and bears the same legal validity as a typical wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, by email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 8832 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 8832

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 8832

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is Form 8832 and why do I need it?

Form 8832 is an IRS form used by eligible entities to elect how they will be classified for federal tax purposes. Understanding and utilizing Form 8832 is crucial for businesses to ensure they are taxed according to their preferred structure, which can signNowly affect their financial obligations.

-

How can airSlate SignNow help me with Form 8832?

airSlate SignNow provides an efficient platform for electronically signing and managing Form 8832 and other important documents. Our user-friendly interface simplifies the document signing process, ensuring you can complete and submit Form 8832 in a timely manner, reducing delays in your business operations.

-

Is there a cost associated with using airSlate SignNow for Form 8832?

Yes, airSlate SignNow offers several pricing plans to cater to different business needs when signing Form 8832 and other documents. You can choose a plan that fits your budget while taking advantage of our powerful eSignature and document management tools.

-

What features does airSlate SignNow offer for completing Form 8832?

With airSlate SignNow, you can easily upload, edit, and sign Form 8832 with our intuitive tools. Key features include customizable templates, seamless integrations with popular applications, and secure storage solutions, making it easier to manage your documents efficiently.

-

Can I integrate airSlate SignNow with other software to manage Form 8832?

Absolutely! airSlate SignNow offers integrations with numerous applications, making it simple to manage Form 8832 alongside your other accounting or business tools. This ensures that you can streamline processes and maintain a cohesive workflow.

-

What are the benefits of using airSlate SignNow for my Form 8832 submissions?

By using airSlate SignNow, businesses benefit from increased efficiency, reduced paperwork, and faster processing times for Form 8832 submissions. Our secure eSignature solutions also ensure compliance with legal regulations while maintaining document integrity.

-

Is airSlate SignNow secure for handling sensitive documents like Form 8832?

Yes, airSlate SignNow implements robust security measures, including encryption and secure access protocols, to protect sensitive documents such as Form 8832. You can trust our platform to keep your information safe and secure throughout the signing process.

Get more for Form 8832

- Florida addendum 497303501 form

- Amendment additional form

- Correction statement online form

- Legal last will and testament form for single person with no children florida

- Legal last will and testament form for a single person with minor children florida

- Florida legal adult form

- Legal last will and testament form for single person with adult children florida

- Legal last will and testament for married person with minor children from prior marriage florida form

Find out other Form 8832

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed