1125 E Form 2011

What is the 1125 E Form

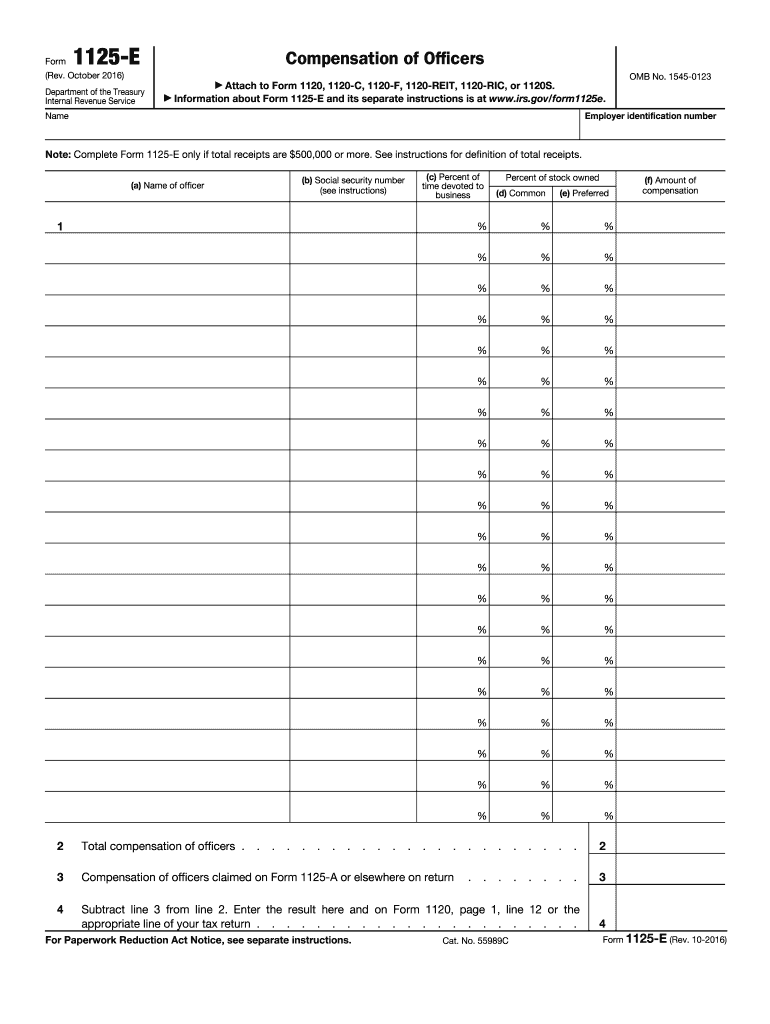

The 1125 E Form is a tax document utilized by businesses to report income and expenses related to their operations. This form is particularly relevant for entities that need to disclose specific financial information to the Internal Revenue Service (IRS). It serves as a crucial tool for ensuring compliance with federal tax regulations and helps in accurately calculating tax liabilities.

How to use the 1125 E Form

Using the 1125 E Form involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements and expense reports. Next, fill out the form by entering relevant information in the designated fields, such as income earned, expenses incurred, and any applicable deductions. It's essential to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the IRS guidelines.

Steps to complete the 1125 E Form

Completing the 1125 E Form requires careful attention to detail. Follow these steps:

- Collect all financial documents, including receipts and bank statements.

- Access the 1125 E Form through the IRS website or a tax preparation software.

- Fill in your business information, including name, address, and Employer Identification Number (EIN).

- Report your total income and list all allowable expenses in the appropriate sections.

- Review the form for accuracy and completeness.

- Submit the form electronically or print and mail it to the IRS.

Legal use of the 1125 E Form

The 1125 E Form must be used in accordance with IRS regulations to ensure its legal validity. This includes accurately reporting all income and expenses, adhering to filing deadlines, and maintaining proper documentation to support the entries made on the form. Failure to comply with these legal requirements can result in penalties or audits by the IRS.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines associated with the 1125 E Form. Generally, the form must be submitted by the due date of the business's tax return. For most businesses, this is typically the fifteenth day of the fourth month following the end of the tax year. However, specific deadlines may vary based on the business structure and any extensions that may have been granted. Always check the IRS website for the most current deadlines.

Required Documents

To complete the 1125 E Form accurately, several documents are required. These include:

- Income statements detailing revenue generated.

- Expense receipts and invoices related to business operations.

- Previous tax returns for reference.

- Any supporting documentation for deductions claimed.

Form Submission Methods (Online / Mail / In-Person)

The 1125 E Form can be submitted through various methods, including online filing, mailing a paper form, or in-person submission at designated IRS offices. Online filing is often the most efficient method, allowing for quicker processing and confirmation of receipt. If mailing the form, ensure it is sent to the correct IRS address based on your location and business type. In-person submissions may be available for those needing assistance or clarification on the filing process.

Quick guide on how to complete 1125 e 2011 form

Complete 1125 E Form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle 1125 E Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and eSign 1125 E Form with ease

- Find 1125 E Form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important parts of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign 1125 E Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1125 e 2011 form

Create this form in 5 minutes!

How to create an eSignature for the 1125 e 2011 form

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1125 E Form and how can it benefit my business?

The 1125 E Form is a crucial document used for electronically submitting certain tax information to the IRS. By using the 1125 E Form with airSlate SignNow, you can streamline your workflow, ensuring your tax submissions are accurate and timely. This form helps in maintaining compliance and reduces the risk of errors that can lead to penalties.

-

How does airSlate SignNow make filling out the 1125 E Form easier?

airSlate SignNow simplifies the process of filling out the 1125 E Form by providing a user-friendly interface that guides you every step of the way. The platform includes templates and auto-fill features that save time and minimize mistakes. With electronic signatures, you can finalize your form quickly and securely.

-

Is there a pricing plan specifically for using the 1125 E Form with airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need unlimited eSignatures or access to advanced features for the 1125 E Form, you can choose a plan that fits your budget. Explore our pricing page to find the option that best meets your needs.

-

Can I integrate airSlate SignNow with other software for handling the 1125 E Form?

Absolutely! airSlate SignNow offers integrations with various popular software, enhancing the functionality of the 1125 E Form. This means you can easily sync your data between platforms, improving your efficiency and ensuring that all necessary information is accurate across your documents.

-

What security features are implemented when using the 1125 E Form with airSlate SignNow?

Security is a priority when handling sensitive documents like the 1125 E Form. airSlate SignNow utilizes top-tier encryption and complies with industry standards to protect your data. Your information is securely stored, and authentication processes help ensure that only authorized users can access your documents.

-

Can I access the 1125 E Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is designed to be fully functional on mobile devices. You can access, fill out, and sign the 1125 E Form anytime, anywhere. This mobile accessibility allows for greater flexibility and convenience, making it easier to manage your documents on the go.

-

What are the advantages of using airSlate SignNow for the 1125 E Form compared to traditional methods?

Using airSlate SignNow for the 1125 E Form offers numerous advantages over traditional methods, including speed, cost-effectiveness, and accuracy. Digital solutions eliminate the need for printing and mailing, reducing costs and turnaround time. Additionally, the risk of human error is minimized, leading to smoother compliance with tax regulations.

Get more for 1125 E Form

- Form 14157 a rev 5 2012 tax return preparer fraud or misconduct affidavit

- Form 433 b oic dor mo

- 2013 943 fillable form pdf

- 2015 instructions for schedule m 3 form 1065 instructions for schedule m 3 form 1065 net income loss reconciliation for certain

- Notice 1036 rev december 2016 early release copies of the 2017 percentage method tables for income tax withholding irs form

- Publication 974 rev march 2015 irs form

- Joining instructions for form five students 2011

- W 3 ss 2015 form

Find out other 1125 E Form

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free