Form 433 B OIC Dor Mo 2012

What is the Form 433 B OIC Dor Mo

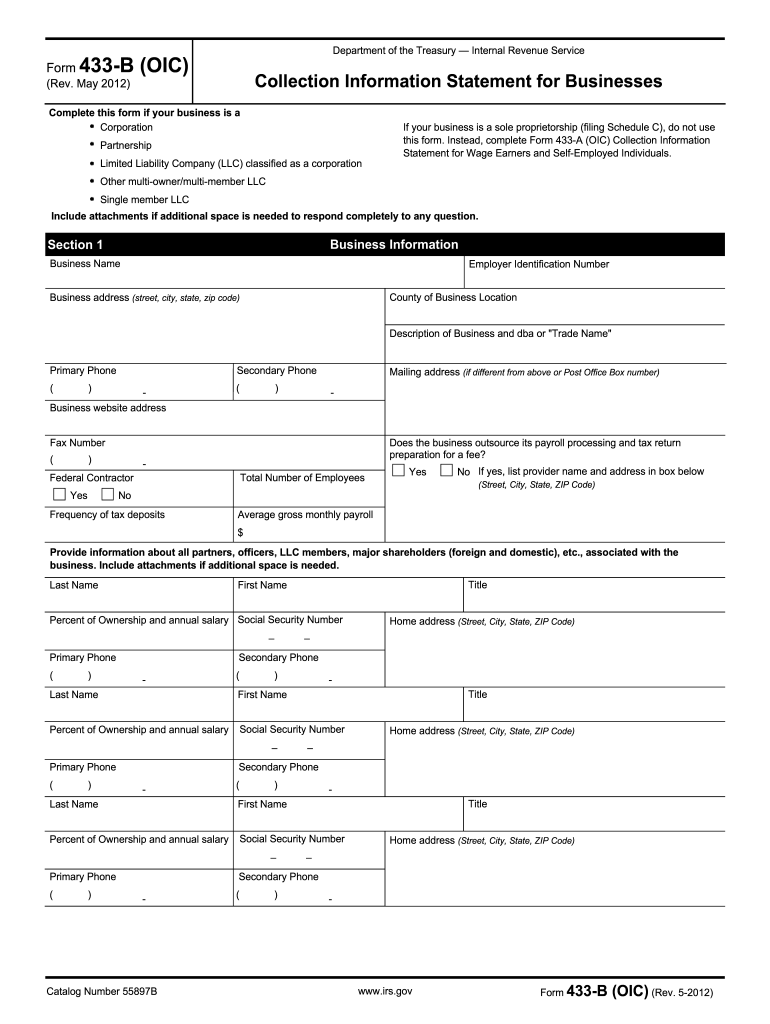

The Form 433 B OIC Dor Mo is a financial statement used by businesses to provide the Internal Revenue Service (IRS) with a detailed overview of their financial situation. This form is primarily utilized when a business seeks to settle its tax liabilities through an Offer in Compromise (OIC). By submitting this form, a business can demonstrate its inability to pay the full amount owed, thereby requesting a reduction in the total tax debt. The information provided on this form helps the IRS assess the taxpayer's financial condition and determine eligibility for an OIC.

Steps to complete the Form 433 B OIC Dor Mo

Completing the Form 433 B OIC Dor Mo involves several key steps. First, gather all necessary financial documents, including bank statements, profit and loss statements, and balance sheets. Next, accurately fill out the form by detailing all assets, liabilities, income, and expenses. It is important to ensure that all information is truthful and complete, as inaccuracies can lead to delays or denials. After completing the form, review it thoroughly for any errors before submitting it to the IRS. Finally, keep a copy of the completed form for your records.

Legal use of the Form 433 B OIC Dor Mo

The legal use of the Form 433 B OIC Dor Mo is crucial for businesses seeking to negotiate their tax debts with the IRS. This form must be completed accurately and submitted as part of the Offer in Compromise process. It is essential that the information provided is consistent with other financial documents to avoid potential legal issues. Additionally, businesses must comply with IRS regulations regarding the submission of this form, ensuring that all required documentation is included to support their claim for an OIC.

Key elements of the Form 433 B OIC Dor Mo

Several key elements must be included in the Form 433 B OIC Dor Mo. These include a detailed list of the business's assets, such as cash, accounts receivable, and property. The form also requires a comprehensive breakdown of liabilities, including loans, credit obligations, and unpaid taxes. Income and expenses must be documented, providing a clear picture of the business's financial health. Additionally, the form may require information about the business's ownership structure and any relevant financial agreements. Accurate completion of these elements is vital for the IRS's evaluation of the OIC.

Filing Deadlines / Important Dates

When submitting the Form 433 B OIC Dor Mo, it is important to be aware of filing deadlines and important dates. The IRS typically has specific timelines for processing Offers in Compromise, and timely submission can influence the outcome. Businesses should also be mindful of any additional deadlines related to tax payments or other filings that may affect their eligibility for an OIC. Keeping track of these dates ensures that businesses remain compliant and can effectively manage their tax obligations.

Eligibility Criteria

Eligibility for submitting the Form 433 B OIC Dor Mo is based on specific criteria set by the IRS. Businesses must demonstrate that they are unable to pay their full tax liability and that settling for a lesser amount is in the best interest of both the taxpayer and the government. Factors considered include the business's income, expenses, and overall financial situation. Additionally, businesses must be current with all required tax filings to qualify for an OIC. Understanding these criteria is essential for businesses considering this option.

Quick guide on how to complete form 433 b oic dor mo

Prepare Form 433 B OIC Dor Mo effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Form 433 B OIC Dor Mo on any platform using airSlate SignNow's Android or iOS apps and enhance any document-centric operation today.

How to modify and eSign Form 433 B OIC Dor Mo with ease

- Obtain Form 433 B OIC Dor Mo and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors necessitating new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Form 433 B OIC Dor Mo and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433 b oic dor mo

Create this form in 5 minutes!

How to create an eSignature for the form 433 b oic dor mo

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is Form 433 B OIC Dor Mo and how is it used?

Form 433 B OIC Dor Mo is a financial disclosure form required by the IRS for businesses applying for an Offer in Compromise (OIC). It helps the IRS assess a business's ability to pay its tax liabilities. Completing this form accurately is crucial for a successful OIC application.

-

How can airSlate SignNow assist with completing Form 433 B OIC Dor Mo?

airSlate SignNow offers a user-friendly platform that simplifies the eSigning and document management process for Form 433 B OIC Dor Mo. With templates and customizable fields, you can easily fill out and send this crucial form to the IRS, ensuring compliance and accuracy.

-

What are the pricing options for airSlate SignNow when using Form 433 B OIC Dor Mo?

airSlate SignNow provides flexible pricing plans, allowing you to choose the option that best fits your business's needs for handling forms like Form 433 B OIC Dor Mo. With affordable plans, you can manage your document workflows without compromising on quality.

-

Are there features specifically designed for eSigning Form 433 B OIC Dor Mo?

Yes, airSlate SignNow offers specific features tailored for eSigning Form 433 B OIC Dor Mo, including secure electronic signatures, document tracking, and automated reminders. These features streamline the process, helping you submit your OIC application efficiently.

-

What are the benefits of using airSlate SignNow for Form 433 B OIC Dor Mo?

Using airSlate SignNow for Form 433 B OIC Dor Mo ensures a smooth, hassle-free document signing experience. It not only accelerates the submission process but also enhances security, compliance, and accessibility, making it easier to manage your OIC applications.

-

Can airSlate SignNow integrate with other tools for managing Form 433 B OIC Dor Mo?

Absolutely! airSlate SignNow offers integrations with various tools like CRM systems and project management software. This allows you to manage and track your Form 433 B OIC Dor Mo alongside other business processes seamlessly.

-

Is it easy to store and access completed Form 433 B OIC Dor Mo using airSlate SignNow?

Yes, airSlate SignNow provides a secure cloud storage solution for your completed Form 433 B OIC Dor Mo and other documents. You can easily access your forms anytime and from any device, ensuring convenience and peace of mind.

Get more for Form 433 B OIC Dor Mo

- Living trust property record hawaii form

- Financial account transfer to living trust hawaii form

- Assignment to living trust hawaii form

- Notice of assignment to living trust hawaii form

- Revocation of living trust hawaii form

- Letter to lienholder to notify of trust hawaii form

- Hawaii timber sale contract hawaii form

- Hawaii forest products timber sale contract hawaii form

Find out other Form 433 B OIC Dor Mo

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement