Form 14157 a Rev 5 Tax Return Preparer Fraud or Misconduct Affidavit 2012

What is the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit

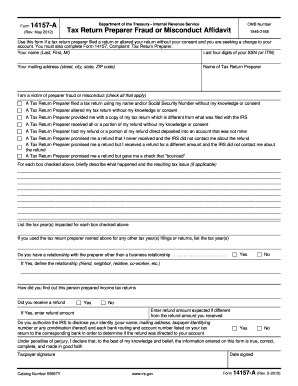

The Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit serves as a formal document used by taxpayers to report suspected fraud or misconduct by tax return preparers. This affidavit is particularly important for maintaining the integrity of the tax preparation process. It allows individuals to provide detailed information regarding any unethical practices they may have encountered, ensuring that the Internal Revenue Service (IRS) can investigate and take appropriate action. This form is crucial for protecting taxpayers and maintaining trust in the tax system.

How to use the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit

Using the Form 14157 A Rev 5 involves several steps to ensure that the information provided is accurate and comprehensive. First, gather all relevant details about the tax return preparer, including their name, address, and any specific incidents of misconduct. Next, fill out the form carefully, providing a clear account of the issues encountered. It is essential to include any supporting documentation that can substantiate your claims. Once completed, the form can be submitted to the IRS for review. Utilizing a digital solution like signNow can simplify this process by allowing for electronic signatures and secure document submission.

Steps to complete the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit

Completing the Form 14157 A Rev 5 requires attention to detail. Follow these steps for effective completion:

- Begin by entering your personal information, including your name, address, and contact details.

- Provide the tax return preparer's information, including their name and business address.

- Describe the specific misconduct or fraudulent activity you observed, ensuring to include dates and relevant circumstances.

- Attach any supporting documents that may help substantiate your claims.

- Review the form thoroughly for accuracy before signing and dating it.

Legal use of the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit

The legal use of the Form 14157 A Rev 5 is critical for ensuring that allegations of misconduct are taken seriously by the IRS. This affidavit must be filled out truthfully and accurately, as providing false information can lead to legal repercussions. The form is protected under various legal frameworks, which means that the information you provide is confidential and will be used solely for investigative purposes. This legal protection encourages taxpayers to report misconduct without fear of retaliation.

Key elements of the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit

Several key elements must be included in the Form 14157 A Rev 5 to ensure its effectiveness:

- Taxpayer Information: Accurate personal information of the individual submitting the affidavit.

- Preparer Information: Detailed information about the tax return preparer in question.

- Description of Misconduct: A clear and concise account of the fraudulent or unethical behavior observed.

- Supporting Documentation: Any relevant documents that can corroborate the claims made in the affidavit.

Form Submission Methods (Online / Mail / In-Person)

The Form 14157 A Rev 5 can be submitted through various methods, ensuring flexibility for taxpayers. It can be sent via mail to the designated IRS address, which is typically provided on the form itself. Additionally, taxpayers may have the option to submit the form electronically through secure online platforms. Utilizing electronic submission methods can expedite the process and provide confirmation of receipt. In-person submissions may also be possible at certain IRS offices, allowing for direct communication with IRS representatives.

Quick guide on how to complete form 14157 a rev 5 2012 tax return preparer fraud or misconduct affidavit

Handle Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit on any platform through airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit effortlessly

- Find Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes moments and has the same legal effect as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14157 a rev 5 2012 tax return preparer fraud or misconduct affidavit

Create this form in 5 minutes!

How to create an eSignature for the form 14157 a rev 5 2012 tax return preparer fraud or misconduct affidavit

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit?

The Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit is a document used to report instances of fraud or misconduct by tax return preparers. This form is essential for individuals who believe they have been wronged or have witnessed unethical practices in the tax preparation sector. By filing this affidavit, you can help ensure accountability among tax professionals.

-

How can airSlate SignNow assist with the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit?

airSlate SignNow provides a user-friendly platform to easily create, send, and eSign your Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit. This seamless process ensures that your affidavit is securely delivered and can be tracked throughout its lifecycle. Our platform helps you streamline documentation processes related to tax return issues.

-

Is there a cost associated with using airSlate SignNow for the affidavit?

Yes, airSlate SignNow offers various pricing plans suitable for businesses of all sizes, including those needing to manage and send Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit. Our cost-effective solutions provide access to essential features while ensuring you stay compliant with legal document requirements. We recommend exploring our pricing options to find the plan that best fits your needs.

-

What features does airSlate SignNow offer for signing the affidavit?

airSlate SignNow includes features like electronic signatures, document templates, and secure cloud storage, all of which are crucial for managing the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit. These features not only expedite the signing process but also enhance document security and compliance. Plus, our intuitive interface makes it easy for users to navigate and complete their affidavits quickly.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications designed to enhance your workflow when dealing with documents such as the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit. This includes popular platforms like CRM systems, cloud storage services, and more. Our API helps automate processes and minimize data entry.

-

What benefits does using airSlate SignNow provide when filing the affidavit?

Using airSlate SignNow to file the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit offers numerous benefits, such as increased efficiency, enhanced security, and improved compliance tracking. SignNow ensures that all signatures are legally binding and that your documents are stored securely. You’ll save time and reduce the stress associated with traditional paper processes.

-

Is airSlate SignNow compliant with legal standards for affidavits?

Absolutely, airSlate SignNow is designed to comply with legal standards for electronic signatures and documents, including the Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit. Our platform adheres to regulations that ensure your documents are valid and secure. You can trust SignNow to handle your important legal documents with utmost care and compliance.

Get more for Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit

- Hawaii bylaws corporation form

- Sample corporate records for a hawaii professional corporation hawaii form

- Organizational minutes for a hawaii professional corporation hawaii form

- Sample transmittal letter for articles of incorporation hawaii form

- Acknowledgment for corporation by another corporation as its attorney hawaii form

- New resident guide hawaii form

- Satisfaction release or cancellation of mortgage by corporation hawaii form

- Satisfaction release or cancellation of mortgage by individual hawaii form

Find out other Form 14157 A Rev 5 Tax Return Preparer Fraud Or Misconduct Affidavit

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed