Form 706 2012

What is the Form 706

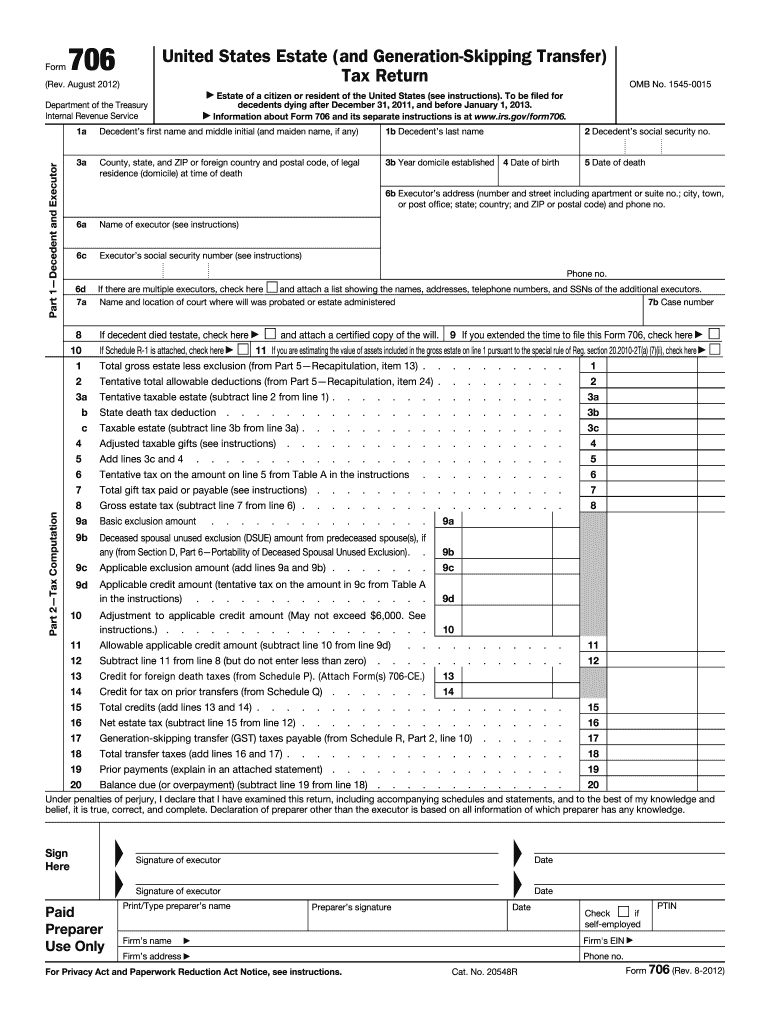

The Form 706, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a tax form used to report the estate tax liability of a deceased individual. This form is required when the gross estate exceeds a specific threshold set by the IRS. It includes all assets owned by the deceased, such as real estate, bank accounts, investments, and personal property. The purpose of the form is to calculate the estate tax owed to the federal government, which is based on the total value of the estate at the time of death.

How to use the Form 706

Using the Form 706 involves several steps to ensure accurate completion and compliance with IRS requirements. First, gather all necessary financial documents related to the deceased's estate, including property appraisals, bank statements, and investment records. Next, complete the form by providing detailed information about the estate's assets, liabilities, and deductions. It is essential to follow the instructions carefully, as any errors may lead to delays or penalties. Once the form is completed, it must be filed with the IRS, typically within nine months of the date of death.

Steps to complete the Form 706

Completing the Form 706 requires a systematic approach to ensure all information is accurate and complete. Begin by filling out the decedent's information, including their name, Social Security number, and date of death. Next, list all assets in the estate, categorizing them into real estate, personal property, and financial accounts. After listing the assets, deduct any liabilities, such as debts and funeral expenses. Include any applicable deductions, such as charitable contributions. Finally, calculate the total estate tax liability and sign the form. It is advisable to review the completed form thoroughly or consult a tax professional before submission.

Filing Deadlines / Important Dates

The filing deadline for the Form 706 is typically nine months after the date of death of the decedent. However, an extension may be requested using Form 4768, which can provide an additional six months to file the return. It is crucial to adhere to these deadlines to avoid penalties and interest on any unpaid taxes. Additionally, if the estate is subject to state estate taxes, be aware of any separate deadlines that may apply at the state level.

Required Documents

To complete the Form 706, several documents are necessary to substantiate the information reported. These documents include:

- Death certificate of the decedent

- Appraisals for real estate and valuable personal property

- Bank statements and investment account statements

- Records of debts and liabilities

- Documentation of any deductions, such as charitable contributions

Having these documents ready will facilitate the accurate completion of the form and help ensure compliance with IRS regulations.

Legal use of the Form 706

The legal use of the Form 706 is essential for ensuring that the estate tax is calculated and reported correctly. The form must be signed by the executor or administrator of the estate, who is legally responsible for filing the return. Inaccuracies or omissions can lead to legal repercussions, including audits or penalties. Therefore, it is important to maintain accurate records and adhere to IRS guidelines when completing and submitting the form. Consulting with an estate attorney or tax professional can provide additional assurance of compliance.

Quick guide on how to complete form 706 2012

Complete Form 706 with ease on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage Form 706 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest method to alter and eSign Form 706 effortlessly

- Obtain Form 706 and click Get Form to begin.

- Employ the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced papers, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 706 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 706 2012

Create this form in 5 minutes!

How to create an eSignature for the form 706 2012

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is Form 706, and how can airSlate SignNow help with it?

Form 706 is the United States Estate Tax Return, which is used to report the estate tax owed on the transfer of the deceased's assets. airSlate SignNow provides a seamless solution for signing and managing this form electronically, ensuring compliance with legal requirements while saving time and reducing paperwork.

-

What features does airSlate SignNow offer for managing Form 706?

airSlate SignNow offers various features for managing Form 706, including customizable templates, cloud storage, and automated workflows. These features simplify the process, ensuring that your Form 706 is completed accurately and efficiently, minimizing errors and delays.

-

Is airSlate SignNow cost-effective for handling Form 706?

Yes, airSlate SignNow provides a cost-effective solution for handling Form 706. With flexible pricing plans, it enables users to eSign and manage important documents without breaking the bank, making it a great choice for businesses of all sizes.

-

How does eSigning Form 706 work with airSlate SignNow?

eSigning Form 706 with airSlate SignNow is straightforward. Users can upload the form, designate signers, and add signature fields. Once set up, recipients receive an email invitation to eSign the document, streamlining the entire process.

-

Can airSlate SignNow integrate with other software when managing Form 706?

Absolutely! airSlate SignNow integrates with a variety of software applications, which allows for efficient management of Form 706 and other documents. This seamless integration helps you to maintain your workflow without needing to switch between different platforms.

-

What are the benefits of using airSlate SignNow for Form 706?

Using airSlate SignNow for Form 706 offers several benefits including increased efficiency, enhanced security, and easy access to documents. The ability to eSign and track the status of your Form 706 ensures that you stay organized and compliant with legal requirements.

-

How secure is airSlate SignNow when handling sensitive documents like Form 706?

airSlate SignNow prioritizes the security of your sensitive documents like Form 706. With GDPR compliance, advanced encryption, and secure cloud storage, users can trust that their information is protected from unauthorized access.

Get more for Form 706

- Wwwsantiagohsorg santiago high school siteconsider form

- Form 5502 city of chula vista ci chula vista ca

- Instructions for portfolio submission form

- Kap questionnaire on tuberculosis form

- De 4 form

- 2018 1 application cover sheet form

- California coastal commission exemption form

- Catc certification renewal application form

Find out other Form 706

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now