Form 706 2009

What is the Form 706

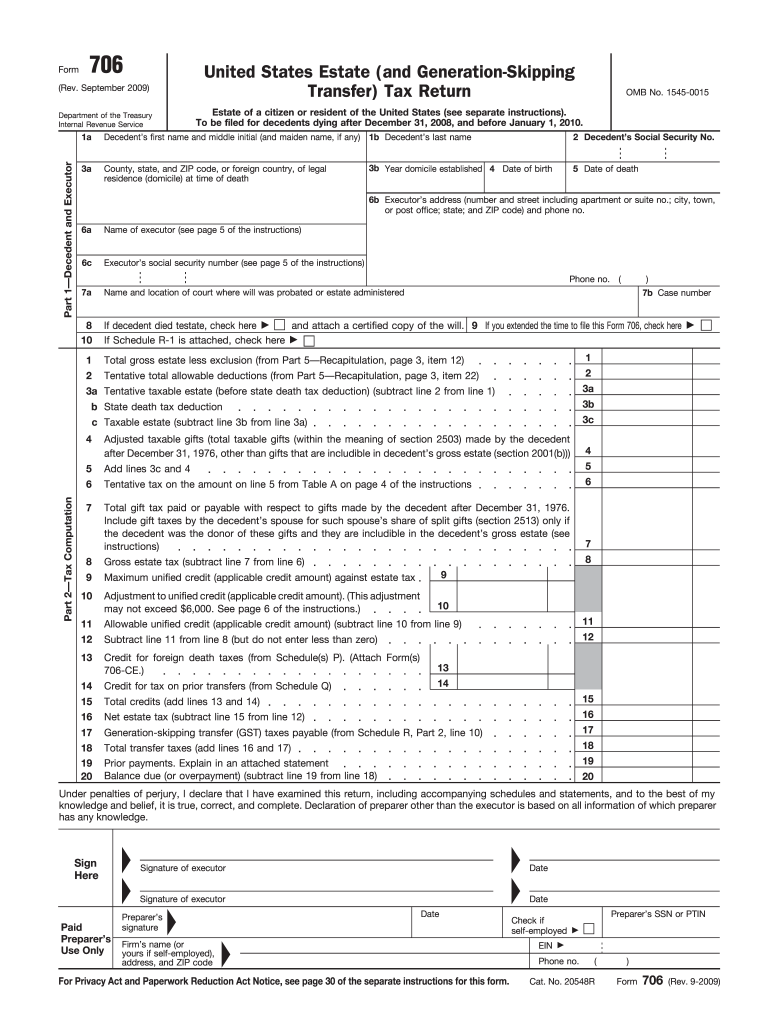

The Form 706, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a tax form used to report the value of an estate for federal tax purposes. This form is typically required when the gross estate exceeds a certain threshold, which is adjusted periodically. It includes detailed information about the deceased's assets, liabilities, and any deductions that may apply. The completion of Form 706 is essential for determining the estate tax owed to the Internal Revenue Service (IRS).

How to use the Form 706

Using Form 706 involves several steps to ensure accurate reporting of the estate's value. Executors or administrators must first gather necessary documentation, including appraisals of assets, debts, and any previous tax returns related to the deceased. The form requires detailed information about the decedent's assets, such as real estate, bank accounts, and investments. After filling out the form, it must be signed and filed with the IRS, typically within nine months of the decedent's death, unless an extension is granted.

Steps to complete the Form 706

Completing Form 706 requires careful attention to detail. Here are key steps to follow:

- Gather all necessary documents, including asset appraisals and debt statements.

- Determine the gross estate value by listing all assets owned by the decedent at the time of death.

- Calculate allowable deductions, such as debts, funeral expenses, and estate administration costs.

- Complete the form by entering all required information accurately, ensuring that all calculations are correct.

- Review the completed form for accuracy and completeness before signing.

- File the form with the IRS by the deadline, which is typically nine months after the date of death.

Legal use of the Form 706

The legal use of Form 706 is governed by IRS regulations. It is important for executors to understand that the form must be filed correctly to avoid penalties. The information provided on the form must be truthful and complete, as inaccuracies can lead to legal consequences, including audits or additional taxes owed. Executors should also be aware of the estate tax exemption limits, which can affect the necessity of filing the form.

Filing Deadlines / Important Dates

Filing deadlines for Form 706 are crucial for compliance. The form must generally be filed within nine months of the decedent's death. If additional time is needed, an extension can be requested using Form 4768, which may grant up to six additional months. However, any estate taxes owed are still due by the original deadline to avoid interest and penalties. Keeping track of these dates is essential for proper estate management.

Required Documents

To complete Form 706, several documents are necessary. These include:

- Death certificate of the decedent.

- Asset appraisals for real estate, investments, and personal property.

- Documentation of debts and liabilities owed by the decedent.

- Previous tax returns, if applicable, to provide context for the estate's financial situation.

- Records of any gifts made by the decedent during their lifetime that may affect the estate tax calculation.

Form Submission Methods (Online / Mail / In-Person)

Form 706 can be submitted to the IRS through various methods. Traditionally, it is mailed to the appropriate IRS address based on the estate's location. However, electronic filing options may be available through authorized e-file providers. It is important for filers to check the IRS guidelines for the most current submission methods, as these can change. In-person submission is generally not available for this form.

Quick guide on how to complete 2009 form 706

Accomplish Form 706 effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 706 on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to alter and eSign Form 706 effortlessly

- Locate Form 706 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any preferred device. Modify and eSign Form 706 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 form 706

Create this form in 5 minutes!

How to create an eSignature for the 2009 form 706

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 706 and why is it important?

Form 706 is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is crucial for estate planning as it helps determine the value of an estate for tax purposes. Completing Form 706 accurately can help ensure compliance with IRS regulations and minimize potential tax liabilities.

-

How can airSlate SignNow help with signing Form 706?

airSlate SignNow provides a streamlined process for eSigning Form 706, allowing users to send, sign, and manage their documents securely online. With its user-friendly interface, you can easily upload your Form 706 and invite signers, making the process efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for Form 706?

Yes, airSlate SignNow offers various pricing plans that are flexible and designed to meet different user needs. The cost-effective solution allows you to choose a plan that suits your volume of Form 706 transactions, ensuring you only pay for what you need.

-

Can I integrate airSlate SignNow with other software for managing Form 706?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, including CRMs and document management systems. This allows you to efficiently manage your Form 706 alongside your other business processes, enhancing productivity and workflow.

-

What features does airSlate SignNow offer for managing Form 706?

airSlate SignNow includes features such as document templates, customizable workflows, and advanced security measures. These features ensure that your Form 706 is handled efficiently, securely, and in compliance with legal standards.

-

How do I ensure the security of my Form 706 when using airSlate SignNow?

airSlate SignNow employs advanced security protocols, including encryption and secure access controls, to protect your Form 706 and other sensitive documents. You can feel confident knowing that your data is safe and compliant with industry standards.

-

Can I track the status of my Form 706 with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features that allow you to monitor the status of your Form 706 at every stage of the signing process. This transparency helps you stay informed and ensures that all necessary parties complete their signatures promptly.

Get more for Form 706

- Revisions adopted by presidents cabinet 52218 form

- Grid landlord form

- Instructions for schedule d form 1040 or 1040 sr capital

- 2020 schedule j form 1040 internal revenue service

- 2020 form 1041 es estimated income tax for estates and trusts

- 2020 instructions for form 1042 s internal revenue service

- 2020 form 1094 c transmittal of employer provided health insurance offer and coverage information returns

- Internal revenue service us taxesus consulate general in form

Find out other Form 706

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF